- United States

- /

- Energy Services

- /

- NasdaqCM:NCSM

NCS Multistage Holdings, Inc. (NASDAQ:NCSM) Shares Fly 31% But Investors Aren't Buying For Growth

The NCS Multistage Holdings, Inc. (NASDAQ:NCSM) share price has done very well over the last month, posting an excellent gain of 31%. The last 30 days bring the annual gain to a very sharp 97%.

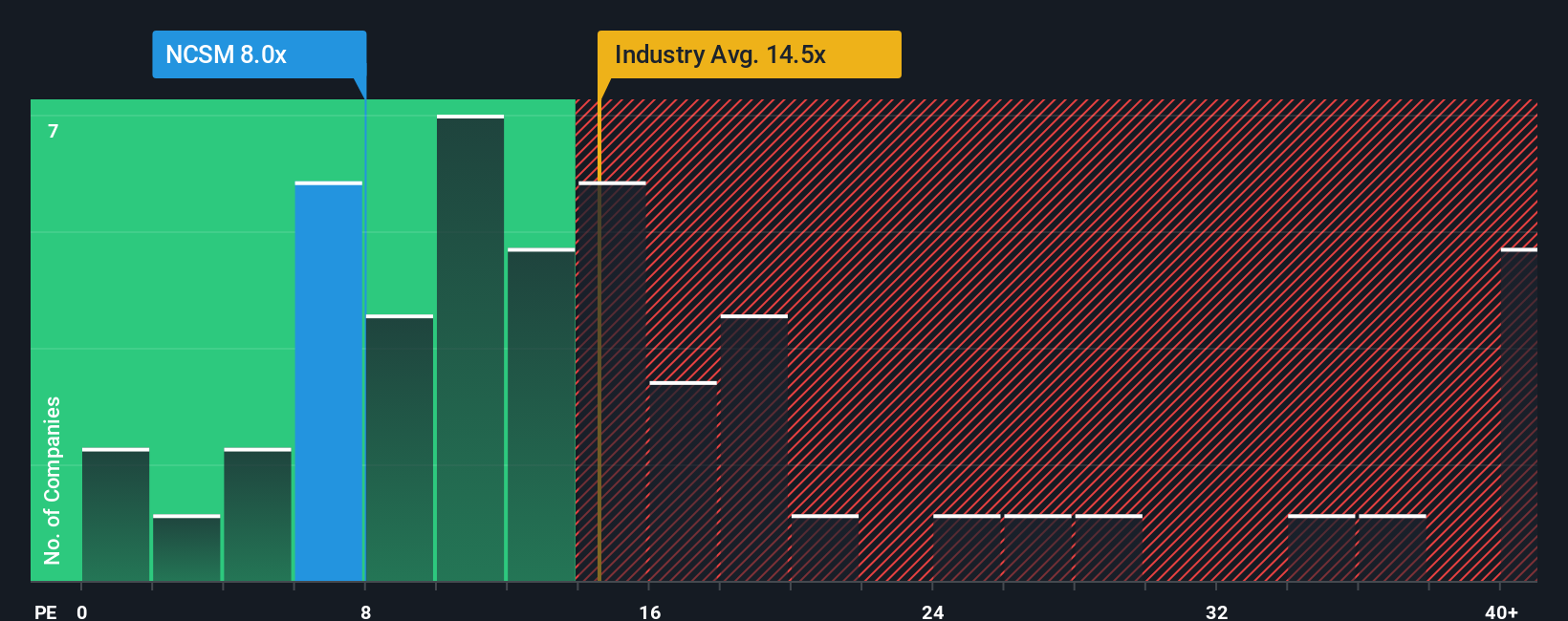

Although its price has surged higher, NCS Multistage Holdings' price-to-earnings (or "P/E") ratio of 8x might still make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 20x and even P/E's above 34x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

NCS Multistage Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for NCS Multistage Holdings

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like NCS Multistage Holdings' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 71%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to slump, contracting by 14% during the coming year according to the one analyst following the company. That's not great when the rest of the market is expected to grow by 15%.

In light of this, it's understandable that NCS Multistage Holdings' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On NCS Multistage Holdings' P/E

Even after such a strong price move, NCS Multistage Holdings' P/E still trails the rest of the market significantly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that NCS Multistage Holdings maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware NCS Multistage Holdings is showing 3 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if NCS Multistage Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NCSM

NCS Multistage Holdings

Provides engineered products and support services for oil and natural gas well completions and construction, and field development strategies in the United States, Canada, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives