- United States

- /

- Oil and Gas

- /

- NasdaqCM:PNRG

Undiscovered Gems in United States To Explore February 2025

Reviewed by Simply Wall St

The United States market has experienced a flat performance over the last week, yet it boasts an impressive 23% increase over the past year with earnings projected to grow by 15% annually. In this dynamic environment, discovering promising stocks often involves identifying companies with solid growth potential and innovative strategies that align well with these robust market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

We'll examine a selection from our screener results.

PrimeEnergy Resources (NasdaqCM:PNRG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: PrimeEnergy Resources Corporation, with a market cap of $374.24 million, operates in the United States focusing on the acquisition, development, and production of oil and natural gas properties through its subsidiaries.

Operations: PrimeEnergy's primary revenue stream is from oil and gas exploration, development, operation, and servicing, generating $210.06 million.

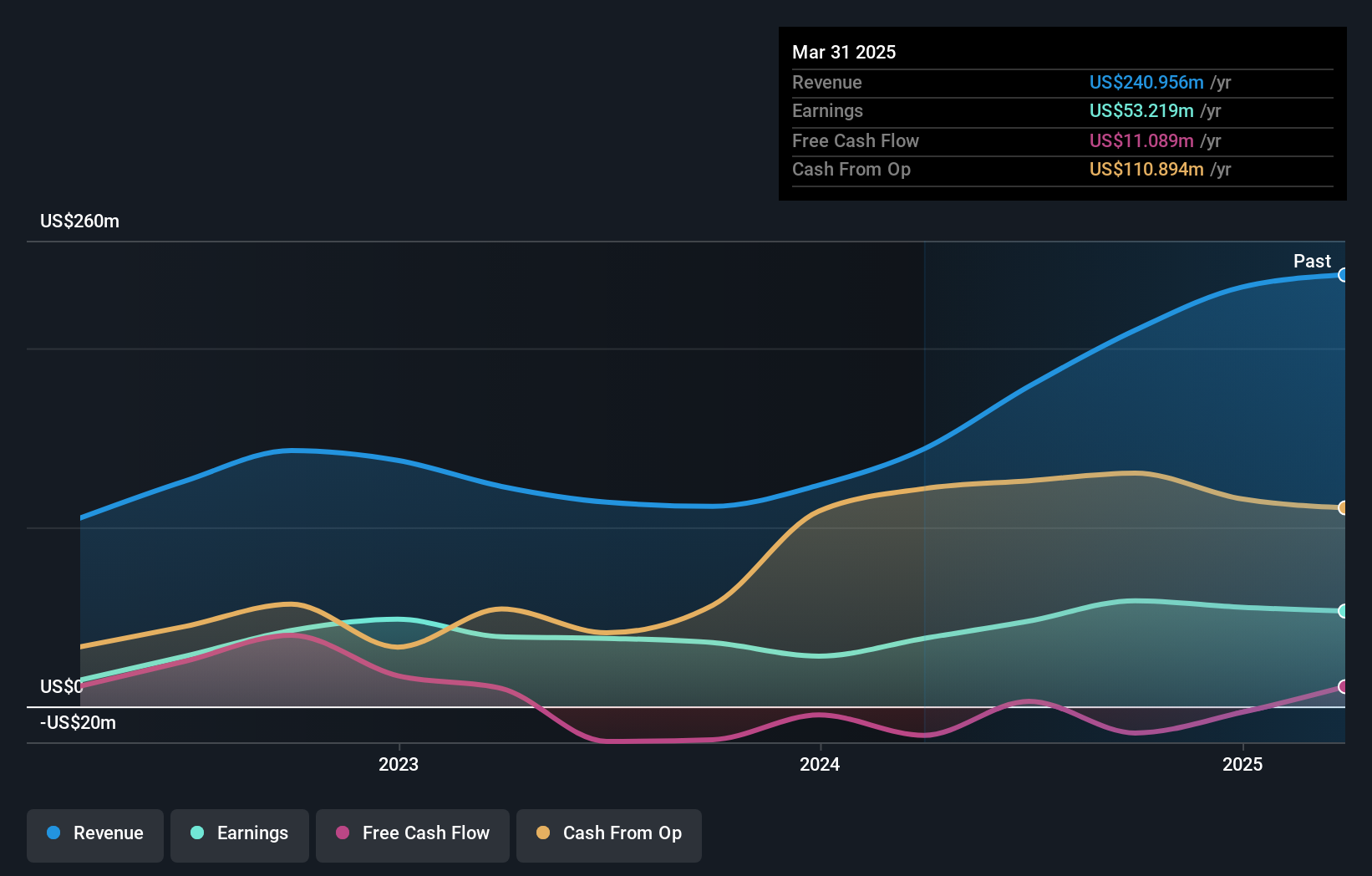

PrimeEnergy Resources, a smaller player in the energy sector, has shown impressive growth with earnings rising 65.7% last year, outpacing the broader oil and gas industry. The company reported significant production increases for oil and natural gas in recent quarters, contributing to a revenue boost to US$69.46 million from US$37.58 million year-over-year for Q3 2024. Net income also jumped to US$22.08 million from US$10.72 million previously. Despite these gains, PrimeEnergy's free cash flow remains negative, though its debt-to-equity ratio has improved dramatically over five years from 57.5% to just 1.5%.

TSS (NasdaqCM:TSSI)

Simply Wall St Value Rating: ★★★★★★

Overview: TSS, Inc. offers integration technology services focused on implementing, operating, and maintaining IT systems for enterprises in the United States, with a market cap of $349.75 million.

Operations: TSS, Inc. generates revenue primarily from system integration services, contributing $114.68 million, and facilities services at $7.85 million.

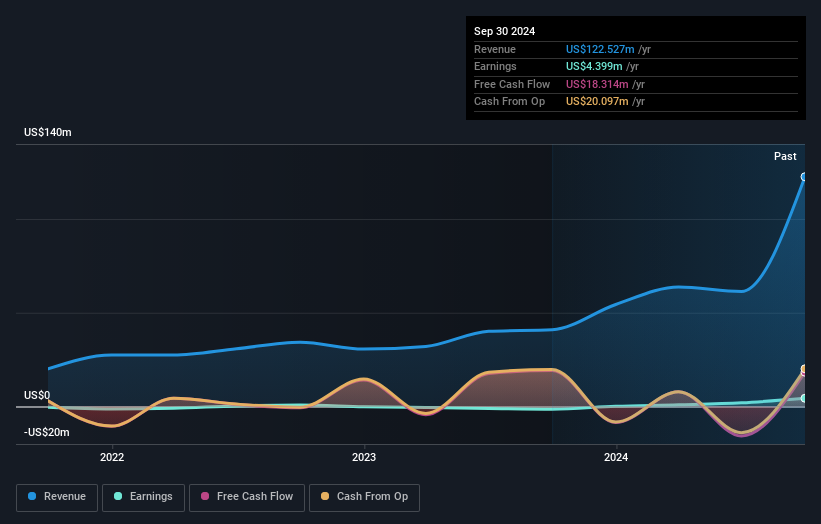

TSS, Inc., a dynamic player in the IT sector, recently turned profitable and now trades at 1.6% below its estimated fair value. The company has eliminated its debt over the past five years, previously standing at an 82.1% debt-to-equity ratio. Despite this financial improvement, TSS experienced significant insider selling in the last quarter and saw high share price volatility over three months. With a $20 million credit facility secured for expanding AI-enabled technologies and added to major indices like NASDAQ Composite, TSS seems poised for growth despite industry challenges with earnings growth of -2.6%.

- Navigate through the intricacies of TSS with our comprehensive health report here.

Assess TSS' past performance with our detailed historical performance reports.

Photronics (NasdaqGS:PLAB)

Simply Wall St Value Rating: ★★★★★★

Overview: Photronics, Inc. is a company that manufactures and sells photomask products and services globally, with a market capitalization of approximately $1.46 billion.

Operations: Photronics generates revenue primarily from the manufacture of photomasks, with reported sales amounting to $866.95 million. The company's financial performance is influenced by its gross profit margin trends, which reflect its ability to manage production costs and pricing strategies effectively.

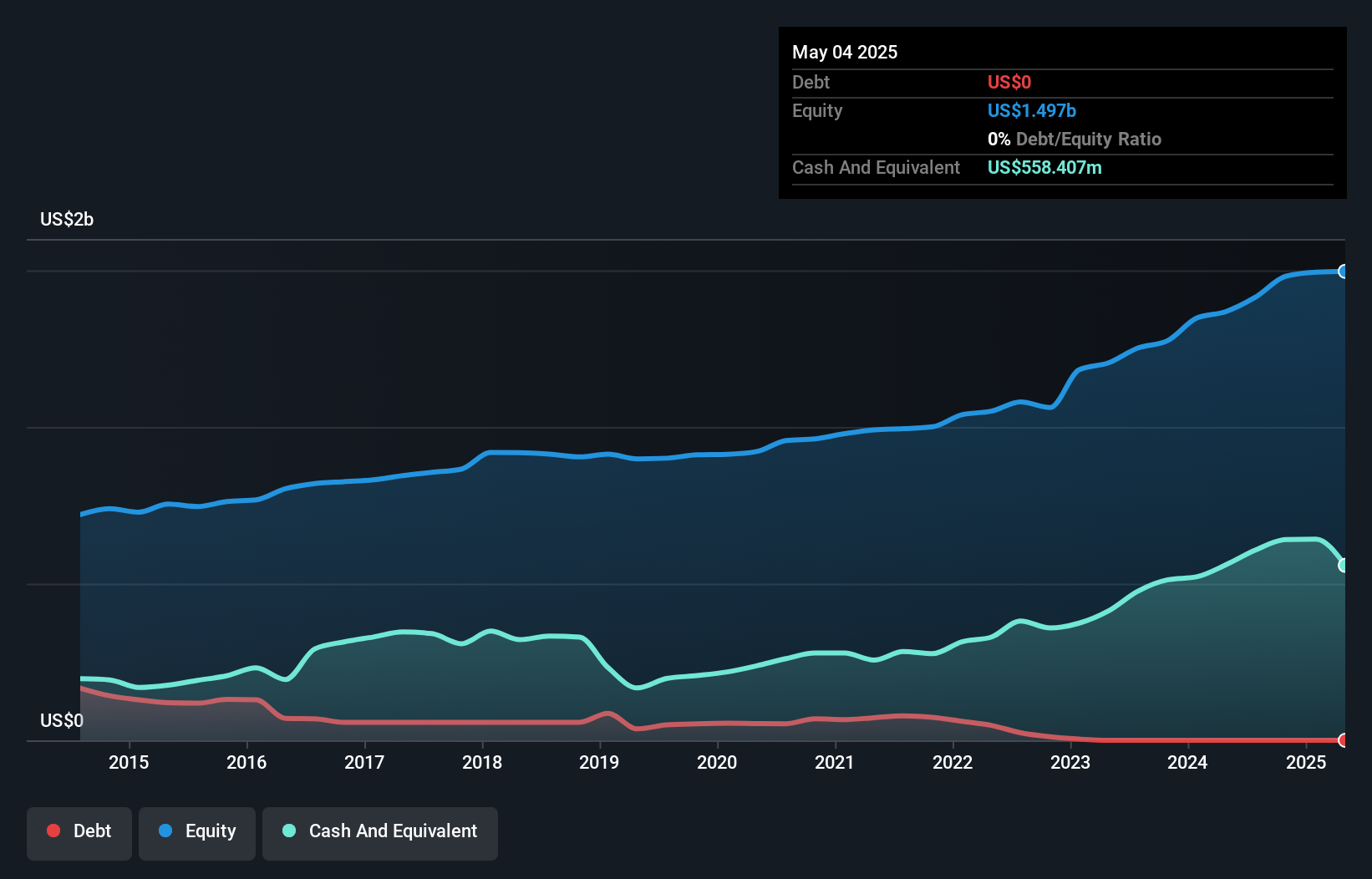

Photronics, a nimble player in the semiconductor industry, is making waves with its strategic investments and solid financial health. The company has no debt, a stark contrast to five years ago when its debt-to-equity ratio was 5.8%. Trading at 33.5% below estimated fair value, it offers good relative value compared to peers. Earnings grew by 4.1% last year, outpacing the industry's modest 0.4% growth rate. Despite significant insider selling recently, Photronics remains focused on expanding its IC manufacturing capacity with a $200 million investment in the U.S., aiming to boost revenue while navigating competitive pressures and geopolitical challenges in China.

Turning Ideas Into Actions

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 275 more companies for you to explore.Click here to unveil our expertly curated list of 278 US Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PNRG

PrimeEnergy Resources

Through its subsidiaries, engages in acquisition, development, and production of oil and natural gas properties in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives