- United States

- /

- Energy Services

- /

- NasdaqCM:NCSM

NCS Multistage Holdings, Inc. (NASDAQ:NCSM) Stock Catapults 45% Though Its Price And Business Still Lag The Industry

NCS Multistage Holdings, Inc. (NASDAQ:NCSM) shareholders would be excited to see that the share price has had a great month, posting a 45% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 29% in the last twelve months.

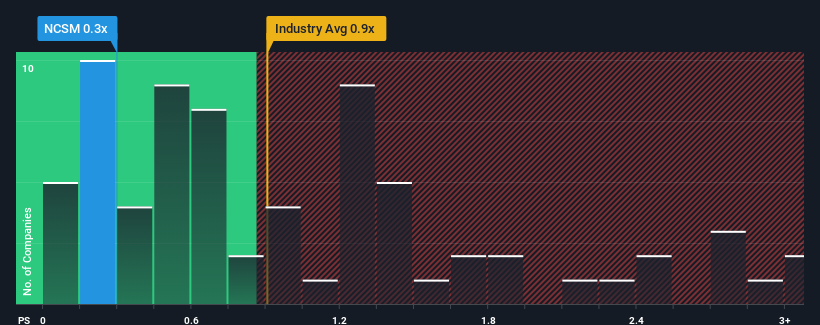

Although its price has surged higher, given about half the companies operating in the United States' Energy Services industry have price-to-sales ratios (or "P/S") above 0.9x, you may still consider NCS Multistage Holdings as an attractive investment with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for NCS Multistage Holdings

How NCS Multistage Holdings Has Been Performing

NCS Multistage Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on NCS Multistage Holdings.How Is NCS Multistage Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like NCS Multistage Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 2.7% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 12% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 5.1% each year during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 9.7% per year, which is noticeably more attractive.

With this information, we can see why NCS Multistage Holdings is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

NCS Multistage Holdings' stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that NCS Multistage Holdings maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for NCS Multistage Holdings that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if NCS Multistage Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NCSM

NCS Multistage Holdings

Provides engineered products and support services for oil and natural gas well completions and construction, and field development strategies in the United States, Canada, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives