- United States

- /

- Oil and Gas

- /

- NasdaqCM:OPAL

OPAL Fuels Inc. (NASDAQ:OPAL) Might Not Be As Mispriced As It Looks After Plunging 27%

To the annoyance of some shareholders, OPAL Fuels Inc. (NASDAQ:OPAL) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 55% loss during that time.

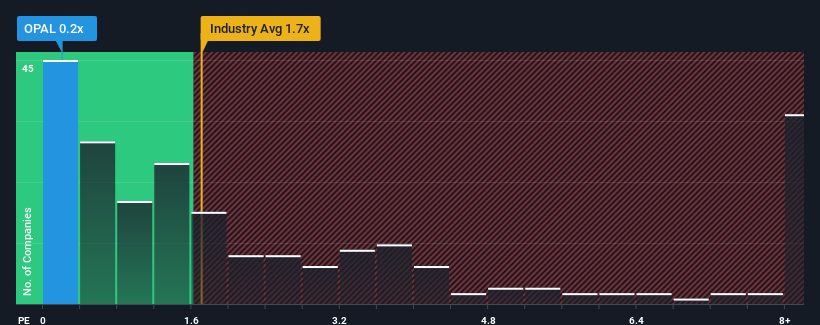

Following the heavy fall in price, OPAL Fuels' price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Oil and Gas industry in the United States, where around half of the companies have P/S ratios above 1.7x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for OPAL Fuels

What Does OPAL Fuels' Recent Performance Look Like?

Recent times have been advantageous for OPAL Fuels as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OPAL Fuels.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, OPAL Fuels would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 30%. Pleasingly, revenue has also lifted 121% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 27% each year over the next three years. With the industry only predicted to deliver 5.2% each year, the company is positioned for a stronger revenue result.

With this information, we find it odd that OPAL Fuels is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

OPAL Fuels' recently weak share price has pulled its P/S back below other Oil and Gas companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at OPAL Fuels' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you take the next step, you should know about the 3 warning signs for OPAL Fuels (1 can't be ignored!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:OPAL

OPAL Fuels

Engages in the production and distribution of renewable natural gas (RNG) for use as a vehicle fuel for heavy and medium-duty trucking fleets throughout the United States.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives