- United States

- /

- Oil and Gas

- /

- NasdaqCM:GEVO

What Gevo (GEVO)'s Shift to North Dakota and Carbon Sequestration Focus Means For Shareholders

Reviewed by Sasha Jovanovic

- Gevo has paused its plans for a US$1 billion alcohol-to-jet fuel plant in Lake Preston, South Dakota, shifting focus to a smaller North Dakota project after receiving approval to modify a US Department of Energy loan agreement. The change was driven by financial savings, carbon sequestration benefits, and what Gevo’s CEO described as a more favorable regulatory environment in North Dakota.

- This move also follows Gevo’s partnership with Frontier Infrastructure Holdings to launch a fully integrated carbon management platform for ethanol producers, highlighting the company’s push into carbon solutions alongside aviation fuel production.

- We'll examine how the relocation to North Dakota and emphasis on carbon sequestration could impact Gevo's future growth narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Gevo Investment Narrative Recap

To be a Gevo shareholder, you need to believe in the company’s ability to commercialize low-carbon aviation fuels and generate recurring revenue from carbon management solutions, despite heavy competition and high up-front investment. The recent decision to prioritize a more manageable North Dakota project, with focused carbon sequestration and regulatory clarity, looks set to preserve cash and align with Gevo’s near-term path, yet this shift does not materially alter the biggest challenge: securing external financing to build scale quickly before tax credit policy changes potentially curtail margins.

Gevo’s collaboration with Frontier Infrastructure Holdings for a comprehensive carbon management platform ties directly to the North Dakota pivot and supports efforts to monetize carbon credits, an increasingly important catalyst as the company seeks new high-margin revenue streams to offset substantial development costs and timing risks.

Yet, even as Gevo advances partnerships and touts savings, there remains the risk that...

Read the full narrative on Gevo (it's free!)

Gevo's narrative projects $192.2 million revenue and $28.4 million earnings by 2028. This requires 33.8% yearly revenue growth and a $86.7 million earnings increase from -$58.3 million.

Uncover how Gevo's forecasts yield a $5.92 fair value, a 140% upside to its current price.

Exploring Other Perspectives

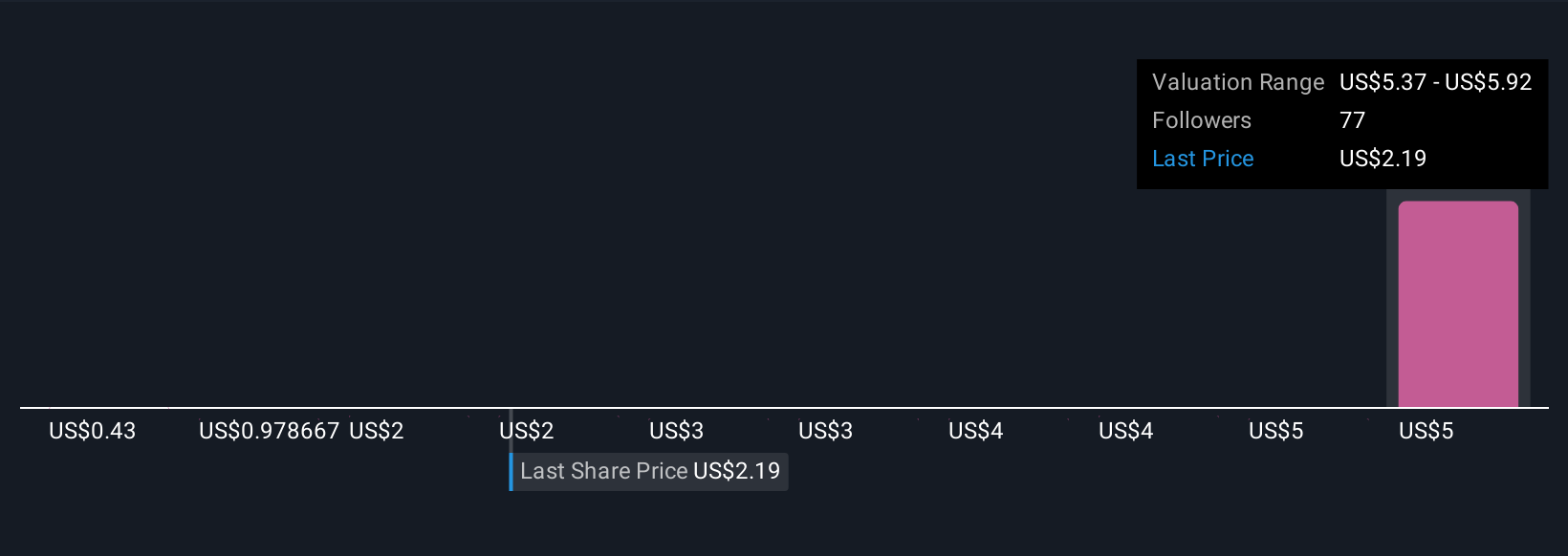

Nine individual fair value estimates from the Simply Wall St Community range widely, from US$0.43 to US$5.92 per share. While these show just how far opinions can vary, the ongoing need for external funding continues to be a core concern for anyone assessing Gevo’s long-term prospects.

Explore 9 other fair value estimates on Gevo - why the stock might be worth less than half the current price!

Build Your Own Gevo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gevo research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Gevo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gevo's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GEVO

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives