- United States

- /

- Energy Services

- /

- NYSE:AROC

Archrock (AROC): Assessing Valuation After Analyst Upgrades and Forecasted Earnings Growth Outpace Industry

Reviewed by Simply Wall St

Archrock (AROC) has been catching investors’ attention after several analyst reports categorized it as a strong buy, supported by a wave of upward earnings estimate revisions. With Wall Street signaling optimism and highlighting the company’s expected earnings per share growth, which is outpacing much of its industry, it is easy to see why investors are re-evaluating where Archrock sits in their portfolios. This renewed consensus has put a spotlight on the company’s long-term growth story and raised questions about whether the market is starting to recognize its potential.

Following these positive analyst notes, Archrock’s share price has climbed 8% over the past month, a contrast to its flat performance through most of the year. The stock has delivered a solid 28% return over the last twelve months, with a multiyear run-up that exceeds broader sector moves. Momentum appears to be building again as new forecasts suggest that Archrock could be entering a period of stronger near-term growth, particularly as recent earnings and revenue trends continue to look favorable compared to peers.

But with this renewed interest and a year of strong gains, is Archrock still undervalued, or is the market already factoring in everything investors are hoping for?

Most Popular Narrative: 18.4% Undervalued

According to community narrative, Archrock is considered significantly undervalued, with a fair value that analysts estimate to be well above current market pricing.

Sustained investments in domestic energy production and infrastructure, bolstered by energy security priorities and manufacturing onshoring, are generating broad-based demand across major shale basins. This enables Archrock to expand geographically and diversify its customer base, which reduces revenue volatility and supports stable earnings.

Curious about the bold strategy behind Archrock’s high fair value? The narrative points to powerful growth engines and a surprisingly bullish future. One metric in particular could challenge your expectations. Discover the unknowns behind the forecast and see which assumptions are reshaping what Archrock could be worth.

Result: Fair Value of $30.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, accelerated global decarbonization or disruptive energy regulations could dampen natural gas demand. This could challenge Archrock’s earnings outlook and current bullish forecasts.

Find out about the key risks to this Archrock narrative.Another View: Multiples Paint a More Cautious Picture

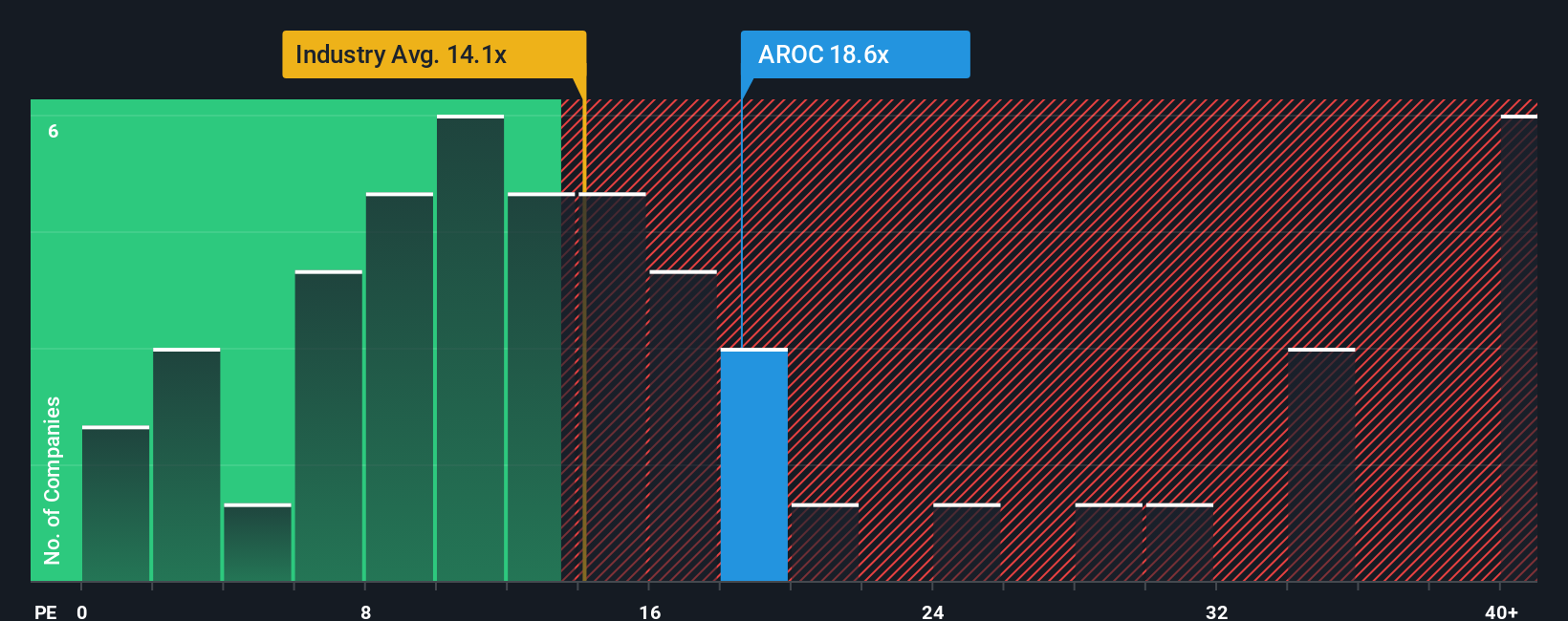

While the narrative and SWS DCF model both highlight Archrock’s upside, another common perspective uses earnings multiples. This method suggests the stock may not be as inexpensive as it first appears. Which method best reflects Archrock’s value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Archrock Narrative

If you see things differently or want to dig deeper into Archrock’s numbers, you can shape your own view in just a few minutes, so why not do it your way?

A great starting point for your Archrock research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Do not let standout investment ideas slip by. If you are on the hunt for your next portfolio winner, take advantage of these handpicked themes that thousands of savvy investors are already watching on Simply Wall Street:

- Grow your income by securing dividend stocks with yields > 3%. This approach can provide reliable cash flows, especially in volatile markets.

- Jump ahead of the curve with AI penny stocks. These investments are shaping the artificial intelligence landscape and contributing to tomorrow’s technology breakthroughs.

- Capitalize on value by finding undervalued stocks based on cash flows that the market may be overlooking. This strategy can help position your portfolio for long-term gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AROC

Archrock

Operates as an energy infrastructure company in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives