- United States

- /

- Oil and Gas

- /

- NasdaqGS:MMLP

Marine Transportation Beats Guidance, Challenging Bearish Profitability Narratives for Martin Midstream (MMLP)

Reviewed by Simply Wall St

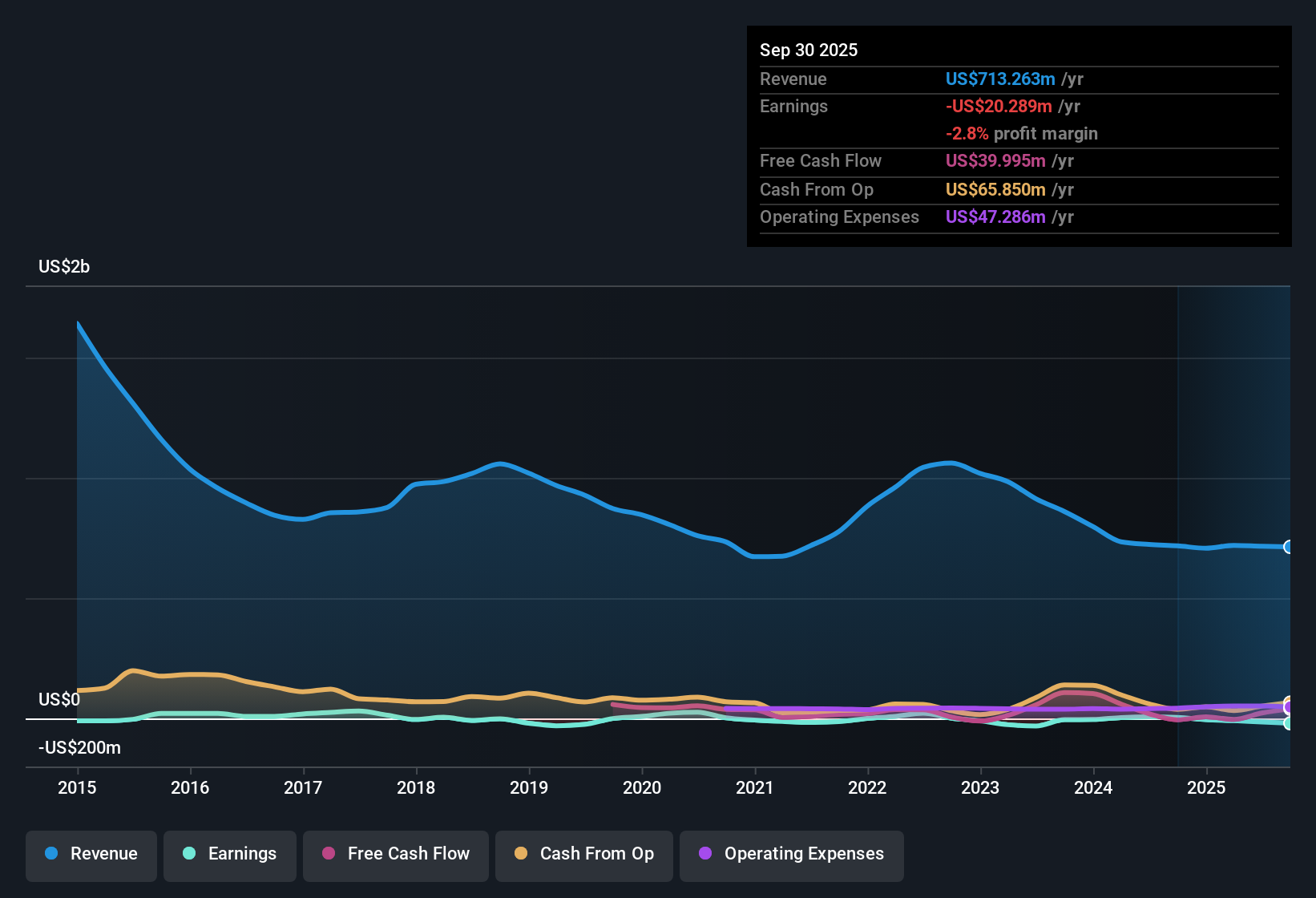

Martin Midstream Partners (MMLP) remains unprofitable, with its losses increasing at an average rate of 2.3% per year over the past five years. Profit margins show no signs of improvement, and the most recent year continues to track in line with the company's lack of earnings traction over a longer-term average. Despite the ongoing losses, there is no indication in the latest data of a shift toward better profitability or higher quality results.

See our full analysis for Martin Midstream Partners.Next, we will see how these reported numbers compare with the prevailing narratives. Some perspectives may be validated, while others will be put to the test.

See what the community is saying about Martin Midstream Partners

Marine Transportation Surpasses Guidance

- The Marine Transportation segment delivered adjusted EBITDA above guidance due to stronger-than-anticipated inland day rates, signaling this operation is a bright spot within Martin Midstream’s portfolio.

- Analysts' consensus view emphasizes that sustained tightness in the inland market is helping drive stable cash flow and could set up steady revenue. However, they caution that overall profit margins remain pressured by costs and broader market softness.

- While guidance-beating Marine Transportation results give bulls something to cheer, consensus also points to weak specialty products demand holding back the company’s overall growth trajectory.

- The narrative expects continued strong performance from Marine Transportation and Sulfur Services segments to partially offset ongoing margin pressure elsewhere. This highlights internal diversity while also reflecting structural headwinds.

Sulfur Services Volume Strength

- Sulfur Services exceeded internal projections with a notable jump in volumes from Gulf Coast refinery customers, a key driver expected to keep near-term production and revenue elevated.

- Analysts' consensus view notes that although increased sulfur volumes have given this segment an edge, looming risks include potential delays in the ELSA joint venture and increased compensation expenses that could curb future margin gains.

- Consensus highlights that stable, higher sulfur output is positive, but increased costs linked to long-term incentive plans have directly dented recent quarter earnings performance.

- Pending ELSA project revenue and capital expenditure shifts are called out as factors that could determine whether Sulfur Services strength is sustained or becomes more volatile over the next year.

Trading at a Deep Discount to Fair Value

- Martin Midstream Partners' share price of $2.58 sits well below both its DCF fair value of $5.89 and analyst price target of $4.00. This reflects a significant valuation gap relative to fundamentals and expectations.

- Analysts' consensus view sees the current market price as offering a value opportunity only if revenue projections are credible. Achieving analyst targets would require the company to increase profit margins to 2.0% and earnings to $14.9 million by 2028. Both remain uncertain against the backdrop of persistent losses and muted growth forecasts.

- Consensus points out that, despite a very low Price-To-Sales Ratio of 0.1x compared to an industry and peer group average of 1.5x, the company’s lack of clear earnings momentum keeps many investors on the sidelines.

- To justify the consensus price target, Martin Midstream would need to execute substantial operational improvements. The current discount reflects deep skepticism in the market about this happening.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Martin Midstream Partners on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the numbers others might have missed? Share your take and shape a fresh perspective in just a few minutes with Do it your way.

A great starting point for your Martin Midstream Partners research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Martin Midstream Partners continues to struggle with persistent losses, weak profit margins, and inconsistent growth compared to peers with more stable performance.

Want to avoid similar uncertainty? Use our stable growth stocks screener (2097 results) to quickly spot companies that consistently post steady growth and reliable results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMLP

Martin Midstream Partners

Provides terminalling, processing, storage, and packaging services for petroleum products and by-products in the United States.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives