- United States

- /

- Energy Services

- /

- NasdaqGS:WFRD

Even With A 26% Surge, Cautious Investors Are Not Rewarding Weatherford International plc's (NASDAQ:WFRD) Performance Completely

The Weatherford International plc (NASDAQ:WFRD) share price has done very well over the last month, posting an excellent gain of 26%. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 56% share price drop in the last twelve months.

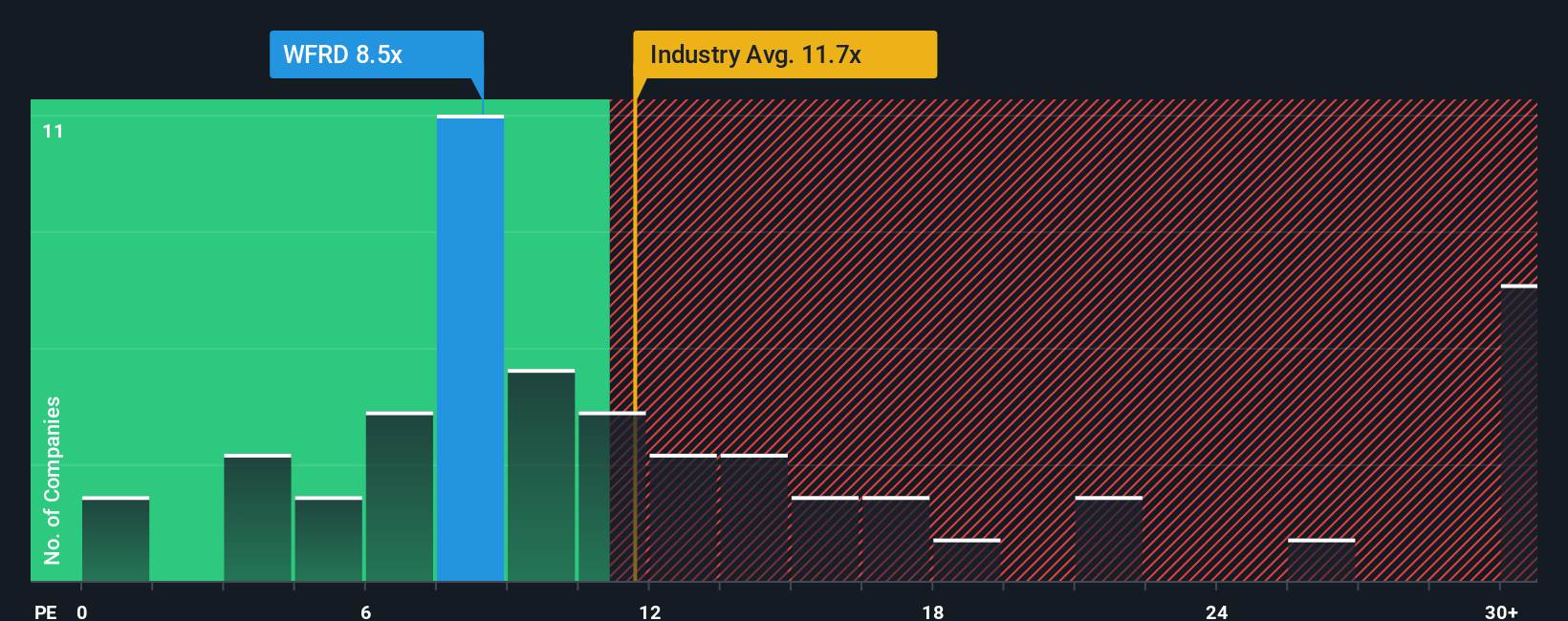

In spite of the firm bounce in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may still consider Weatherford International as a highly attractive investment with its 8.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times haven't been advantageous for Weatherford International as its earnings have been rising slower than most other companies. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Weatherford International

Is There Any Growth For Weatherford International?

In order to justify its P/E ratio, Weatherford International would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Turning to the outlook, the next three years should generate growth of 9.6% per year as estimated by the seven analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 10% each year, which is not materially different.

With this information, we find it odd that Weatherford International is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Weatherford International's recent share price jump still sees its P/E sitting firmly flat on the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Weatherford International currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Weatherford International you should be aware of.

Of course, you might also be able to find a better stock than Weatherford International. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Weatherford International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WFRD

Weatherford International

An energy services company, provides equipment and services for the drilling, evaluation, completion, production, and intervention of oil, geothermal, and natural gas wells worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives