- United States

- /

- Medical Equipment

- /

- NasdaqCM:KRMD

Alto Ingredients And 2 Other Penny Stocks To Watch Closely

Reviewed by Simply Wall St

As the U.S. stock market experiences a sharp downturn, with major indices like the Dow Jones and Nasdaq seeing significant losses, investors are evaluating their portfolios in search of resilient opportunities. Amidst this volatility, penny stocks—often smaller or newer companies—remain an intriguing investment category due to their potential for growth and affordability. Despite being considered a somewhat outdated term, penny stocks can still offer compelling prospects when backed by strong financials, as we'll explore through three noteworthy examples that stand out for their balance sheet resilience and growth potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.70 | $370.75M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.60 | $589.51M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $4.14 | $698.29M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.95 | $251.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.14 | $27.23M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.58 | $598.45M | ✅ 4 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.63 | $1.01B | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.8925 | $6.52M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.22 | $73.63M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 359 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Alto Ingredients (ALTO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alto Ingredients, Inc. is engaged in the production, distribution, and marketing of specialty alcohols, renewable fuel, and essential ingredients in the United States with a market cap of approximately $147.34 million.

Operations: The company's revenue is primarily derived from Pekin Campus Production at $583.46 million, Marketing and Distribution at $213.32 million, and Western Production contributing $129.65 million.

Market Cap: $147.34M

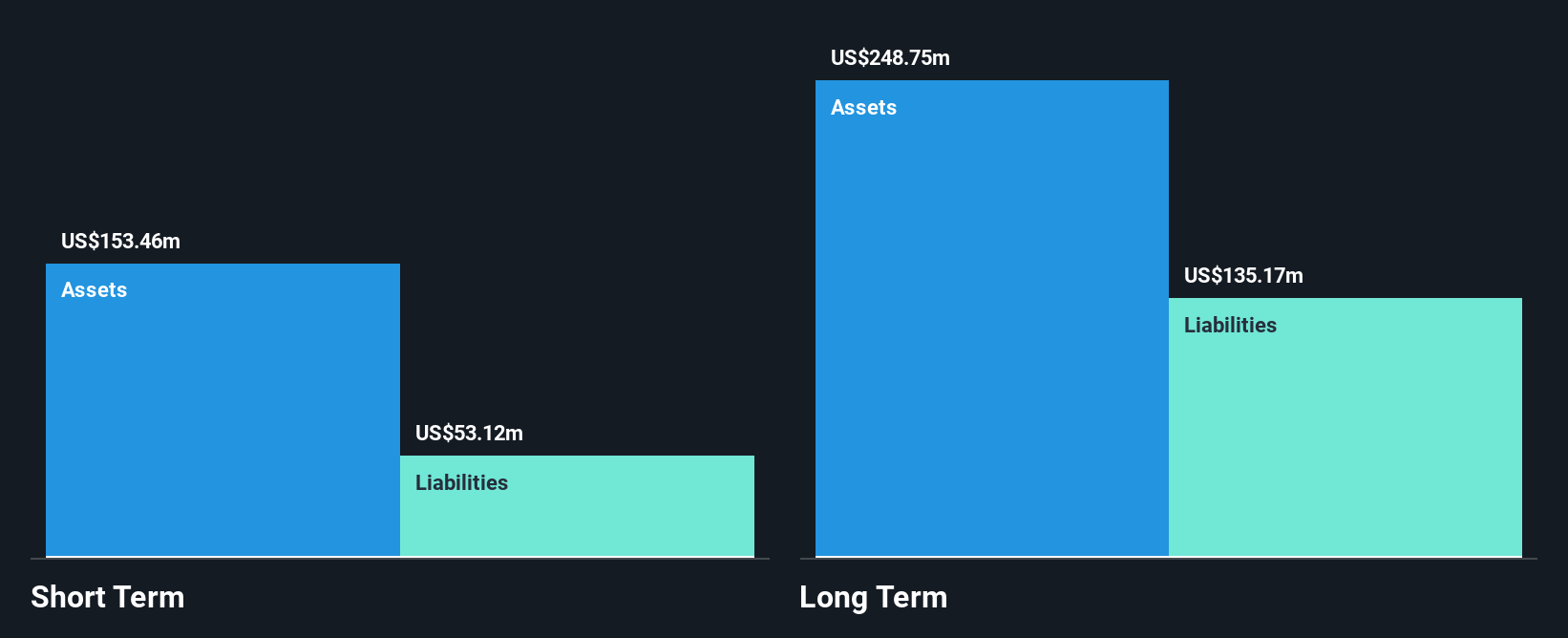

Alto Ingredients, Inc. has shown some improvement in financial performance despite being unprofitable. The company reported a net income of US$14.21 million for Q3 2025, reversing a loss from the prior year, although sales decreased slightly to US$240.99 million. Its debt situation has improved with a reduced debt-to-equity ratio over five years and satisfactory net debt levels at 30.6%. While short-term assets cover both short- and long-term liabilities, volatility remains high, and profitability is not expected within the next three years despite trading at good relative value compared to peers.

- Dive into the specifics of Alto Ingredients here with our thorough balance sheet health report.

- Assess Alto Ingredients' future earnings estimates with our detailed growth reports.

KORU Medical Systems (KRMD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: KORU Medical Systems, Inc. develops, manufactures, and commercializes subcutaneous infusion solutions for the drug delivery market both in the United States and internationally, with a market cap of $175.10 million.

Operations: KORU Medical Systems, Inc. does not report distinct revenue segments.

Market Cap: $175.1M

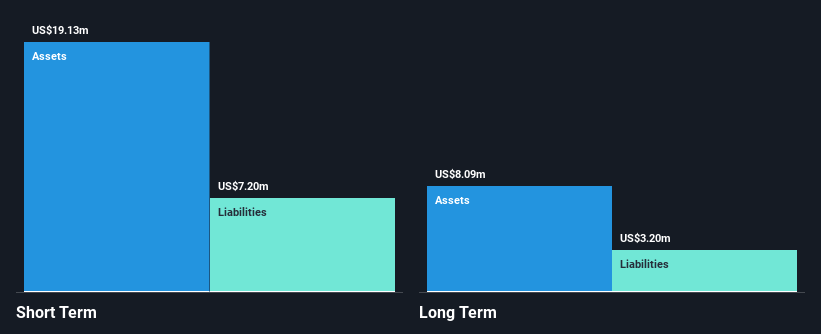

KORU Medical Systems has demonstrated revenue growth, reporting US$10.4 million in Q3 2025 sales, up from the previous year. Despite being unprofitable with a net loss of US$0.78 million for the quarter, the company has improved its financial position by reducing losses and raising its full-year revenue guidance to between US$40.5 million and US$41 million. The firm maintains a strong cash position exceeding total debt and covers both short- and long-term liabilities with current assets. Recent collaborations, such as with ForCast Orthopedics for innovative infusion systems, highlight strategic partnerships that may drive future growth opportunities.

- Jump into the full analysis health report here for a deeper understanding of KORU Medical Systems.

- Understand KORU Medical Systems' earnings outlook by examining our growth report.

Smart Sand (SND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Smart Sand, Inc. offers proppant supply and logistics solutions for frac sand customers, with a market cap of $100.62 million.

Operations: The company's revenue is primarily derived from its Sand segment, contributing $301.91 million, with an additional $3.94 million from Smartsystems.

Market Cap: $100.62M

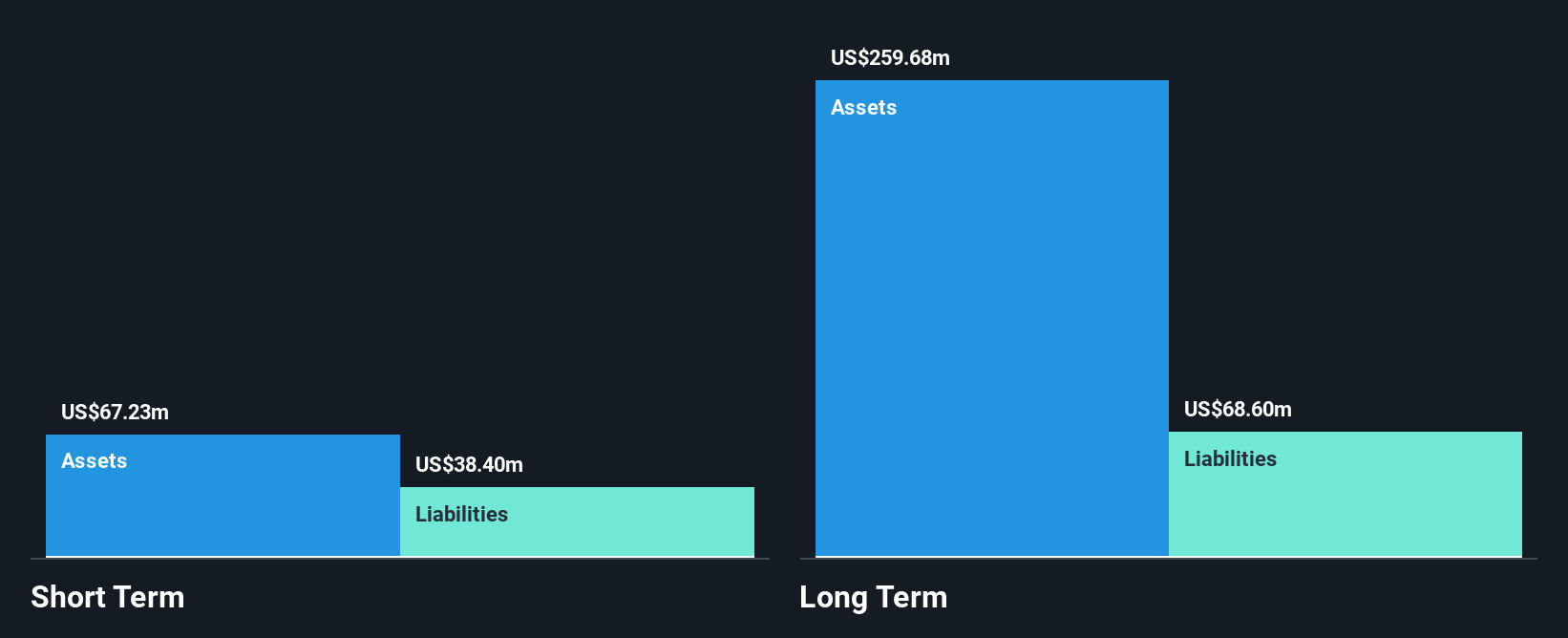

Smart Sand, Inc. has shown growth with Q3 2025 revenue reaching US$92.78 million, up from US$63.16 million a year earlier, and net income of US$3 million compared to a prior loss. Despite negative earnings growth over the past year, the company maintains high-quality earnings and reduced debt levels with satisfactory net debt to equity ratio of 7%. Recent developments include terminating a multi-year agreement with EQT Corporation by year's end and completing a share buyback program representing 2.55% of shares for US$2.09 million, reflecting strategic financial management amidst volatile industry conditions.

- Click to explore a detailed breakdown of our findings in Smart Sand's financial health report.

- Review our historical performance report to gain insights into Smart Sand's track record.

Summing It All Up

- Dive into all 359 of the US Penny Stocks we have identified here.

- Interested In Other Possibilities? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KORU Medical Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:KRMD

KORU Medical Systems

Develops, manufactures, and commercializes subcutaneous infusion solutions primarily for the subcutaneous drug delivery market in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives