- United States

- /

- Energy Services

- /

- NasdaqCM:MIND

MIND Technology, Inc.'s (NASDAQ:MIND) 32% Share Price Surge Not Quite Adding Up

Despite an already strong run, MIND Technology, Inc. (NASDAQ:MIND) shares have been powering on, with a gain of 32% in the last thirty days. The last 30 days bring the annual gain to a very sharp 46%.

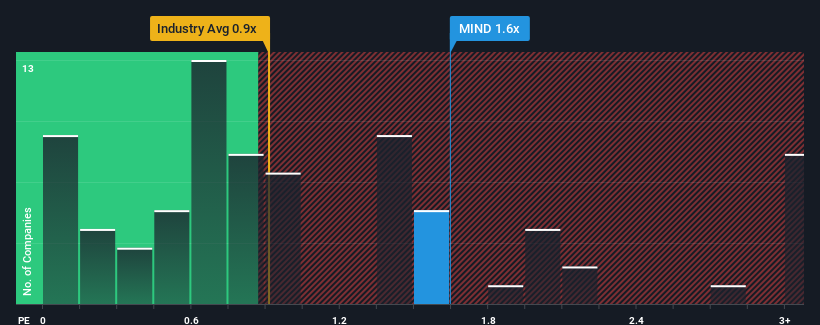

Since its price has surged higher, you could be forgiven for thinking MIND Technology is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.6x, considering almost half the companies in the United States' Energy Services industry have P/S ratios below 0.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for MIND Technology

What Does MIND Technology's P/S Mean For Shareholders?

Recent times have been advantageous for MIND Technology as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on MIND Technology will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as MIND Technology's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 41% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 76% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 4.8% as estimated by the one analyst watching the company. That's shaping up to be similar to the 4.2% growth forecast for the broader industry.

With this information, we find it interesting that MIND Technology is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

The large bounce in MIND Technology's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that MIND Technology currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 4 warning signs for MIND Technology (2 are a bit unpleasant!) that you need to be mindful of.

If you're unsure about the strength of MIND Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MIND

MIND Technology

Provides technology to the oceanographic, hydrographic, defense, seismic, and maritime security industries in the United States, China, Norway, Turkey, Singapore, Canada, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives