- United States

- /

- Oil and Gas

- /

- NasdaqGS:VNOM

Should Investors Re-Evaluate Viper Energy After Recent Share Price Drop in 2025?

Reviewed by Bailey Pemberton

If you're eyeing Viper Energy stock and wondering whether it's time to make a move, you're not alone. The company has seen its shares bounce around lately, and there's plenty to unpack for investors focused on long-term value. While Viper Energy closed most recently at $38.31, the journey there has had its twists. The stock is down 1.1% in the last week, has gained 2.3% over the past month, but is still sitting nearly 20% lower than a year ago. Year-to-date, it's down 23.2%. This kind of price action often signals shifting risk perceptions and changing views on the company's prospects.

What's really interesting for value-focused investors is that Viper Energy scores a solid 4 out of 6 on our undervaluation checklist. That means by four major valuation measures, the stock currently looks undervalued. If you're trying to figure out whether the recent dip offers a buying opportunity or a red flag, understanding these numbers is key.

Let's break down how these valuation checks stack up, and then explore a smarter, even more insightful way to tell if the stock is truly a bargain.

Why Viper Energy is lagging behind its peers

Approach 1: Viper Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a key tool for valuing companies like Viper Energy. It works by estimating the business’s future free cash flows, then discounting these back to their present value to account for the time value of money. This provides a data-driven way to calculate what the company might be worth today, based on future earning power rather than just current profits.

For Viper Energy, the model uses a 2 Stage Free Cash Flow to Equity approach. The company’s latest twelve months free cash flow came in at negative $345.2 Million. Looking ahead, analysts expect a swift turnaround, projecting free cash flow of $1.92 Billion by 2029. Estimates for the next several years are positive and growing. Simply Wall St extrapolates this trajectory out to a decade for a fuller long-term view.

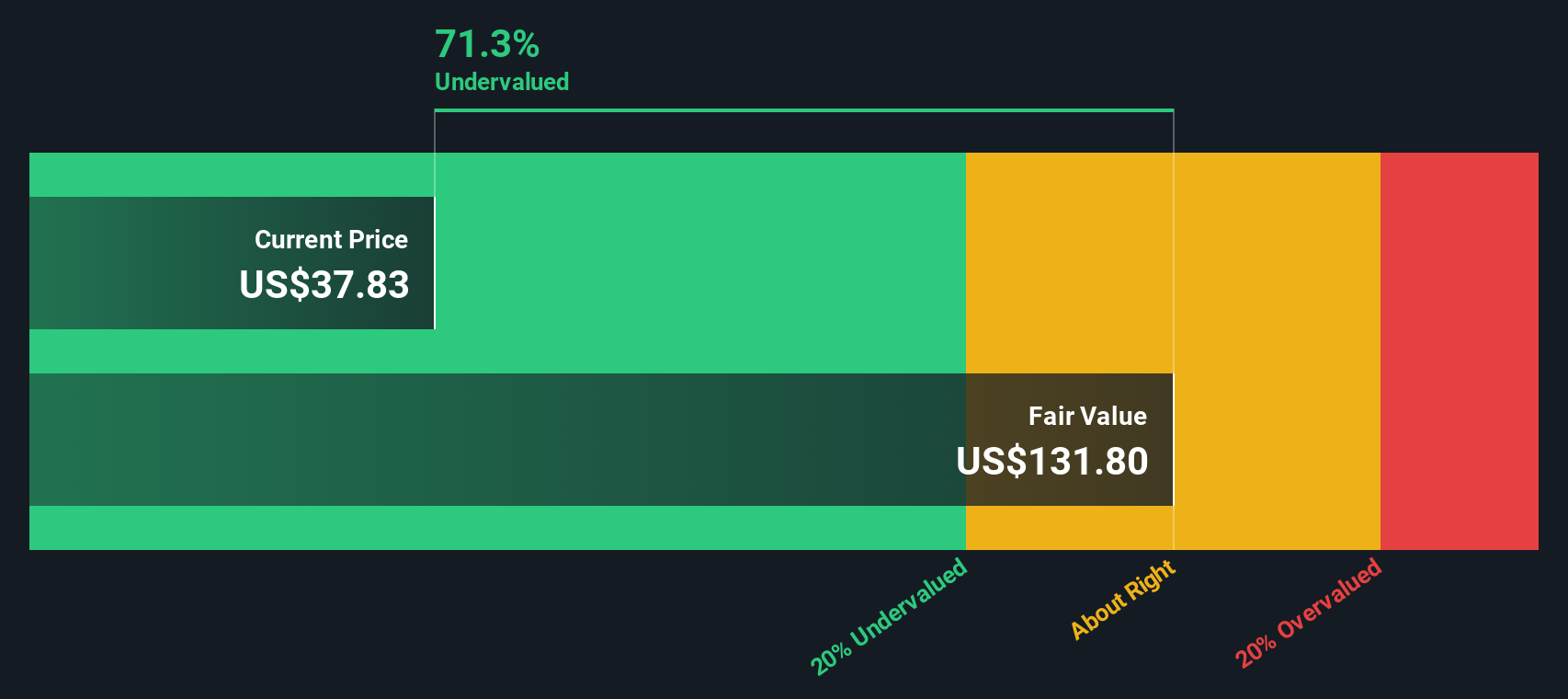

This calculation results in an estimated intrinsic value of $131.80 per share. With Viper Energy currently trading at $38.31, the DCF suggests the stock is trading at a steep 70.9% discount to its calculated fair value. In investor terms, this points to a significant undervaluation by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Viper Energy is undervalued by 70.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Viper Energy Price vs Earnings

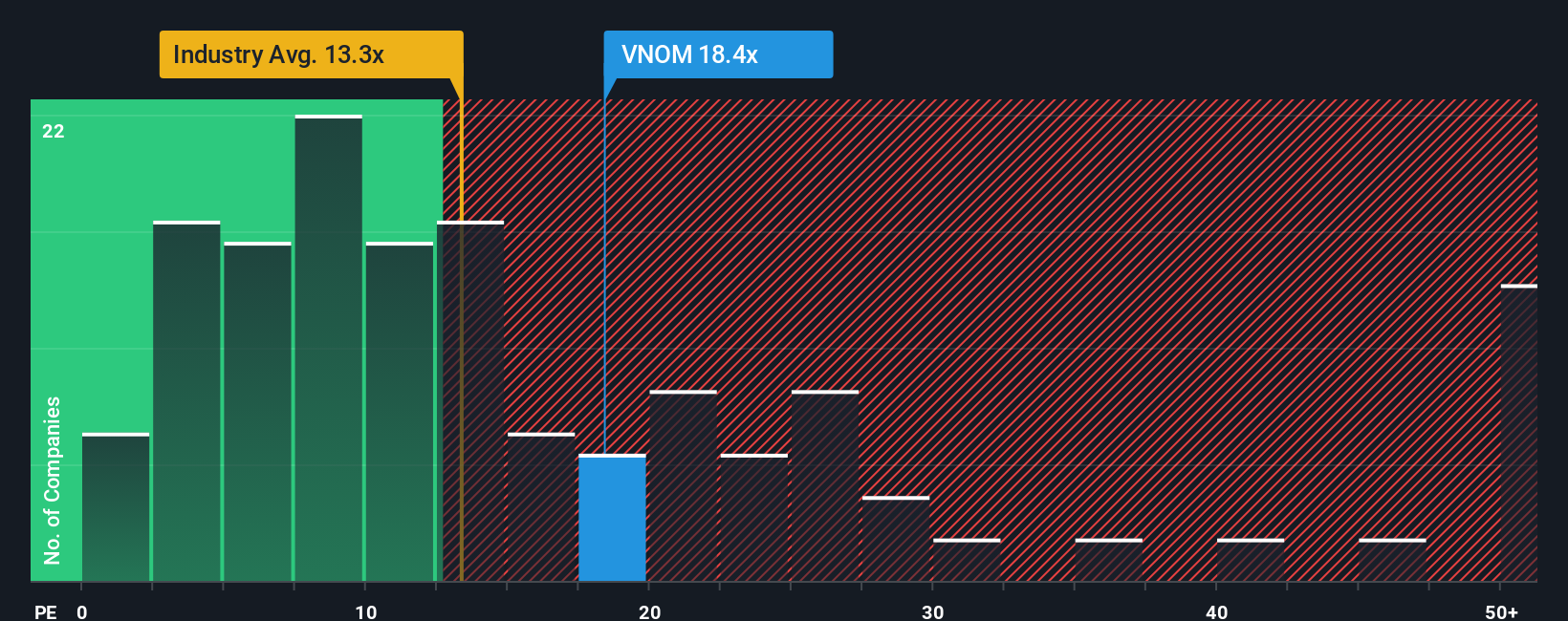

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for evaluating profitable companies like Viper Energy. It works well here because it helps investors quickly compare how much they are paying for each dollar of the company's earnings. In general, companies with higher growth prospects or lower risk tend to justify higher PE ratios, while those with more uncertainty or lower expected growth should trade at lower multiples.

Viper Energy currently trades at a PE ratio of 17.47x. For context, this is just below the average for its peers, which stands at 18.78x, and noticeably above the Oil and Gas industry average of 13.14x. These benchmarks are useful, but they do not capture all the nuances affecting a company's appropriate valuation.

This is where Simply Wall St's "Fair Ratio" comes in. Designed to go deeper than a simple peer or industry comparison, the Fair Ratio (14.85x) uses a proprietary blend of factors including the company’s expected earnings growth, profit margins, market cap and risk profile, all put in the context of its specific industry. By considering these additional dimensions, the Fair Ratio gives a clearer view of what multiple the business should reasonably trade at today.

Comparing Viper Energy's current PE of 17.47x to its Fair Ratio of 14.85x shows that the stock is trading meaningfully above its calculated fair value based on these fundamentals. This may suggest the market is pricing in higher growth or overlooking some risks, so investors should stay cautious here.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Viper Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story and outlook for a company, combining your expectations of its future revenue, margins, and fair value, then linking those numbers to a data-backed view of what the business is really worth. This approach helps you go beyond the basic ratios and headlines, connecting your perspective on Viper Energy’s strengths and risks with a specific, actionable forecast.

Narratives are quick and accessible for anyone on Simply Wall St’s Community page, making it easy to build, update, and share your investment thesis just like millions of other investors do. Each Narrative acts like a living scenario, automatically updating when new news or earnings arrive so your view is always current, not static. This empowers you to compare your calculated fair value with the latest share price and decide if now is the right time to buy or sell, based on your own reasoning instead of following the crowd.

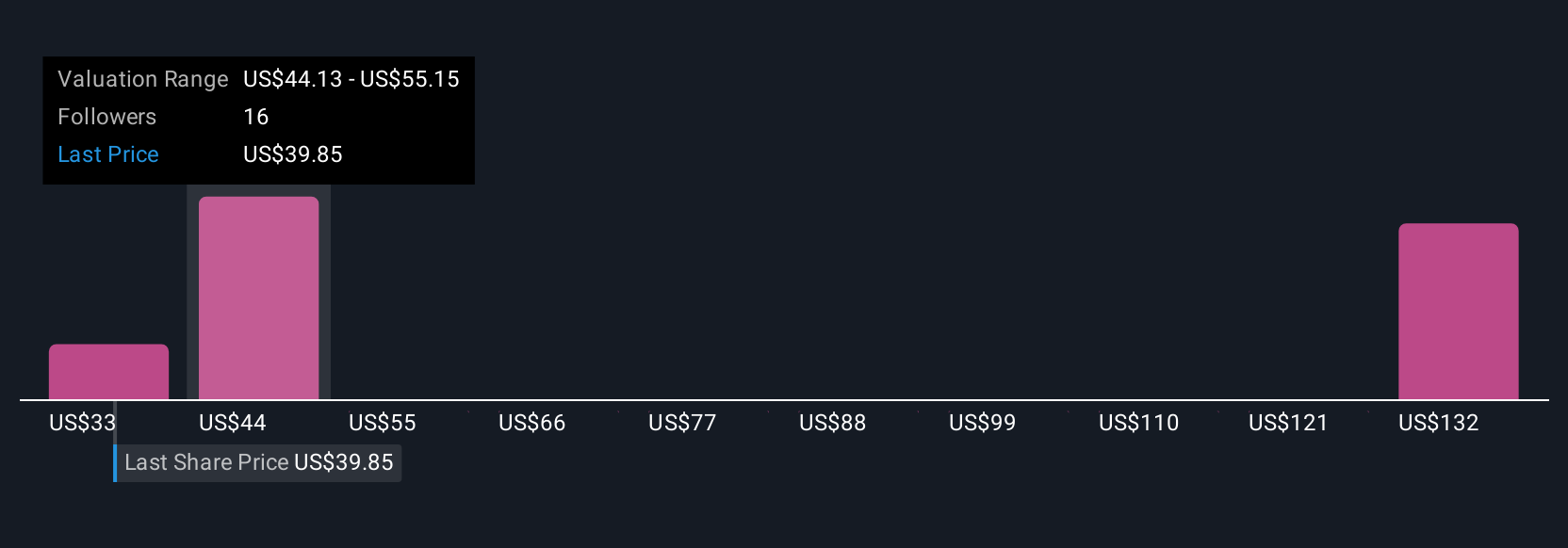

For example, some investors believe Viper Energy’s efficient Permian Basin assets and accretive acquisitions could justify a fair value above $68 per share, while more skeptical narratives see headwinds that put fair value closer to $44. With Narratives, you decide which story fits the evidence, and let the numbers and your strategy lead the way.

Do you think there's more to the story for Viper Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VNOM

Viper Energy

Owns, acquires, and exploits oil and natural gas properties in North America.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives