- United States

- /

- Oil and Gas

- /

- NasdaqGS:EXE

Expand Energy (NasdaqGS:EXE) Added To S&P Global 1200 With 3% Price Increase

Reviewed by Simply Wall St

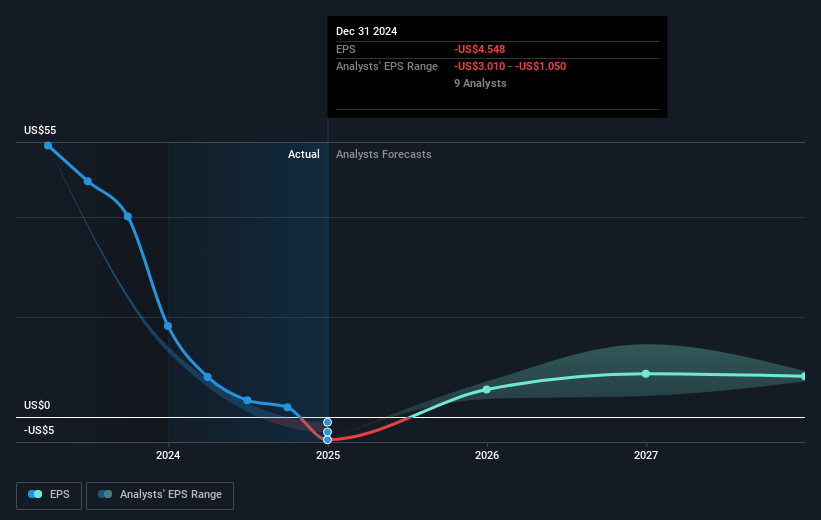

Expand Energy (NasdaqGS:EXE) recently experienced a significant development with its inclusion in the S&P Global 1200 index, which likely bolstered its visibility and attractiveness to institutional investors. This event, within a quarter where the company's stock showed an 11.93% price increase, stood amidst a broader market recovery characterized by a 10% rise over the last year. Concurrently, the company's reaffirmation of its quarterly dividend and its executive appointment might have contributed to investor confidence despite fiscal challenges, including a net loss for 2024. These factors collectively interplay with the overall positive market sentiment to influence EXE's stock performance.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past three years, Expand Energy has delivered a total shareholder return of 45.73%. Notably, this return period saw several strategic changes. One significant event was the company's merger with Southwestern Energy on October 1, 2024, which expanded its operational footprint and possibly contributed to improved future prospects. Furthermore, the integration and focus on operational synergies are expected to achieve annual efficiencies reaching US$500 million by 2026, enhancing margins and reducing expenses.

On the financial front, despite reporting a net loss of US$714 million for 2024, the company maintained its commitment to shareholders, declaring quarterly dividends. Additionally, the company completed a cash tender offer for US$453 million in 5.500% Senior Notes, indicating a strategic approach to managing its debt profile. Together, these actions, amid rising LNG demand and strategic positioning in premium markets, laid the foundation for positive shareholder returns despite broader industry challenges.

Explore Expand Energy's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expand Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXE

Expand Energy

Operates as an independent natural gas production company in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives