Key Takeaways

- Integrated energy solutions and technology-agnostic platform enable resilience to market shifts, driving sustainable revenue and long-term contracts with utilities and institutional clients.

- Operational efficiencies and expansion into hybrid microgrids support improved margins, recurring income streams, and enhanced cash flow stability.

- Exposure to fossil fuels, ongoing capital needs, regulatory risks, and reliance on key clients threaten profitability as renewables and electrification advance rapidly.

Catalysts

About NextNRG- Engages in mobile fueling operations in the United States.

- Rapid growth in commercial traction for NextNRG's integrated energy platform, including AI-powered microgrids, mobile fueling, and wireless EV charging, positions the company to benefit from global energy demand growth and infrastructure modernization, driving higher future revenue and recurring contractual income.

- Expansion into health care and institutional projects through hybrid microgrid solutions (combining natural gas, solar, and battery storage) aligns with increased energy security concerns and client demand for resilient, diversified energy systems, supporting improved margins and long-term earnings visibility.

- Early-stage adoption of NextNRG's Utility Operating System by utilities and governments-involving 25-30 year recurring contracts-offers long-term revenue stability and strengthens cash flow generation as energy security and grid modernization become larger priorities worldwide.

- The platform's technology-agnostic approach allows NextNRG to capture business both from legacy fossil-fuel needs and clients transitioning to renewables, reducing substitution risk from decarbonization trends and supporting sustained revenue growth through the transition period.

- Expanding operational scale, successfully demonstrated synergies (route optimization, local logistics), and evidence of gross margin improvement signal continued efficiency gains that are likely to improve EBITDA margins, reduce operating expenses, and accelerate path to profitability.

NextNRG Future Earnings and Revenue Growth

Assumptions

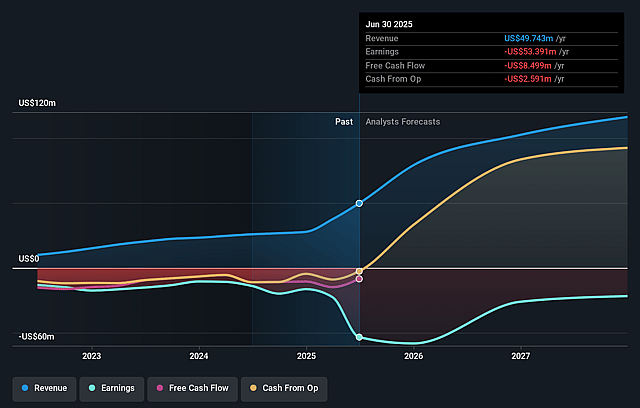

How have these above catalysts been quantified?- Analysts are assuming NextNRG's revenue will grow by 35.9% annually over the next 3 years.

- Analysts are not forecasting that NextNRG will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate NextNRG's profit margin will increase from -107.3% to the average US Oil and Gas industry of 14.9% in 3 years.

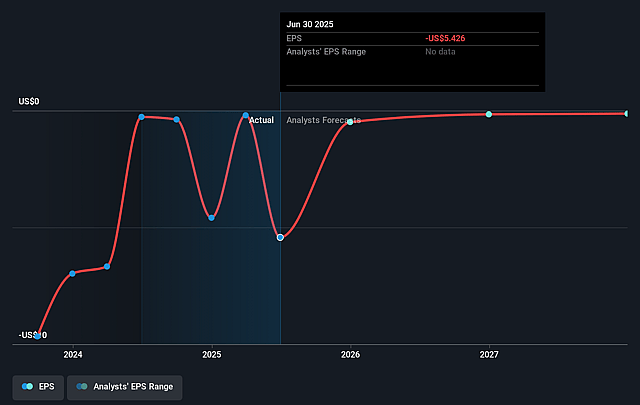

- If NextNRG's profit margin were to converge on the industry average, you could expect earnings to reach $18.6 million (and earnings per share of $0.12) by about September 2028, up from $-53.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 55.2x on those 2028 earnings, up from -3.6x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.03%, as per the Simply Wall St company report.

NextNRG Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NextNRG's continued reliance on legacy fossil fuel-based solutions (e.g., natural gas generators in microgrids) exposes it to long-term demand erosion as global decarbonization accelerates and government net-zero mandates increase, likely impacting future revenue streams tied to non-renewable segments.

- The company's aggressive growth and market expansion strategy requires ongoing capital investment, and repeated references to future capital raises and current operating losses signal a risk of persistent negative free cash flow if projects underperform or sales cycles for newer solutions (like the Utility Operating System) remain long, compressing earnings and increasing dilution risk for shareholders.

- NextNRG's technology-agnostic approach-integrating both traditional and renewable energy sources-may reduce short-term transition risk but increases exposure to regulatory uncertainty or punitive carbon taxation as jurisdictions tighten emissions rules, leading to potential margin compression and increased operating costs.

- Margin improvement is in early stages (gross margins moved from 3% to 8% but remain low), and significant dependence on a few anchor clients in each new market creates concentration risk; loss or underperformance of these key clients could materially impact recurring revenues and net margins.

- Rapid adoption and declining costs of renewables, vehicle electrification, and grid-scale battery storage could make parts of NextNRG's offering-especially hybrid or fossil-fuel-based solutions-less competitive or even stranded, undermining long-term revenue growth and putting pressure on future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.5 for NextNRG based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $124.8 million, earnings will come to $18.6 million, and it would be trading on a PE ratio of 55.2x, assuming you use a discount rate of 7.0%.

- Given the current share price of $1.54, the analyst price target of $5.5 is 72.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.