- United States

- /

- Oil and Gas

- /

- NasdaqGS:NFE

Should Puerto Rico’s Conditional LNG Deal Amid Rising Losses and Tighter Credit Terms Require Action From New Fortress Energy (NFE) Investors?

Reviewed by Sasha Jovanovic

- New Fortress Energy’s recent results showed revenue falling to US$327.37 million in the third quarter of 2025 and a net loss of US$299.97 million, while the company also amended key credit agreements that extended maturities but tightened restrictions on dividends and debt service.

- Soon after, Puerto Rico’s Financial Oversight and Management Board conditionally approved a roughly US$3.20 billion, seven-year LNG supply contract that could underpin New Fortress Energy’s future cash flows while it addresses heightened refinancing and bankruptcy risk.

- We’ll now examine how this conditional Puerto Rico LNG contract, arriving amid deeper losses and tighter lending terms, reshapes New Fortress Energy’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

New Fortress Energy Investment Narrative Recap

To own New Fortress Energy today, you need to believe it can turn a capital‑intensive, LNG‑to‑power platform into stable, contracted cash flows before its balance sheet pressures force a more punitive restructuring. The conditional US$3.20 billion Puerto Rico LNG deal directly hits the key near term catalyst, by potentially anchoring future revenues, while the biggest immediate risk remains refinancing and default risk if covenants or forbearance terms are breached.

The Eleventh Amendment to New Fortress Energy’s Letter of Credit Agreement is central here: it extends a key maturity to March 31, 2026 and temporarily eases financial covenants, but sharply limits dividends and debt payments. That makes the conditional Puerto Rico contract even more important, because any slippage in final approval or contract execution now interacts with tighter lender controls and the threat of accelerated debt.

Yet behind the excitement around the Puerto Rico deal, investors should be aware that the company’s high reliance on a capital intensive model means...

Read the full narrative on New Fortress Energy (it's free!)

New Fortress Energy’s narrative projects $3.8 billion revenue and $557.9 million earnings by 2028. This requires 23.2% yearly revenue growth and an earnings increase of roughly $1.6 billion from -$1.0 billion today.

Uncover how New Fortress Energy's forecasts yield a $3.38 fair value, a 172% upside to its current price.

Exploring Other Perspectives

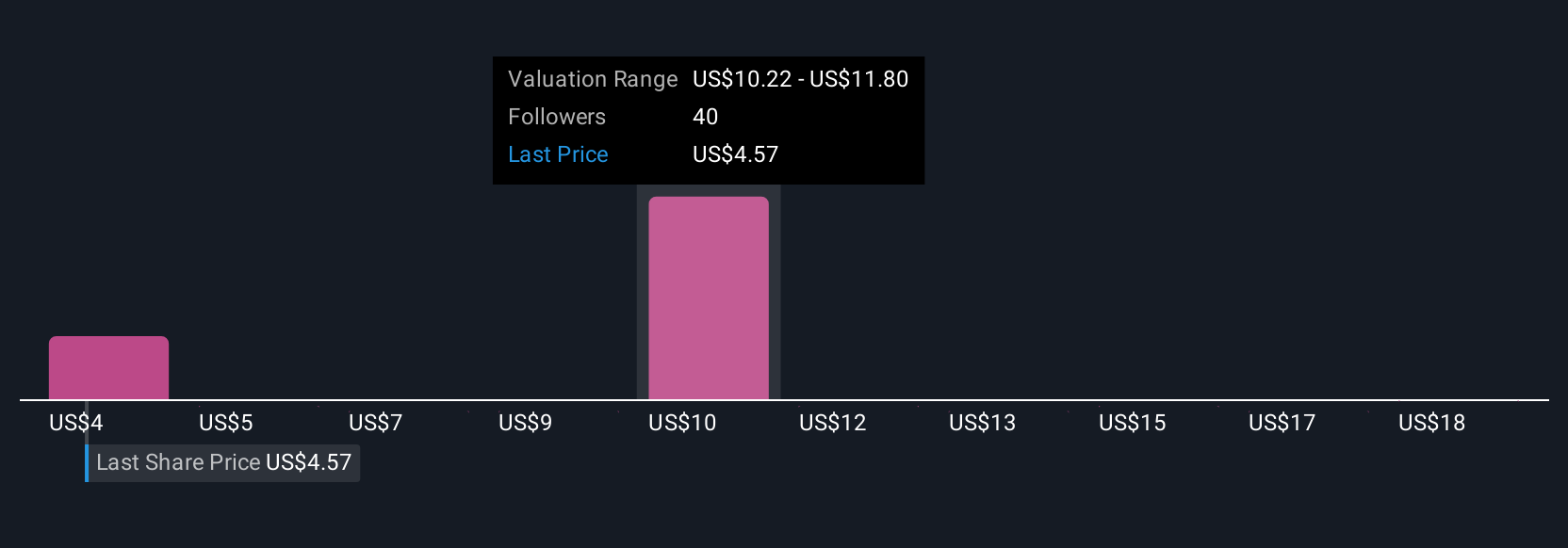

Six fair value estimates from the Simply Wall St Community range from about US$0.09 to US$8.50, underlining how differently individual investors see New Fortress Energy. Against that spread, the conditional Puerto Rico LNG contract and recent covenant amendments highlight how much the investment case hinges on securing long term contracts before balance sheet risk tightens further, so it is worth comparing several viewpoints before forming your own.

Explore 6 other fair value estimates on New Fortress Energy - why the stock might be worth over 6x more than the current price!

Build Your Own New Fortress Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Fortress Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free New Fortress Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Fortress Energy's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Fortress Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFE

New Fortress Energy

Operates as an integrated gas-to-power energy infrastructure company that provides energy and development services to end-users worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026