- United States

- /

- Oil and Gas

- /

- NasdaqCM:NXXT

NextNRG (NXXT): Assessing Valuation After Fort Myers Expansion Fuels Growth Momentum

Reviewed by Kshitija Bhandaru

NextNRG (NXXT) has just launched its newest mobile fueling hub in Fort Myers, Florida, tapping into a key area for e-commerce distribution networks. This addition supports the company’s ongoing push to expand its national footprint.

See our latest analysis for NextNRG.

After a tough year for total shareholder returns, with a decline of nearly 9%, NextNRG’s share price has surged back in a big way, jumping more than 83% over the past month alone. This recent momentum follows a stretch of operational milestones, including the launch of its Fort Myers fueling hub, and suggests investors are warming up to the company’s strategic expansion and growth potential.

If you’re curious about other companies making bold growth moves, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares surging in recent weeks, the critical question now is whether NextNRG’s stock remains attractively valued for investors, or if the market has already priced in all of the company’s future growth prospects.

Most Popular Narrative: 48.7% Undervalued

Market watchers may be taking notice as the most widely followed narrative places NextNRG’s fair value at $5.50, which is nearly double its last close of $2.82. This large gap points to strong confidence in the company’s upside if its ambitious growth targets materialize.

Rapid growth in commercial traction for NextNRG's integrated energy platform, including AI-powered microgrids, mobile fueling, and wireless EV charging, positions the company to benefit from global energy demand growth and infrastructure modernization. These drivers could lead to higher future revenue and recurring contractual income.

Want to know what’s fueling this soaring price estimate? The magic is in a bold projection: a dramatic transformation in margins and fast-paced revenue expansion. NextNRG’s story hinges on whether it can outgrow legacy headwinds and join the ranks of energy innovators with profit multiples that raise eyebrows. Dive in to discover exactly what’s driving those sky-high expectations.

Result: Fair Value of $5.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory scrutiny on emissions and the need for ongoing capital could challenge NextNRG’s expansion, putting pressure on margins and profitability.

Find out about the key risks to this NextNRG narrative.

Another View: How Does the Market Price Stacks Up?

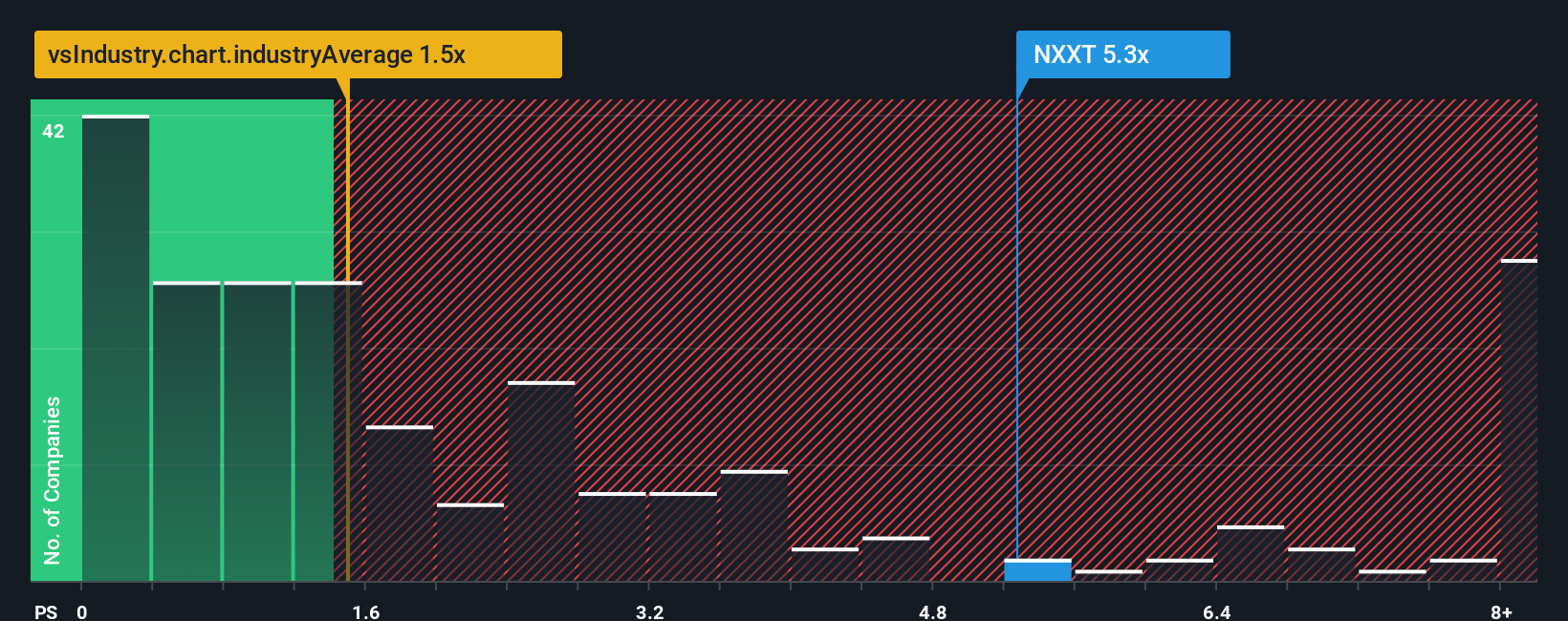

Taking a different approach, let’s compare NextNRG’s current price-to-sales ratio, which stands at a steep 7.2x. This is far higher than the US Oil and Gas industry average of 1.5x and also above its fair ratio of 0.6x. This suggests the stock carries a hefty valuation premium. The gap signals that investors are betting big on future growth, but will the fundamentals catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NextNRG Narrative

If you see things differently or want a hands-on approach, you can analyze the numbers and craft your own narrative for NextNRG in just a few minutes. Do it your way

A great starting point for your NextNRG research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let the next breakout stock pass you by. Use Simply Wall Street’s powerful tools to uncover unique opportunities and build your portfolio with confidence.

- Discover undervalued opportunities before they're widely recognized by exploring these 895 undervalued stocks based on cash flows with strong cash flow prospects.

- Explore the growing field of artificial intelligence by reviewing these 25 AI penny stocks that offer compelling growth stories and innovation-driven results.

- Enhance your income strategy by finding these 19 dividend stocks with yields > 3% that consistently deliver yields above 3% to support your financial objectives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextNRG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NXXT

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives