- United States

- /

- Oil and Gas

- /

- NYSE:BKV

Will BKV’s (BKV) New Capital Flexibility Shape Its Role in Natural Gas Liquids Infrastructure?

Reviewed by Sasha Jovanovic

- On October 1, 2025, BKV Corporation filed a shelf registration for up to US$1 billion, enabling potential future issuance of common stock, preferred stock, rights, debt securities, warrants, and units.

- This filing aligns with BKV’s broadened operational focus beyond gas extraction to include natural gas liquids gathering, processing, and transportation, reflecting an ambition for greater market reach and flexibility.

- We’ll explore how BKV’s ability to access additional capital supports its evolving strategy in natural gas liquids infrastructure.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is BKV's Investment Narrative?

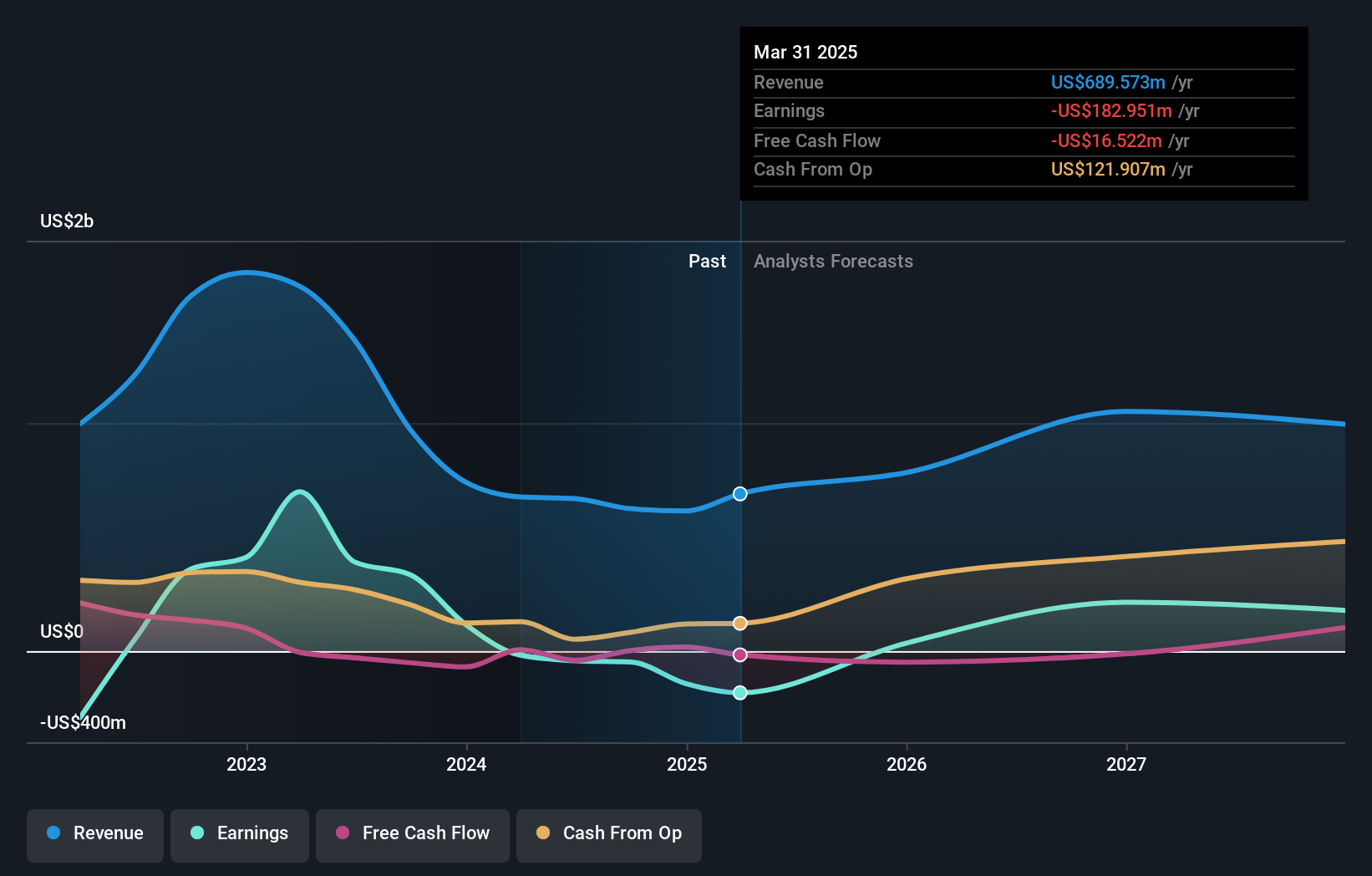

For anyone considering BKV, the decision now rests on believing in the company’s push beyond upstream gas production and its aim to capture wider value from natural gas liquids and midstream services. The recent US$1 billion shelf registration gives BKV increased capital flexibility, possibly speeding up infrastructure expansion or future acquisitions. Short term, this announcement may shift what matters most: rather than production levels alone, focus could move to whether BKV successfully puts new capital to work and how quickly NGL volumes and related revenues ramp up. The risk calculus changes too, balance sheet dilution is now on the table, and execution risk rises as BKV moves into new business lines. If the shelf leads to significant future fundraising, the market could react to perceived dilution or optimism around accelerated growth; if it remains unused, then prior catalysts and risks, like capturing value from carbon capture projects, recent index removals, and maintaining production growth, are still in play. Based on recent price gains, the news appears to have drawn some positive attention, but it is too early to say its impact is material, and the largest risks for investors may now hinge on management’s deployment of any new capital.

However, with the potential for share dilution on the horizon, investors will want to remain watchful.

Exploring Other Perspectives

Explore 2 other fair value estimates on BKV - why the stock might be worth as much as 40% more than the current price!

Build Your Own BKV Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BKV research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free BKV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BKV's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BKV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKV

BKV

Produces and sells natural gas in the Barnett Shale in the Fort Worth Basin of Texas and in the Marcellus Shale in the Appalachian Basin of Northeast Pennsylvania.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives