- United States

- /

- Oil and Gas

- /

- NasdaqGS:FANG

Diamondback Energy (NasdaqGS:FANG) Reports Q1 Production Results With Strong Daily Volumes

Reviewed by Simply Wall St

Diamondback Energy (NasdaqGS:FANG) recently released its Q1 2025 operating results, showing robust production figures, which include significant oil and natural gas outputs, yet the company's stock price saw a 3% decline last week. This price movement coincided with mixed reactions in broader markets, as the Dow experienced a steep fall while the S&P 500 and Nasdaq rose. Market volatility was driven by macroeconomic factors such as new U.S. tariff measures and trade tensions, which could have influenced investor sentiment across energy stocks. These broader market trends likely played a role in Diamondback Energy's recent performance.

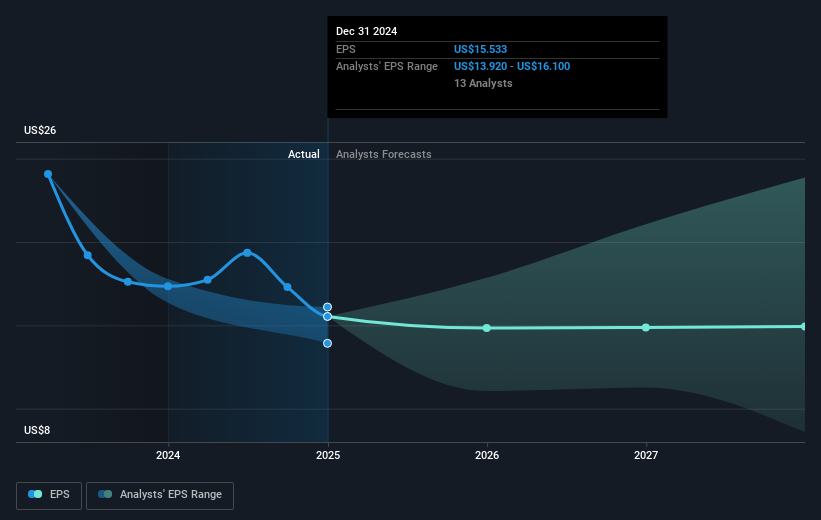

The recent 3% decline in Diamondback Energy's stock price, despite robust production figures, highlights the complex interplay between company-specific achievements and broader market forces. Market volatility, influenced by new U.S. tariffs and trade tensions, may have tempered investor enthusiasm for energy stocks, including Diamondback. These external factors could impact revenue and earnings forecasts, particularly if sustained. Analysts forecast a 10.8% annual revenue growth over the next three years, but such projections might face heightened scrutiny under volatile market conditions.

Over the past five years, Diamondback Energy has delivered a substantial total shareholder return of 373.71%, reflecting long-term growth. However, in the immediate past year, the company's performance fell short of both the US market's 4.6% return and the oil and gas industry's -11.2% return. This disparity calls attention to recent challenges, possibly linked to fluctuating oil prices and operational hurdles.

Diamondback's share price currently stands at US$119.25, which is significantly below the consensus analyst price target of US$193.64, indicating potential upward movement. Investors must weigh the impact of ongoing asset divestitures and production efficiency plans and consider how these initiatives might influence the company's ability to meet or exceed earnings targets, forecasted to reach US$3.8 billion by 2028. With a varying consensus on future prospects, potential investors should carefully assess their position relative to the expected PE ratio of 22.7 times 2028 earnings.

Explore Diamondback Energy's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FANG

Diamondback Energy

An independent oil and natural gas company, acquires, develops, explores, and exploits unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives