- United States

- /

- Oil and Gas

- /

- NasdaqGS:PAA

Evaluating Plains All American Pipeline Amid Regulatory Clarity and Recent 6% Price Surge

Reviewed by Bailey Pemberton

- Ever wondered if Plains All American Pipeline is the kind of value opportunity that stands out from the crowd? Let’s take a closer look at why price alone doesn't tell the whole story for this stock.

- Shares have delivered a 1.0% gain year-to-date, with a robust 6.3% climb over the past month and an impressive 85.4% rally in the last three years. These are clear signs of shifting growth potential and market sentiment.

- Recent news has centered on the ongoing discussions around U.S. energy infrastructure and pipeline investments, pushing headlines about regulatory clarity and expansion plans into the spotlight. These updates give investors a window into both future opportunities and the evolving risk landscape.

- On our 6-point valuation check, Plains All American Pipeline scores a 4, suggesting it passes most but not all of our key undervaluation tests. Up next, we’ll break down what this means across multiple valuation approaches, and later, we’ll reveal an even more insightful way to understand the company’s true value.

Approach 1: Plains All American Pipeline Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting future cash flows and discounting them to their present value. This approach is especially effective for businesses like Plains All American Pipeline, where cash flow projections provide a clear window into long-term earning power.

For Plains All American Pipeline, the latest reported Free Cash Flow stands at $2.29 billion. Analyst consensus covers the next five years, after which future projections are extrapolated by Simply Wall St. By 2029, Free Cash Flow is expected to reach approximately $1.80 billion. Calculations extend up to 2035 for a comprehensive valuation.

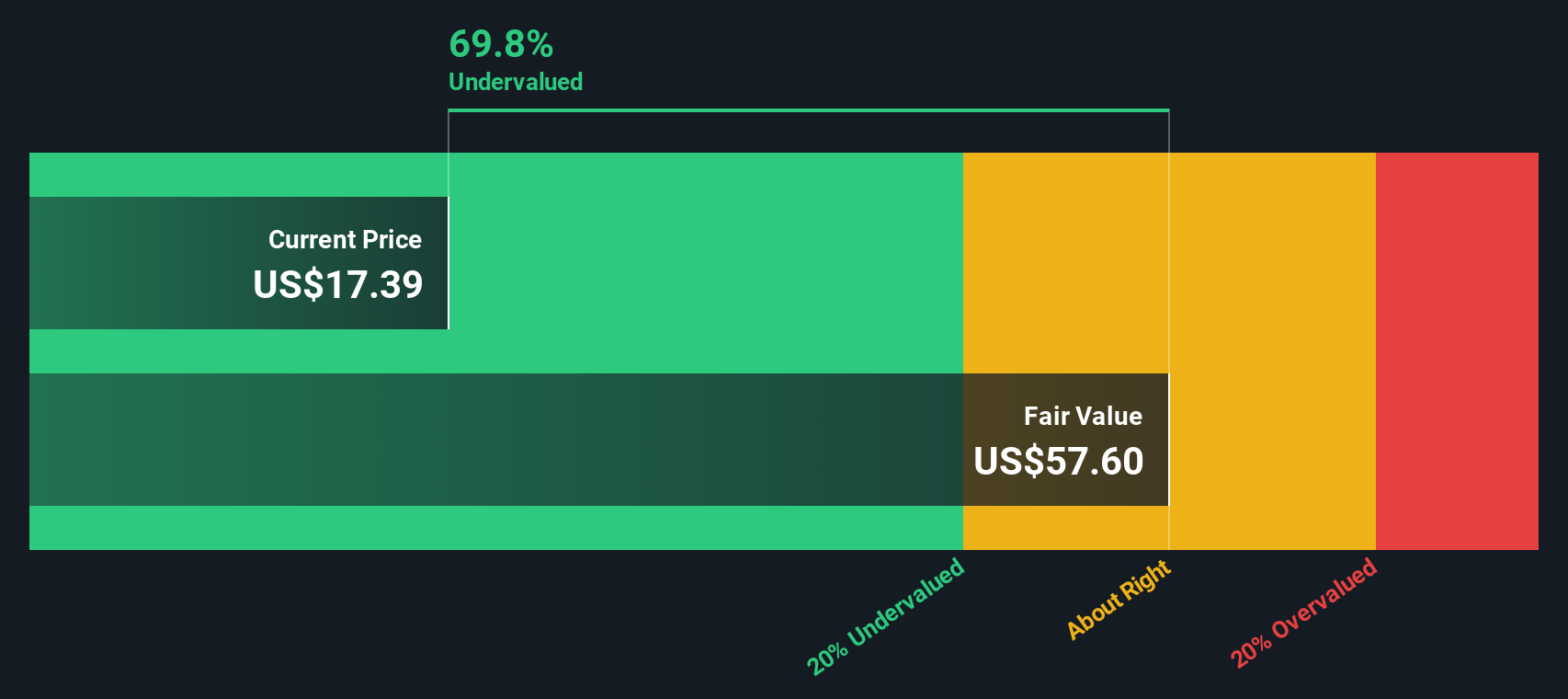

The resulting DCF fair value for Plains All American Pipeline is $57.63 per share. Based on the DCF assessment, the stock is currently trading at a 69.7% discount to its estimated intrinsic value. This indicates a notable undervaluation, as the current market price does not reflect the robust future cash flow potential outlined by analysts and model projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Plains All American Pipeline is undervalued by 69.7%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Plains All American Pipeline Price vs Earnings

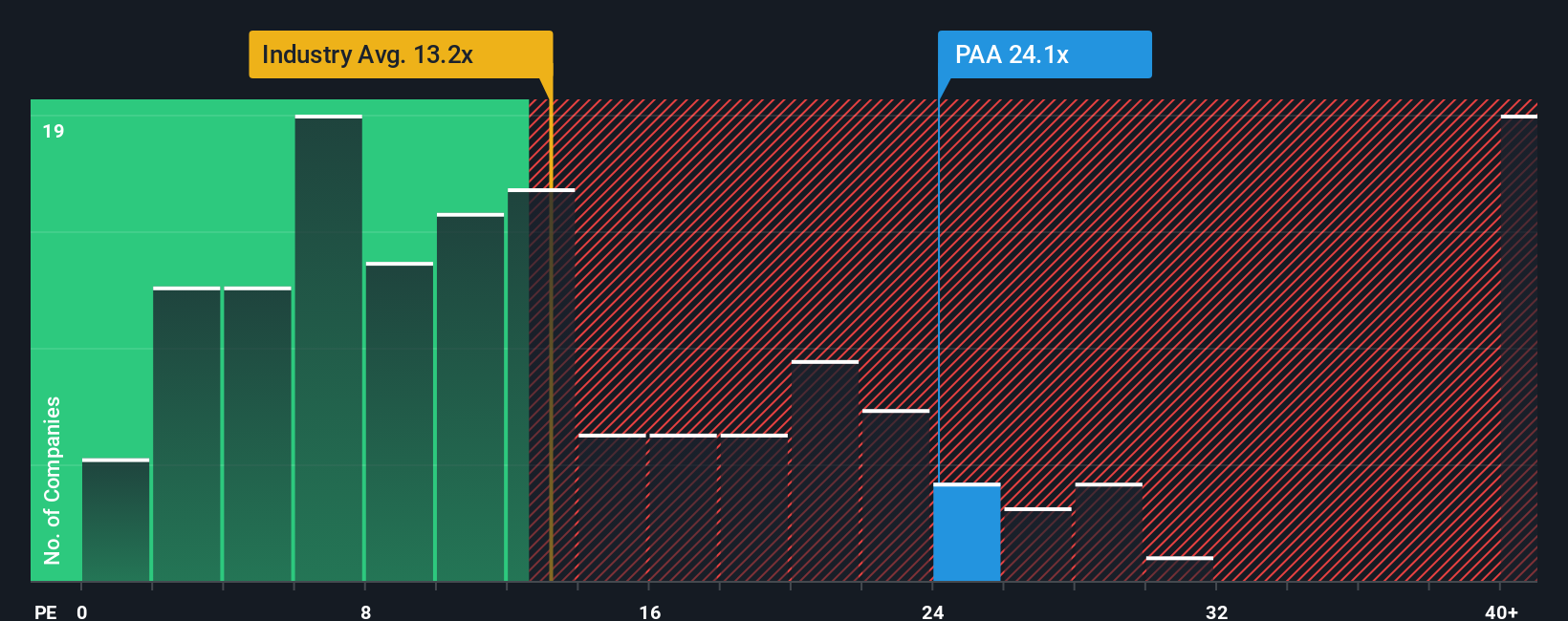

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Plains All American Pipeline, as it relates a company’s share price to its per-share earnings. For firms generating consistent profits, the PE ratio helps investors gauge whether the stock is priced reasonably relative to the company’s bottom-line performance.

A “normal” or “fair” PE ratio is influenced by expectations for future earnings growth and the level of risk investors are willing to accept. Companies with higher growth outlooks or lower risks often justify higher multiples. Those with slower growth or greater risk typically trade at lower PE ratios.

Currently, Plains All American Pipeline trades at a PE ratio of 16.9x. This is somewhat higher than the Oil and Gas industry average of 13.6x and below the peer group average of 18.6x. However, Simply Wall St’s proprietary “Fair Ratio” for Plains All American Pipeline is 20.4x. The Fair Ratio accounts for more than just rough peer or industry comparisons. It adjusts for the specific growth forecasts, profit margins, size, and risks unique to Plains All American Pipeline, providing a fuller and fairer snapshot of a reasonable valuation multiple.

Comparing the Fair Ratio (20.4x) to the company’s actual PE (16.9x) suggests that the stock is undervalued with respect to its earnings power and company-specific characteristics. This points to a potential value opportunity for investors who look deeper than simple surface metrics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Plains All American Pipeline Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about a company: the logic, assumptions, and outlook that explain why you think it’s worth a certain value based on its future revenue, earnings, and profit margins. Instead of relying only on numbers, Narratives help you connect your view of Plains All American Pipeline’s business, industry changes, and risks to a dynamic financial forecast and a calculated fair value, all in one place.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy, accessible tool that lets you test and share your investment perspective and see how it translates to a buy or sell decision by directly comparing your fair value to today’s market price. Narratives update automatically as news or earnings reports are released, so your outlook is always current. For example, one investor’s Narrative for Plains All American Pipeline could reflect optimism about expansion and estimate a fair value as high as $25.00 based on strong margin growth. A more cautious view, focused on energy transition risks, might land at just $17.50. Try creating your own Narrative to see how your unique expectations stack up against the crowd.

Do you think there's more to the story for Plains All American Pipeline? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAA

Plains All American Pipeline

Through its subsidiaries, engages in the pipeline transportation, terminaling, storage, and gathering of crude oil and natural gas liquids (NGL) in the United States and Canada.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026