- United States

- /

- Oil and Gas

- /

- NYSE:BKV

Is BKV’s (BKV) Equity-Funded Power Push a Smart Pivot or a Costly Diversion?

Reviewed by Sasha Jovanovic

- BKV Corporation recently completed a follow-on equity offering of 6,000,000 common shares at US$26.00 each, raising about US$156,000,000 to fund the acquisition of a controlling interest in BKV-BPP Power, LLC.

- The deal structure, including a 30-day option for underwriters to buy an additional 900,000 shares, highlights BKV’s push to expand into power generation alongside its existing operations.

- We’ll now examine how using this equity raise to fund the BKV-BPP Power acquisition could reshape BKV’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is BKV's Investment Narrative?

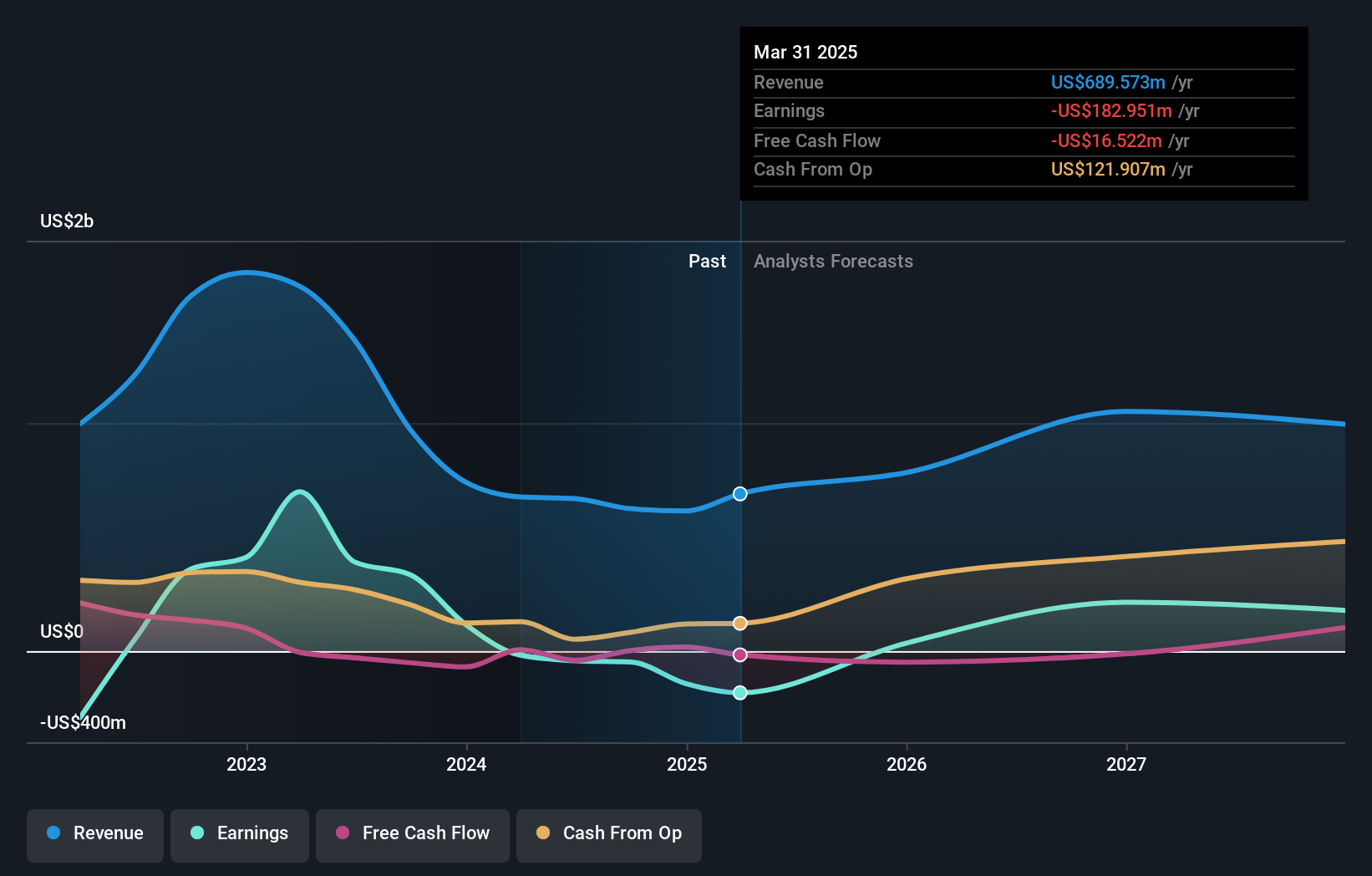

To own BKV, you need to be comfortable with an oil and gas producer that has only recently turned profitable and now wants to bolt on a power generation platform. The core near term catalysts still sit around execution on its lifted production guidance and sustaining the step up in profitability seen through 2025, but the US$156,000,000 equity raise to fund BKV-BPP Power adds a new twist. On one hand, it shores up funding without stretching the balance sheet; on the other, it increases share count and ties more of the story to integrating a power asset that has not yet been reflected in earlier analysis. Given the stock sold off after the offering announcement, the market reaction suggests investors are weighing dilution risk against the potential for a broader, more vertically integrated business.

However, the dilution from this equity raise is something investors should understand in detail. BKV's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Simply Wall St Community members see BKV’s fair value anywhere between US$30.63 and about US$89.64, based on 2 independent views. That spread sits against a business now balancing high growth expectations with fresh dilution and integration risk from the BKV-BPP Power deal, which could influence how much of that perceived upside is ultimately realised.

Explore 2 other fair value estimates on BKV - why the stock might be worth over 3x more than the current price!

Build Your Own BKV Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BKV research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free BKV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BKV's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BKV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKV

BKV

Produces and sells natural gas in the Barnett Shale in the Fort Worth Basin of Texas and in the Marcellus Shale in the Appalachian Basin of Northeast Pennsylvania.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026