- United States

- /

- Energy Services

- /

- NYSE:ARIS

Aris Water Solutions (ARIS): Assessing Valuation After a 45% One-Year Shareholder Return

Reviewed by Kshitija Bhandaru

Aris Water Solutions (ARIS) shares have climbed over the past year, returning 45% to investors. The company’s revenue and net income have both improved, and there are clear signals of ongoing business expansion.

See our latest analysis for Aris Water Solutions.

Momentum for Aris Water Solutions has been steady, with a 1-year total shareholder return of 45% that reflects sustained growth and renewed investor confidence. Recent results suggest that the company’s improving fundamentals are resonating in the market, even as the share price holds around $24.40.

If Aris’s strong run has you looking for the next opportunity, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares continually nudging higher and the company trading just beneath analyst price targets, investors now face a key question: is Aris Water Solutions still undervalued, or has the market already priced in its future growth?

Most Popular Narrative: 5.3% Undervalued

Compared to its last close at $24.40, the current narrative pins Aris Water Solutions' fair value at $25.78, hinting at a modest upside from current levels. While market sentiment remains strong, the story behind this valuation estimate hinges on strategic partnerships and operational improvements that could redefine its future growth profile.

Expansion into industrial water treatment and beneficial reuse projects in collaboration with major partners like ExxonMobil and Chevron signals potential to diversify revenue streams and enhance overall company earnings. A high level of contracted water volumes, with over 80% of forecasted Water Solutions volumes under long-term contracts, provides revenue visibility and stability. This supports future earnings growth.

Want to know what ambitious projections fuel this valuation? The narrative is built on rapid earnings expansion and a bold outlook for margins, but exactly how high could profits climb? Find out what financial leaps justify the current price target in the full narrative.

Result: Fair Value of $25.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected drops in water solutions volumes or significant capital expenditures could quickly challenge even the most optimistic growth assumptions for Aris Water Solutions.

Find out about the key risks to this Aris Water Solutions narrative.

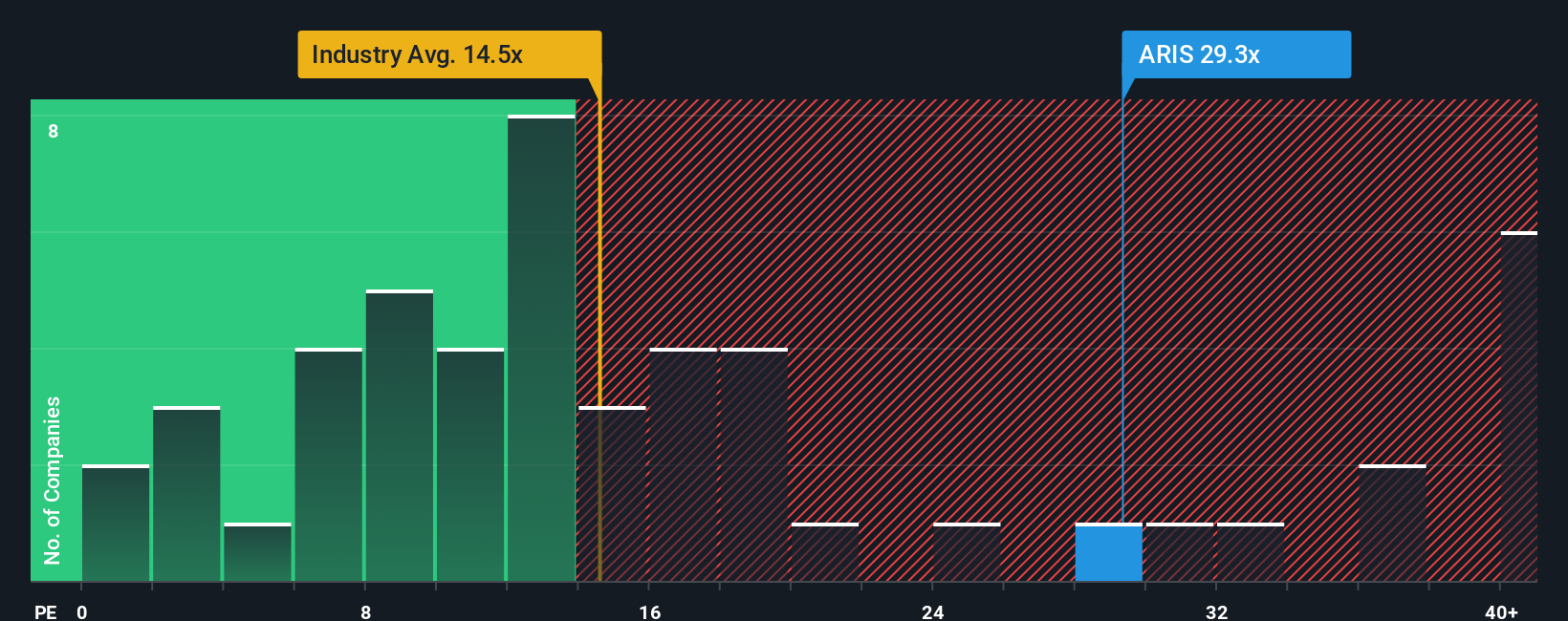

Another View: Multiples Raise a Red Flag

While the fair value narrative points to a modest discount, the current price-to-earnings ratio for Aris Water Solutions stands at 30x, which is double the US Energy Services industry average of 15.1x and well above the fair ratio of 20x. This sharp premium could mean valuation risk if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aris Water Solutions Narrative

If these perspectives don’t quite fit your outlook or you prefer diving into the numbers yourself, you can create your own narrative in just a few minutes by using Do it your way.

A great starting point for your Aris Water Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your money work harder by tapping into unique sectors and riding market trends before everyone else. Great opportunities are waiting for those who take action.

- Supercharge your portfolio by tapping into generous income opportunities through these 19 dividend stocks with yields > 3%, featuring stocks with strong yields above 3%.

- Capitalize on tomorrow’s innovation leaders and uncover growth potential with these 24 AI penny stocks, where artificial intelligence disrupts entire industries.

- Position yourself for the next wave by getting ahead in the world of digital assets with these 78 cryptocurrency and blockchain stocks, spotlighting companies at the forefront of blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARIS

Aris Water Solutions

An environmental infrastructure and solutions company, provides water handling and recycling solutions to oil and natural gas operators in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success