- United States

- /

- Oil and Gas

- /

- NasdaqGS:PAA

Assessing Plains All American Pipeline (PAA) Valuation After Analyst Upgrades and Strategic Moves

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 16% Undervalued

The prevailing narrative suggests that Plains All American Pipeline is undervalued by 16%, offering potential upside for investors willing to bet on its ability to deliver on future expectations.

Limited new pipeline construction due to increased regulatory barriers enhances scarcity value for Plains' existing midstream infrastructure. This increases pricing power and supports sustainable improvements in net margins over time.

Ever wonder what's fueling this optimism? The valuation rests on some big, not-so-obvious projections. These numbers could shift the entire growth story of Plains All American Pipeline. Want to see which assumptions and future trends make analysts set their target so much higher than the current price? The full narrative reveals how this valuation is built on expectations for rising margins, earnings leaps, and structural changes that could redefine what is possible for this pipeline giant.

Result: Fair Value of $21.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a sharper crude focus could heighten exposure to energy transition risks and industry overcapacity. This may challenge future returns if conditions deteriorate.

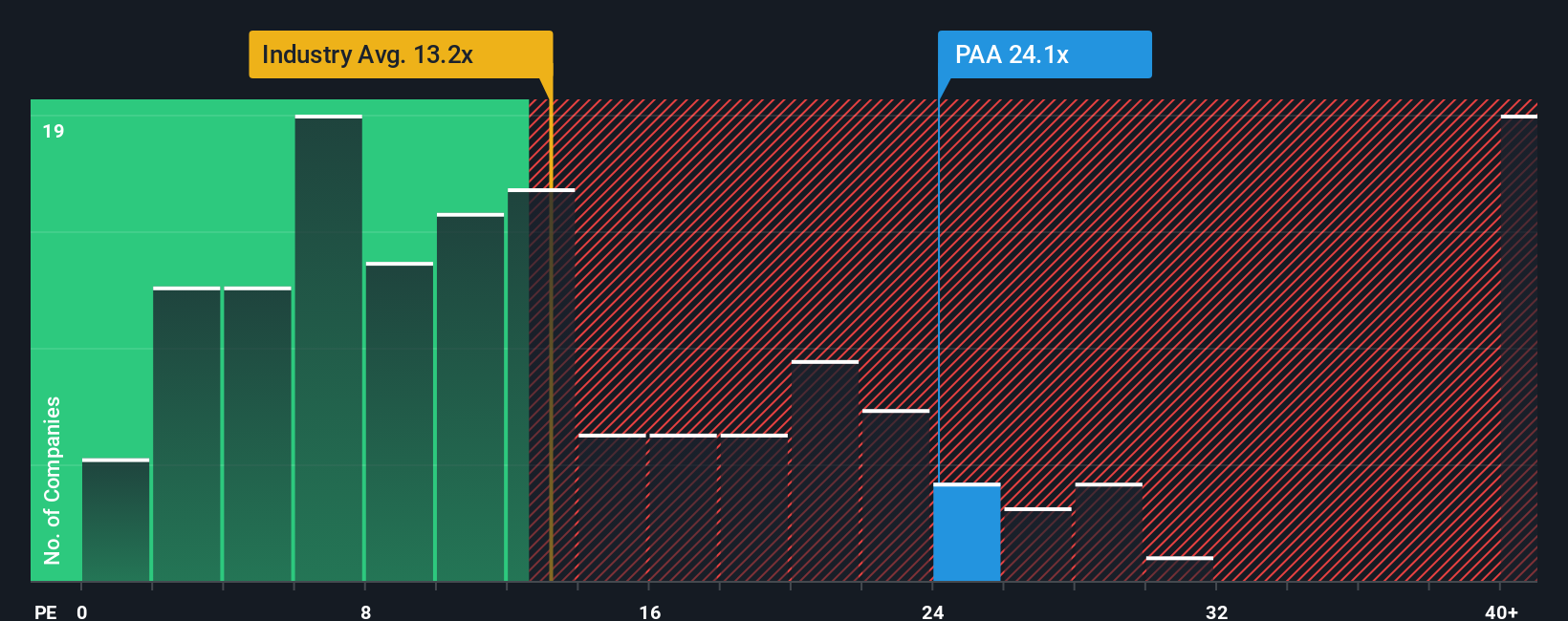

Find out about the key risks to this Plains All American Pipeline narrative.Another View: Pricing Based on Earnings Ratios

While some analysts find value using long-term forecasts, the market’s current price tells a different story when measured against typical industry earnings ratios. This approach suggests Plains All American Pipeline might actually be expensive right now. Which method provides the truest picture?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Plains All American Pipeline to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Plains All American Pipeline Narrative

If you see things differently or want to test your own ideas, you can pull together your version of the Plains All American Pipeline story in just a few minutes. Do it your way

A great starting point for your Plains All American Pipeline research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t limit your search to just one stock. The market is full of unique ideas that could enhance your portfolio, but opportunities are best seized before they become widely recognized.

- Tap into undervalued growth by scanning for companies most overlooked by the market with undervalued stocks based on cash flows.

- Uncover tomorrow’s artificial intelligence breakthroughs by targeting innovators shaking up industries through AI penny stocks.

- Boost your passive income potential by hunting for market leaders paying strong yields over 3% via dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAA

Plains All American Pipeline

Through its subsidiaries, engages in the pipeline transportation, terminaling, storage, and gathering of crude oil and natural gas liquids (NGL) in the United States and Canada.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives