- United States

- /

- Oil and Gas

- /

- NasdaqCM:NXXT

Will NextNRG's (NXXT) Florida Expansion Strengthen Its Integrated Energy Platform Ambitions?

Reviewed by Sasha Jovanovic

- NextNRG recently launched a new mobile fueling operations hub in Fort Myers, Florida, extending its reach along the Gulf Coast and targeting major e-commerce logistics centers and commercial clients in a growing regional market.

- The company also advanced infrastructure ambitions with a long-term lease option for 1,600 acres in Nassau County, Florida, to support large-scale smart microgrid and data center development aligned with rising AI and cloud infrastructure demand.

- We'll explore how NextNRG's rapid expansion into key Florida markets has the potential to reinforce the company's integrated energy platform narrative.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

NextNRG Investment Narrative Recap

The core belief for NextNRG shareholders centers on the company’s ability to rapidly scale its integrated energy solutions platform, leveraging mobile fueling and microgrid development to tap into surging demand from sectors such as AI, cloud computing, and logistics. While the launch of the Fort Myers hub highlights continuing traction in high-volume commercial markets, the near-term risk of ongoing capital needs and persistent operating losses remains a central concern for investors.

The recently secured long-term lease option in Nassau County, designed to support a potential 200 MW smart microgrid and hyperscale data center capacity, stands out as a material development. This announcement is especially relevant in the context of catalysts for NextNRG: it targets rising energy demands from data infrastructure while offering a phased, resource-rich site that could help mitigate risk if executed efficiently.

By contrast, investors should keep in mind the dilution risk that comes with recurring capital raises as the company’s footprint expands...

Read the full narrative on NextNRG (it's free!)

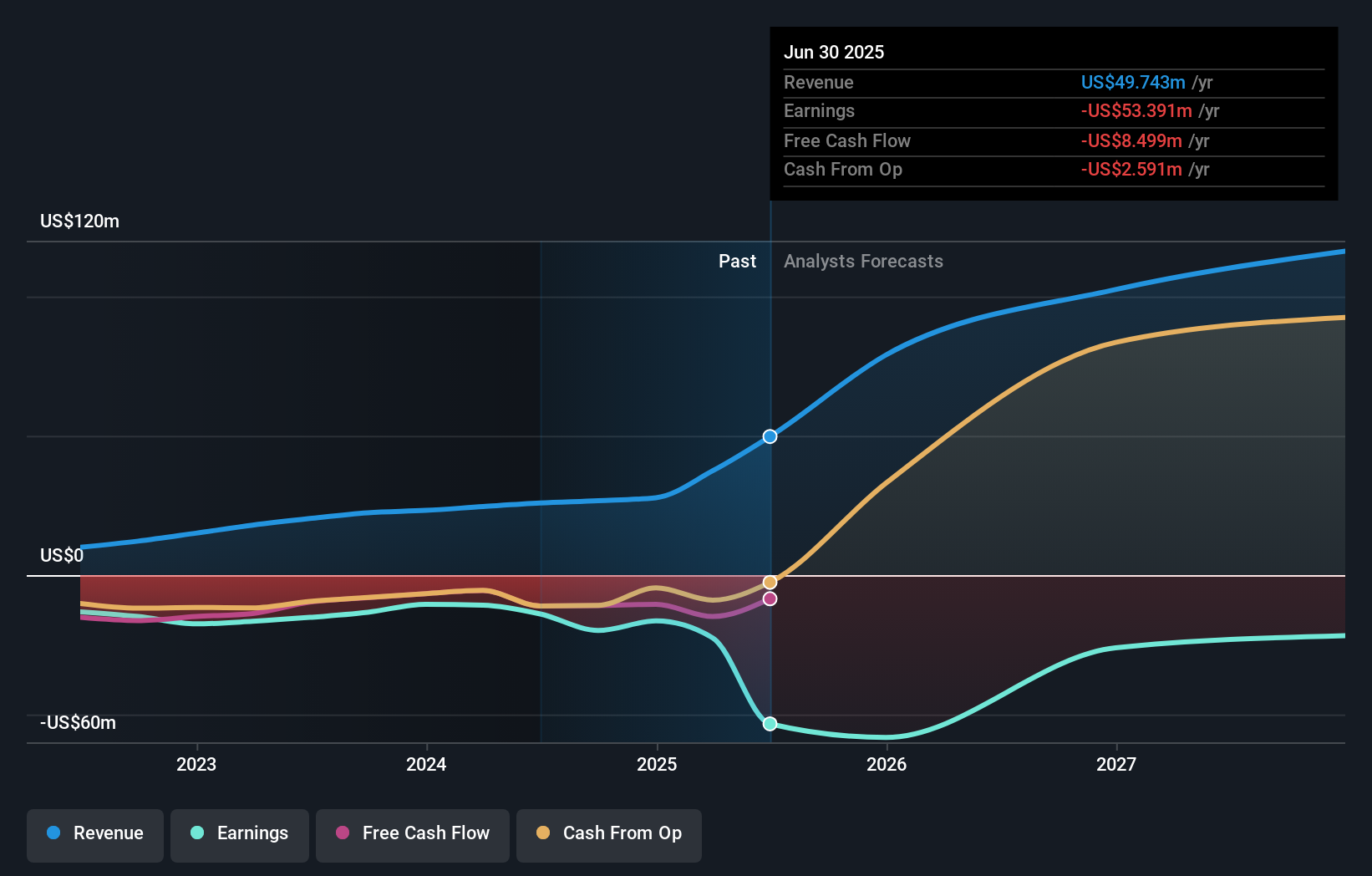

NextNRG's outlook forecasts $124.8 million in revenue and $18.6 million in earnings by 2028. Achieving these figures would require annual revenue growth of 35.9% and an earnings increase of $72 million from current earnings of -$53.4 million.

Uncover how NextNRG's forecasts yield a $5.50 fair value, a 161% upside to its current price.

Exploring Other Perspectives

All 1 Community-sourced fair value estimate for NextNRG sits at US$5.50, reflecting little diversity in viewpoints from the Simply Wall St Community right now. Persistent negative cash flow due to ongoing operating losses is something you should consider as you weigh these community-driven perspectives with your own expectations for the company’s future funding needs.

Explore another fair value estimate on NextNRG - why the stock might be worth just $5.50!

Build Your Own NextNRG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextNRG research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free NextNRG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextNRG's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextNRG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NXXT

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives