- United States

- /

- Food

- /

- NYSE:ADM

3 Dividend Stocks Offering Up To 6.5% Yield For Your Portfolio

Reviewed by Simply Wall St

The market has shown positive momentum, rising 1.6% over the last week and 12% over the past year, with earnings forecasted to grow by 14% annually. In such a dynamic environment, selecting dividend stocks with robust yields can provide a steady income stream while potentially benefiting from broader market growth.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.93% | ★★★★★☆ |

| Universal (UVV) | 5.37% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 6.85% | ★★★★★★ |

| Ennis (EBF) | 5.30% | ★★★★★★ |

| Dillard's (DDS) | 6.46% | ★★★★★★ |

| Credicorp (BAP) | 5.07% | ★★★★★☆ |

| CompX International (CIX) | 4.92% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.16% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.94% | ★★★★★☆ |

| Chevron (CVX) | 4.72% | ★★★★★★ |

Click here to see the full list of 145 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

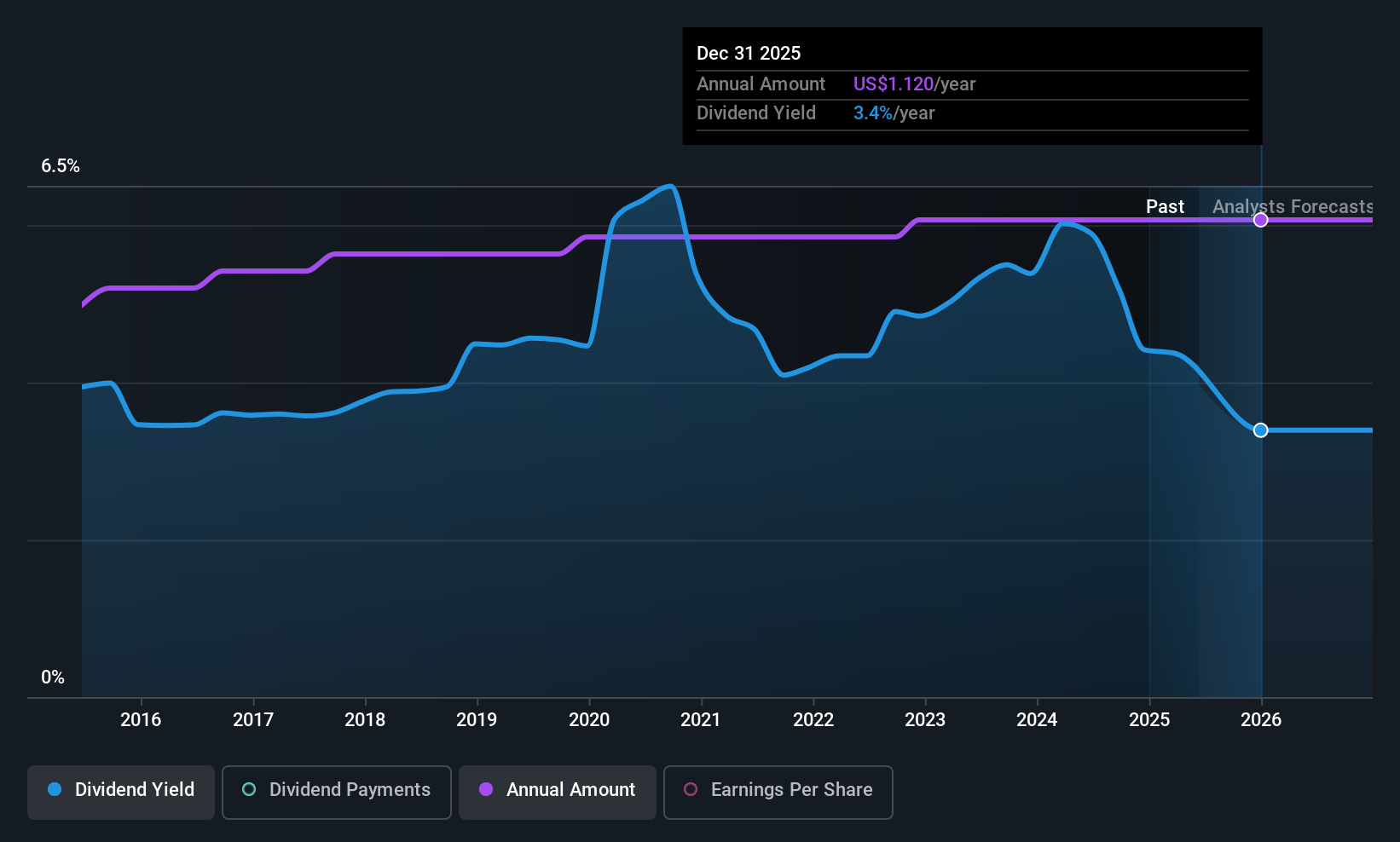

Isabella Bank (ISBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Isabella Bank Corporation is a bank holding company for Isabella Bank, offering banking and wealth management services to businesses, institutions, and individuals in Michigan, with a market cap of $236.60 million.

Operations: Isabella Bank Corporation's revenue from its retail banking operations amounts to $70.31 million.

Dividend Yield: 3.4%

Isabella Bank recently declared a $0.28 per share dividend, payable June 30, 2025. The bank's dividends have been stable and growing over the past decade with a payout ratio of 56.7%, indicating earnings coverage. However, its 3.44% yield is lower than top-tier US dividend payers. Recent moves include listing on NASDAQ and expanding its buyback plan by 500,000 shares to enhance shareholder value while trading below estimated fair value by 35%.

- Delve into the full analysis dividend report here for a deeper understanding of Isabella Bank.

- Our valuation report unveils the possibility Isabella Bank's shares may be trading at a premium.

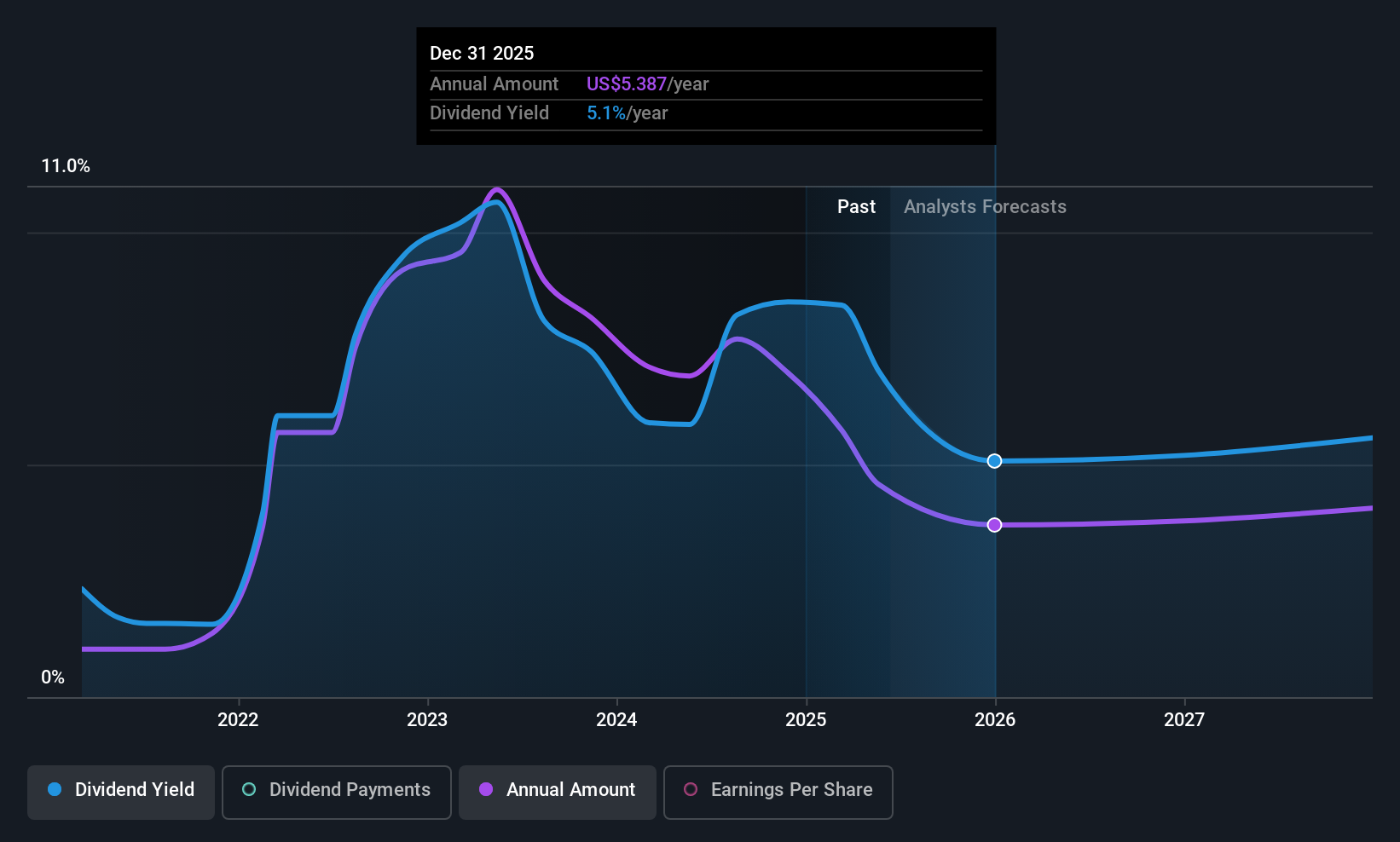

Chord Energy (CHRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chord Energy Corporation is an independent exploration and production company in the United States with a market cap of approximately $5.87 billion.

Operations: Chord Energy Corporation generates revenue primarily from the exploration and production of crude oil, natural gas liquids (NGLs), and natural gas, amounting to $5.04 billion.

Dividend Yield: 6.5%

Chord Energy's dividend yield of 6.5% places it among the top 25% of US dividend payers, supported by a low cash payout ratio of 35.6%. However, its four-year history shows volatility and unreliability in payments. Despite trading at a significant discount to fair value, recent shareholder dilution and forecasted earnings decline may concern investors. The company recently affirmed a $1.30 per share dividend and completed a $218 million share buyback, reflecting efforts to enhance shareholder returns amidst fluctuating performance.

- Get an in-depth perspective on Chord Energy's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Chord Energy is trading behind its estimated value.

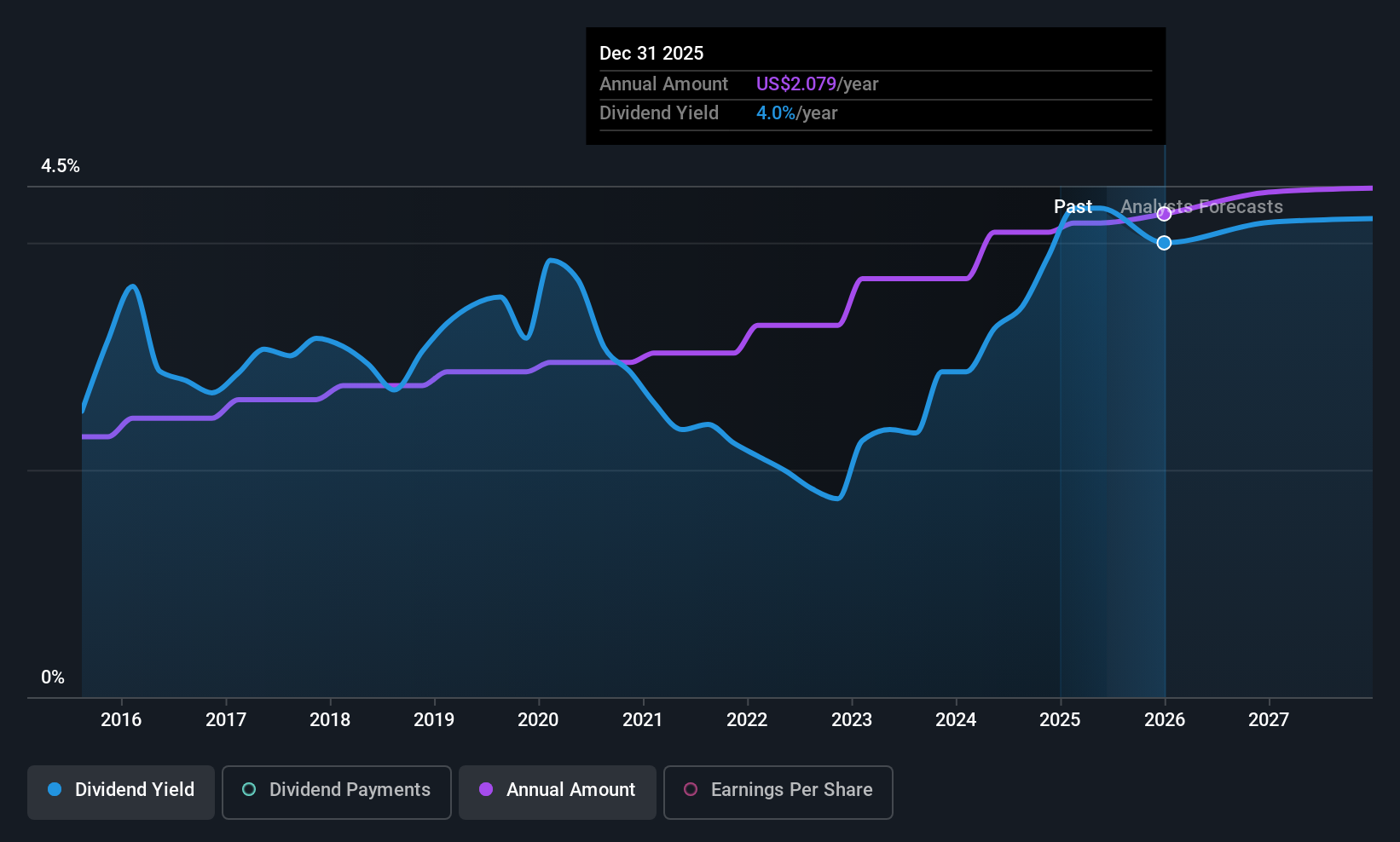

Archer-Daniels-Midland (ADM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Archer-Daniels-Midland Company operates in the procurement, transportation, storage, processing, and merchandising of agricultural commodities and related products across various countries including the United States, with a market capitalization of approximately $23.38 billion.

Operations: Archer-Daniels-Midland Company's revenue segments include Nutrition ($7.40 billion), Carbohydrate Solutions ($12.00 billion), and AG Services and Oilseeds ($66.68 billion).

Dividend Yield: 4.1%

Archer-Daniels-Midland's dividend yield of 4.11% is below the top 25% of US dividend payers, and while dividends have been stable over the past decade, they are not well-covered by cash flows, with a high cash payout ratio of 441.5%. The company's recent earnings report showed decreased net income and profit margins. Despite this, ADM affirmed a $0.51 per share dividend payable in June 2025, maintaining its commitment to returning value to shareholders amid financial challenges.

- Dive into the specifics of Archer-Daniels-Midland here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Archer-Daniels-Midland shares in the market.

Next Steps

- Reveal the 145 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions in the United States, Switzerland, the Cayman Islands, Brazil, Mexico, Canada, the United Kingdom, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives