- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

We Think Shareholders May Want To Consider A Review Of Baker Hughes Company's (NYSE:BKR) CEO Compensation Package

Baker Hughes Company (NYSE:BKR) has not performed well recently and CEO Lorenzo Simonelli will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 14 May 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Baker Hughes

Comparing Baker Hughes Company's CEO Compensation With the industry

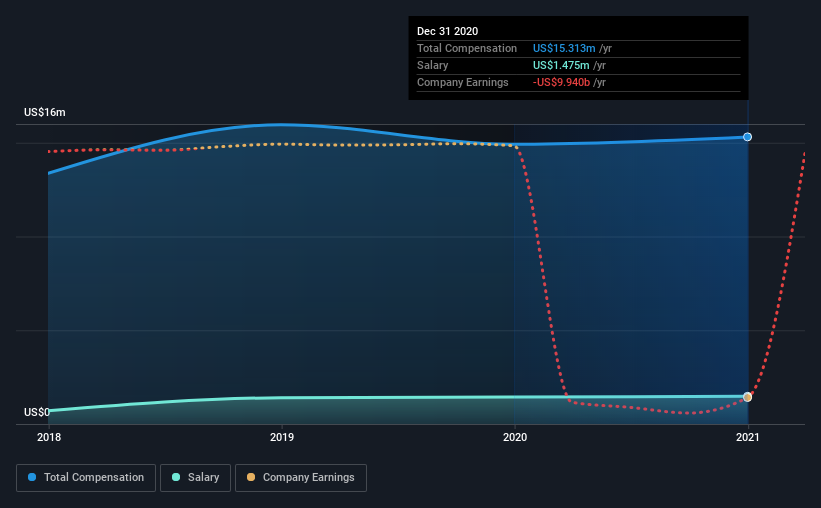

According to our data, Baker Hughes Company has a market capitalization of US$24b, and paid its CEO total annual compensation worth US$15m over the year to December 2020. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.5m.

On comparing similar companies in the industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$15m. From this we gather that Lorenzo Simonelli is paid around the median for CEOs in the industry. Furthermore, Lorenzo Simonelli directly owns US$9.8m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$1.5m | US$1.4m | 10% |

| Other | US$14m | US$13m | 90% |

| Total Compensation | US$15m | US$15m | 100% |

Speaking on an industry level, nearly 22% of total compensation represents salary, while the remainder of 78% is other remuneration. It's interesting to note that Baker Hughes allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Baker Hughes Company's Growth

Baker Hughes Company has reduced its earnings per share by 96% a year over the last three years. In the last year, its revenue is down 15%.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Baker Hughes Company Been A Good Investment?

Since shareholders would have lost about 30% over three years, some Baker Hughes Company investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Baker Hughes that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Baker Hughes or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Baker Hughes, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives