- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Executive Transition and Major Contracts Might Change the Case for Investing in Baker Hughes (BKR)

Reviewed by Sasha Jovanovic

- Earlier this month, Baker Hughes announced the resignation of Ganesh Ramaswamy as Executive Vice President, Industrial & Energy Technology, with Maria Claudia Borras set to assume the role on an interim basis while continuing as Chief Growth and Experience Officer from October 24, 2025.

- Alongside this executive change, Baker Hughes has secured major new contracts to supply equipment for the Port Arthur LNG Phase 2 project and subsea tree systems for Petrobras, reflecting ongoing momentum in expanding its portfolio.

- Next, we’ll explore how this leadership transition and contract momentum could impact Baker Hughes’ long-term growth outlook and portfolio focus.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Baker Hughes Investment Narrative Recap

To be a shareholder in Baker Hughes today, you need confidence in its ability to balance its oil and gas exposure with a push into energy technology and digital solutions. The recent executive change, with Maria Claudia Borras stepping in as interim EVP of Industrial & Energy Technology, is not expected to produce a material shift to the near-term catalyst: large contract wins and backlog growth in gas and LNG infrastructure. The primary risk remains ongoing margin pressure from global trade policy shifts and cost inflation.

Among recent announcements, the contract award to supply liquefaction equipment for the Port Arthur LNG Phase 2 project stands out. This highlights the company's focus on LNG and its efforts to reinforce recurring revenue streams connected to the biggest short-term growth catalysts, providing some resilience versus sector volatility. Yet, there is a contrast investors should be aware of if decarbonization policies accelerate faster than...

Read the full narrative on Baker Hughes (it's free!)

Baker Hughes is projected to achieve $29.1 billion in revenue and $2.9 billion in earnings by 2028. This outlook assumes a 1.8% annual revenue growth rate and a decrease in earnings of $0.1 billion from the current $3.0 billion.

Uncover how Baker Hughes' forecasts yield a $51.75 fair value, a 15% upside to its current price.

Exploring Other Perspectives

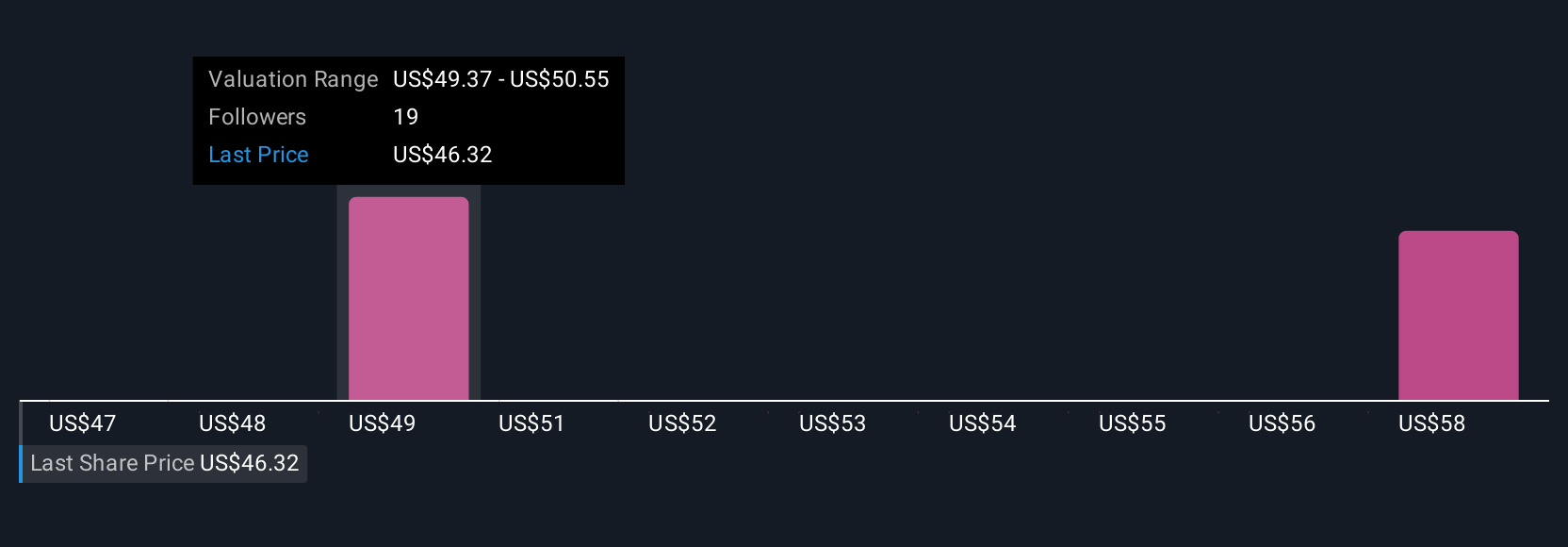

Four different Simply Wall St Community fair value estimates for Baker Hughes range from US$50.00 to US$62.69 per share. While many participants see potential upside, ongoing margin pressures linked to cost inflation and trade policy could influence performance in ways you might not expect, compare your outlook to these varied views and see how your own assumptions stack up.

Explore 4 other fair value estimates on Baker Hughes - why the stock might be worth just $50.00!

Build Your Own Baker Hughes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baker Hughes research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Baker Hughes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baker Hughes' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives