- United States

- /

- Oil and Gas

- /

- NasdaqGS:CHRD

Chord Energy (CHRD): Evaluating Valuation Following $750M Notes Offering and Strategic Williston Basin Expansion

Reviewed by Kshitija Bhandaru

Chord Energy (CHRD) just completed a $750 million senior notes offering to fund new asset acquisitions in the Williston Basin, while also releasing its 2024 Sustainability Report. These moves highlight the company’s focus on growth and sustainable operations.

See our latest analysis for Chord Energy.

Between the successful Enerplus integration and the recent $750 million notes offering, Chord Energy has been building momentum as it invests for growth and scale. Recent announcements highlight its strengthening position in the Williston Basin. Market sentiment remains steady, with the latest share price at $99.13 and the 1-year total shareholder return showing a modest decline. This indicates that the market is still waiting for a clear inflection point.

If you’re interested in what other energy companies are doing to drive growth, now’s a great opportunity to explore fast growing stocks with high insider ownership.

With shares trading at a notable discount to analyst price targets but coming off a year of lackluster returns, investors now face a key question: is there a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 26.6% Undervalued

Compared to Chord Energy’s last close of $99.13, the most widely followed narrative assigns a fair value well above current market pricing. This sets up a story of potential upside, driven by operational breakthroughs and disciplined financial strategy.

Strong execution of longer-lateral (4-mile) drilling, with early results significantly outperforming expectations. This positions Chord to lower breakeven costs and increase access to previously marginal acreage, enabling volume growth with reduced capital intensity and driving higher net margins and free cash flow in the coming years.

Wondering what ambitious growth forecasts are hidden behind these numbers? Shifts in margins, bold capital deployment, and disruptive technology adoption all shape this valuation. The real surprise is how these factors reshape future profitability. Only a full narrative read reveals the details.

Result: Fair Value of $135.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to the Williston Basin and regulatory changes could threaten Chord Energy’s earnings and challenge its optimistic growth story.

Find out about the key risks to this Chord Energy narrative.

Another View: Multiples Suggest a Different Story

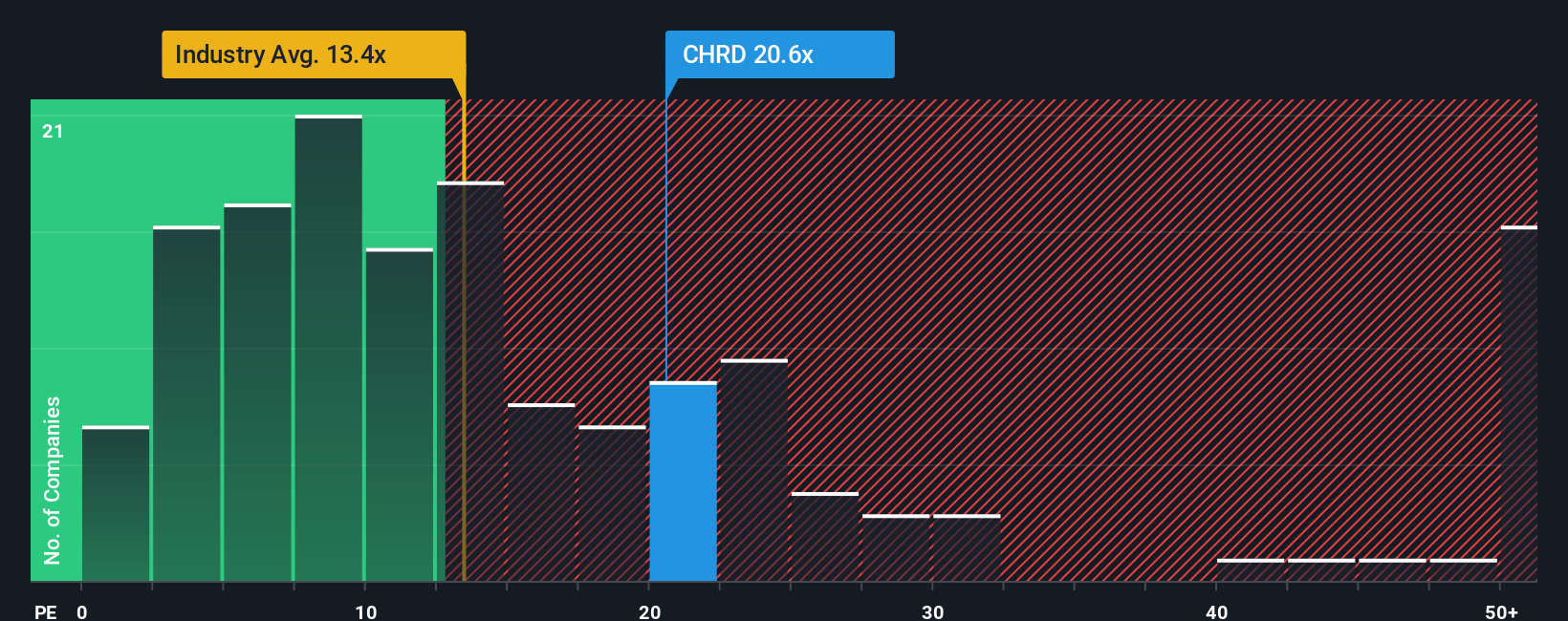

While analyst narratives point to significant upside, the valuation picture through the lens of price-to-earnings multiples is more cautious. Chord Energy trades at 21.2 times earnings, which is much higher than the US Oil and Gas industry average of 13.4x and exactly matches its estimated fair ratio. This suggests investors are paying a premium, leaving less margin for error if the company stumbles on growth or margins.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chord Energy Narrative

If our take doesn’t quite match your perspective, or you’re inclined to dig into the numbers and craft your own story, you can do exactly that in under three minutes with Do it your way.

A great starting point for your Chord Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for what you already know when new opportunities are just a click away. Smart investors always keep fresh ideas in reach.

- Spot the biggest yield-chasers by checking out these 19 dividend stocks with yields > 3% for stocks offering yields above 3% and stable dividend histories.

- Ride the AI momentum by tapping into the most promising innovations with these 24 AI penny stocks that are shaping smarter industries today.

- Find tomorrow’s winners trading below their true value through these 896 undervalued stocks based on cash flows and make undervalued gems work for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHRD

Chord Energy

Operates as an independent exploration and production company in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives