- United States

- /

- Oil and Gas

- /

- NasdaqGS:VNOM

Why Viper Energy (VNOM) Is Up 10.4% After Earnings Beat Driven By Stronger Production Metrics

Reviewed by Sasha Jovanovic

- In the past quarter, Viper Energy reported adjusted earnings of US$0.40 per share, topping estimates as oil-equivalent production climbed despite lower realized prices, higher expenses and a non-cash impairment on Diamondback-acquired properties.

- The company also issued updated production guidance for the fourth quarter and full-year 2025, putting renewed focus on how volume growth balances softer pricing and rising costs.

- We’ll now explore how this earnings beat driven by higher production reshapes Viper Energy’s investment narrative and forward-looking risk–reward profile.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Viper Energy Investment Narrative Recap

To own Viper Energy, you need to believe its Permian mineral and royalty footprint can translate higher production into resilient cash flows despite volatile pricing and new management oversight. The latest earnings beat reinforces production as the key near term catalyst, while the combination of lower realized prices, non cash impairments and a still soft share price keeps commodity exposure and dividend coverage as the most immediate risks. Overall, this quarter does not materially change that risk balance.

The updated 2025 production guidance, pointing to higher oil equivalent volumes even as consensus estimates have drifted lower, is the announcement that most directly connects to this earnings report. It sharpens the focus on whether volume growth from Diamondback and other operators can offset weaker pricing and rising expenses enough to support ongoing buybacks and the base plus variable dividend framework.

Yet behind the stronger production story, investors should still be aware of how dependent Viper remains on a handful of third party operators and...

Read the full narrative on Viper Energy (it's free!)

Viper Energy's narrative projects $2.3 billion revenue and $293.3 million earnings by 2028. This requires 35.1% yearly revenue growth and a $77.9 million earnings decrease from $371.2 million today.

Uncover how Viper Energy's forecasts yield a $50.83 fair value, a 28% upside to its current price.

Exploring Other Perspectives

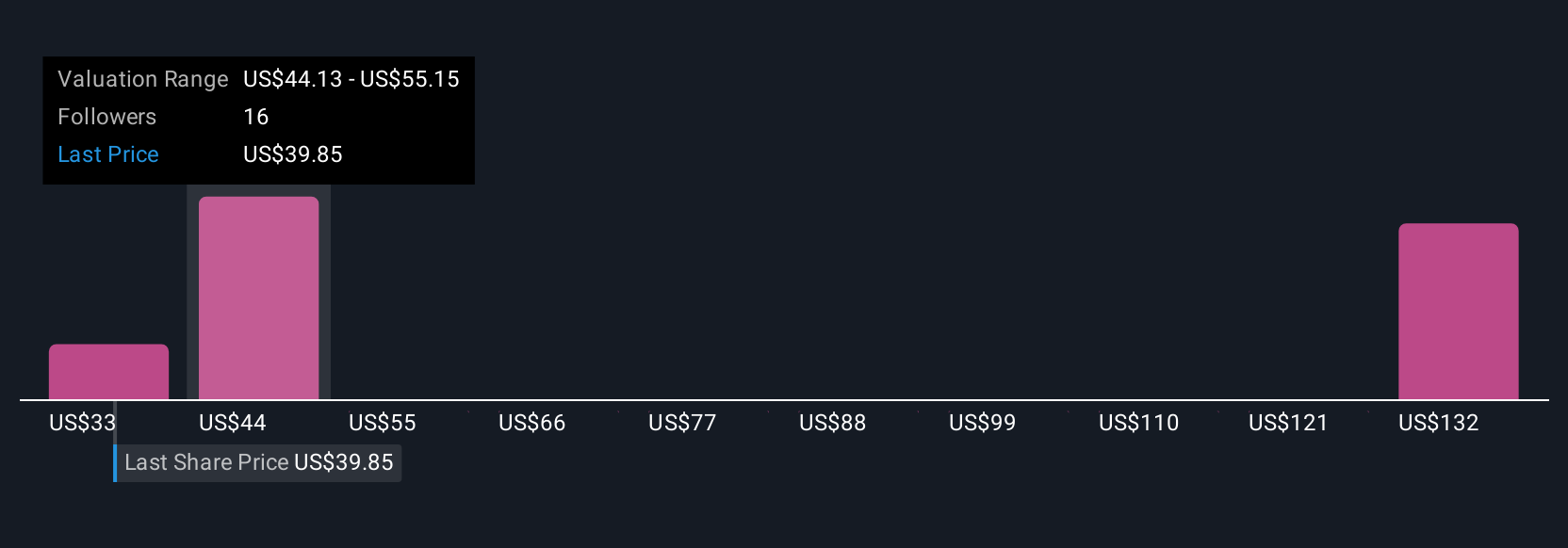

Six members of the Simply Wall St Community currently estimate Viper Energy’s fair value between about US$20 and US$118. With such a wide spread, it is worth weighing their views against the recent earnings beat that leans heavily on higher production but also highlights sensitivity to realized prices and costs.

Explore 6 other fair value estimates on Viper Energy - why the stock might be worth 50% less than the current price!

Build Your Own Viper Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viper Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Viper Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viper Energy's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VNOM

Viper Energy

Owns, acquires, and exploits oil and natural gas properties in North America.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026