- United States

- /

- Oil and Gas

- /

- NasdaqCM:IMPP

Assessing Imperial Petroleum (NasdaqCM:IMPP) Valuation Following Q2 2025 Earnings Decline

Reviewed by Simply Wall St

Imperial Petroleum (NasdaqCM:IMPP) just released its Q2 2025 earnings, shining a spotlight on both its strengths and recent challenges. Investors may already know that the company's reported sales and net income declined compared to last year. Second quarter revenue dropped to $36.35 million from $47.04 million, and net income dipped to $12.76 million from $19.52 million. These numbers can prompt a pause, especially for anyone weighing whether management’s long-term strategy is hitting a rough patch or simply navigating tough industry conditions.

Putting these results into context, Imperial Petroleum’s shares have had a year of ups and downs. The stock has slipped roughly 3% over the past year, underperforming broader markets; but it has climbed 34% in the past month and 20% year-to-date, showing some renewed optimism among investors. With annual revenue and net income growth still looking healthy, short-term volatility contrasts with encouraging trends in the underlying business.

After this year’s swings, should investors be looking at these latest numbers as a potential bargain, or is the current share price already reflecting expectations for a turnaround?

Most Popular Narrative: 33% Undervalued

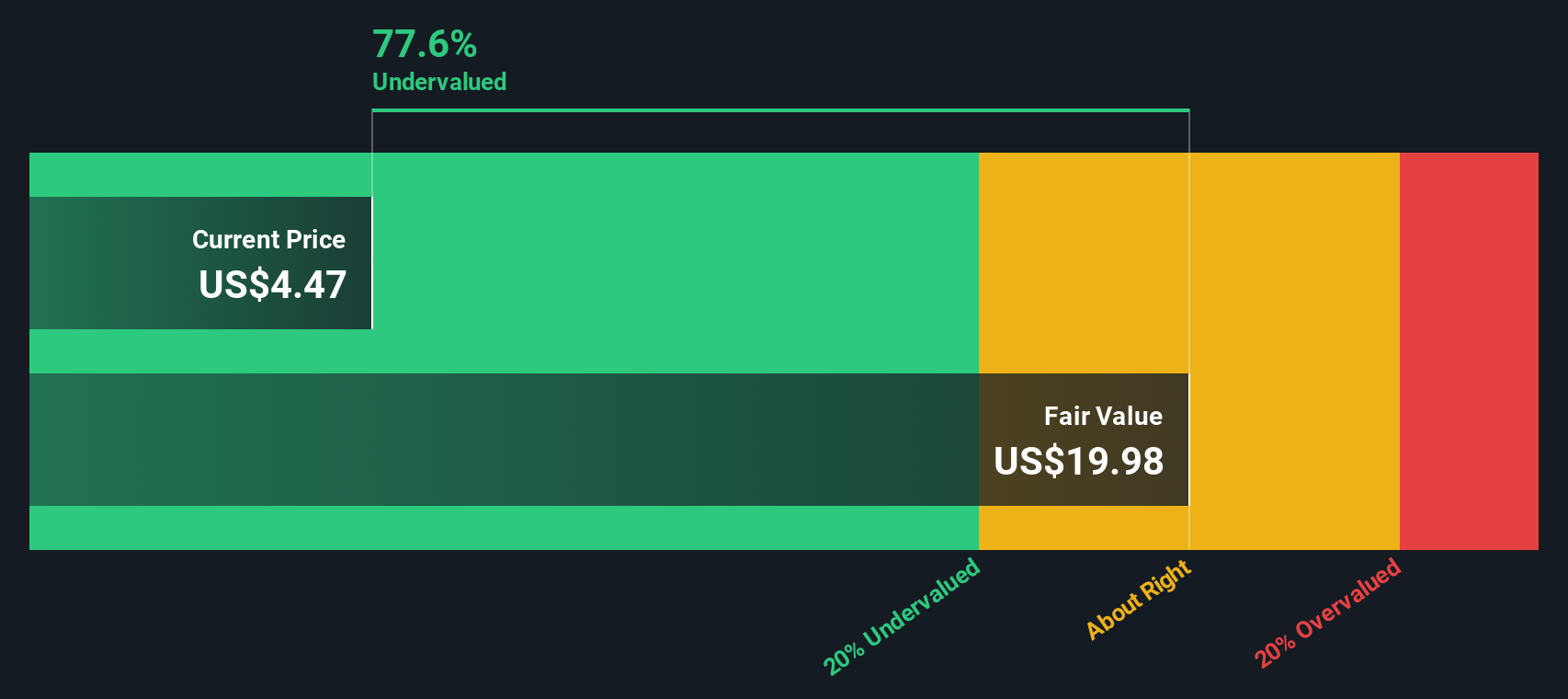

According to the most widely followed narrative, Imperial Petroleum is significantly undervalued, trading at a meaningful discount to its estimated fair value based on robust future earnings expectations.

The company's recent expansion into drybulk carriers alongside its tanker fleet positions it to benefit from sustained global energy demand and increased trade volumes. As population growth and emerging markets drive persistent need for oil and bulk trade, this expanded fleet is likely to boost revenue and asset utilization in future quarters since the new vessels have not yet fully contributed to earnings.

Curious why this shipping underdog could be worth far more than today's price suggests? The consensus narrative is based on aggressive growth projections, bold profitability expectations, and a financial framework that most investors would not expect from a stock trading at this valuation. What are the factors contributing to this eye-catching price target? Explore the full story and see if the numbers challenge market expectations.

Result: Fair Value of $6.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing short-term charter exposure and persistent revenue volatility from unproven fleet additions could quickly reverse the bullish outlook if market conditions soften.

Find out about the key risks to this Imperial Petroleum narrative.Another View: What Does Our DCF Model Show?

While strong earnings expectations support the undervalued case, our SWS DCF model looks at Imperial Petroleum from a different angle. This approach also finds the company undervalued, but each method highlights different assumptions. Which perspective gives you more confidence?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Imperial Petroleum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Imperial Petroleum Narrative

If you see the story differently or want to dig into the data on your own terms, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Imperial Petroleum research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Sharper Investment Opportunities?

Unlock even more market potential by tapping into other powerful stock ideas. Don’t limit yourself; broaden your strategy with new sectors and smart themes, and let the numbers lead you to tomorrow’s standouts.

- Target high yield with stability, and search for reliable dividend stocks with yields > 3% to potentially strengthen your income portfolio with companies offering attractive dividend returns above market averages.

- Harness unstoppable momentum in tech innovation, and track market leaders through promising AI penny stocks driving breakthroughs in artificial intelligence across industries.

- Seek out bargain buys before the market catches up by scanning for compelling undervalued stocks based on cash flows often overlooked but primed for future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IMPP

Flawless balance sheet and undervalued.

Market Insights

Community Narratives