- United States

- /

- Energy Services

- /

- NasdaqGS:BKR

Does Baker Hughes Still Offer Value After Recent 8% Rally in 2025?

Reviewed by Simply Wall St

Thinking about what to do with Baker Hughes stock right now? You are not alone. After a year when shares surged nearly 40%, and with the stock climbing more than 8% just in the last month, it is natural to wonder whether this momentum has more room to run or if it is time for a pause. While daily headlines and global energy news swirl around oil and gas demand, Baker Hughes has quietly delivered reliable growth, reflecting both sector strength and investor appetite for industrial innovation.

Baker Hughes has not only outpaced the market with a 271.2% gain over five years, but it also just posted a 1.9% gain in the past week, suggesting fresh optimism around the company's long-term prospects. Some of this rebound can be traced to evolving market sentiment as energy transition projects and digital solutions become hotter topics. Both areas are where Baker Hughes has continued to invest and win contracts.

If valuation is on your mind, you will be interested to know that Baker Hughes scores a 3 out of 6 when it comes to undervaluation checks. That means there are solid signs of value, but also a few caution lights to pay attention to. However, just relying on multiple valuation checks can miss the bigger picture. In the next section, we will dig into these valuation methods and hint at an even smarter lens for making sense of Baker Hughes' true worth.

Baker Hughes delivered 39.9% returns over the last year. See how this stacks up to the rest of the Energy Services industry.Approach 1: Baker Hughes Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular method for valuing companies by projecting their future cash flows and discounting them back to today’s value. This approach aims to estimate what the company is truly worth based on fundamentals, rather than just relying on market prices or short-term sentiment.

For Baker Hughes, the latest reported Free Cash Flow stands at $2.14 billion. Analysts anticipate steady growth, projecting Free Cash Flow to reach $3.04 billion by 2029. While forecasts from analysts are available for only the next five years, Simply Wall St extrapolates figures further to provide a long-range perspective on the company’s earning potential.

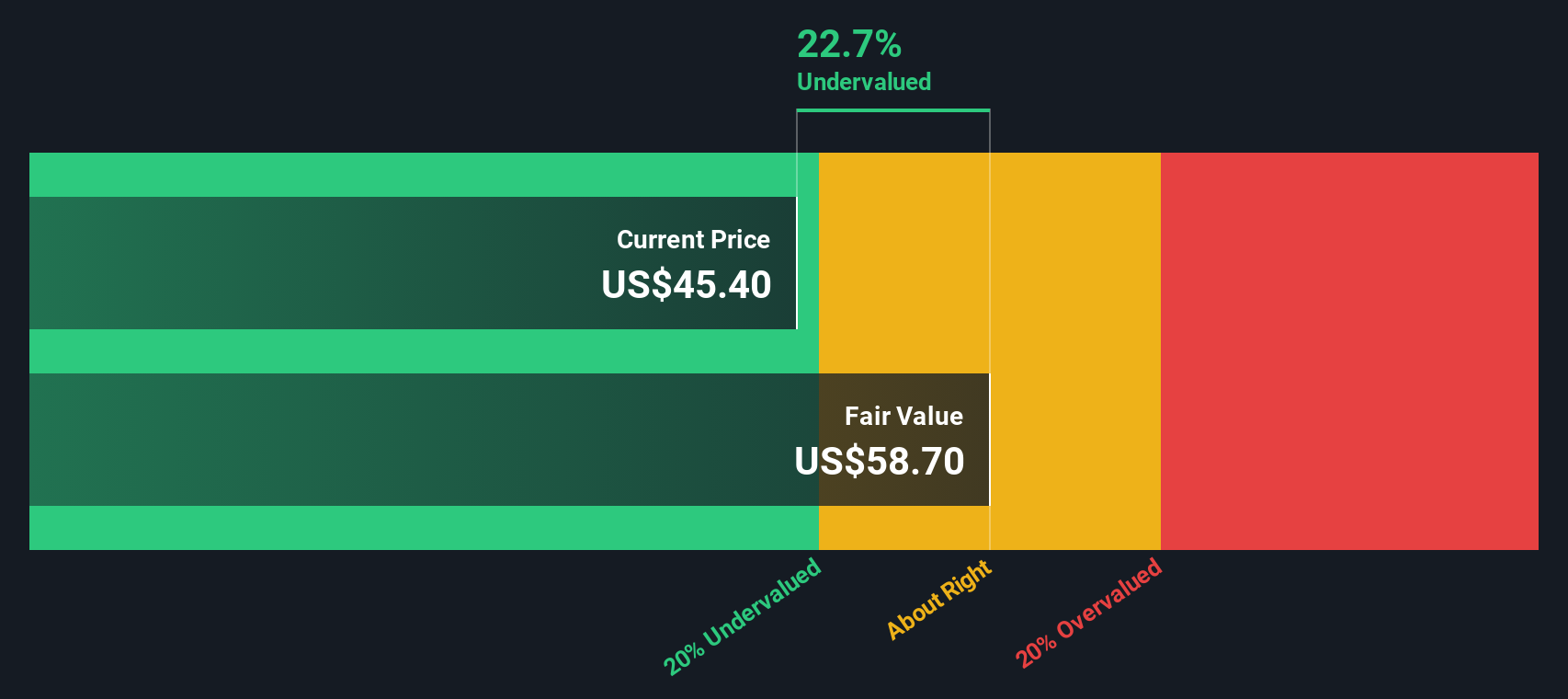

According to these DCF projections, the estimated intrinsic value for Baker Hughes is $57.87 per share. This represents a discount of 19.7% compared to where the stock is currently trading and suggests potential upside if these cash flow expectations are met.

In summary, the DCF analysis indicates that Baker Hughes may be notably undervalued, with the share price having the potential to align with the company’s ongoing cash generation capabilities.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Baker Hughes.

Approach 2: Baker Hughes Price vs Earnings

For established, profitable companies like Baker Hughes, the Price-to-Earnings (PE) ratio is a classic valuation tool. It measures how much investors are willing to pay for each dollar of current earnings, making it an intuitive way to gauge whether a stock is attractively priced relative to its profit generation.

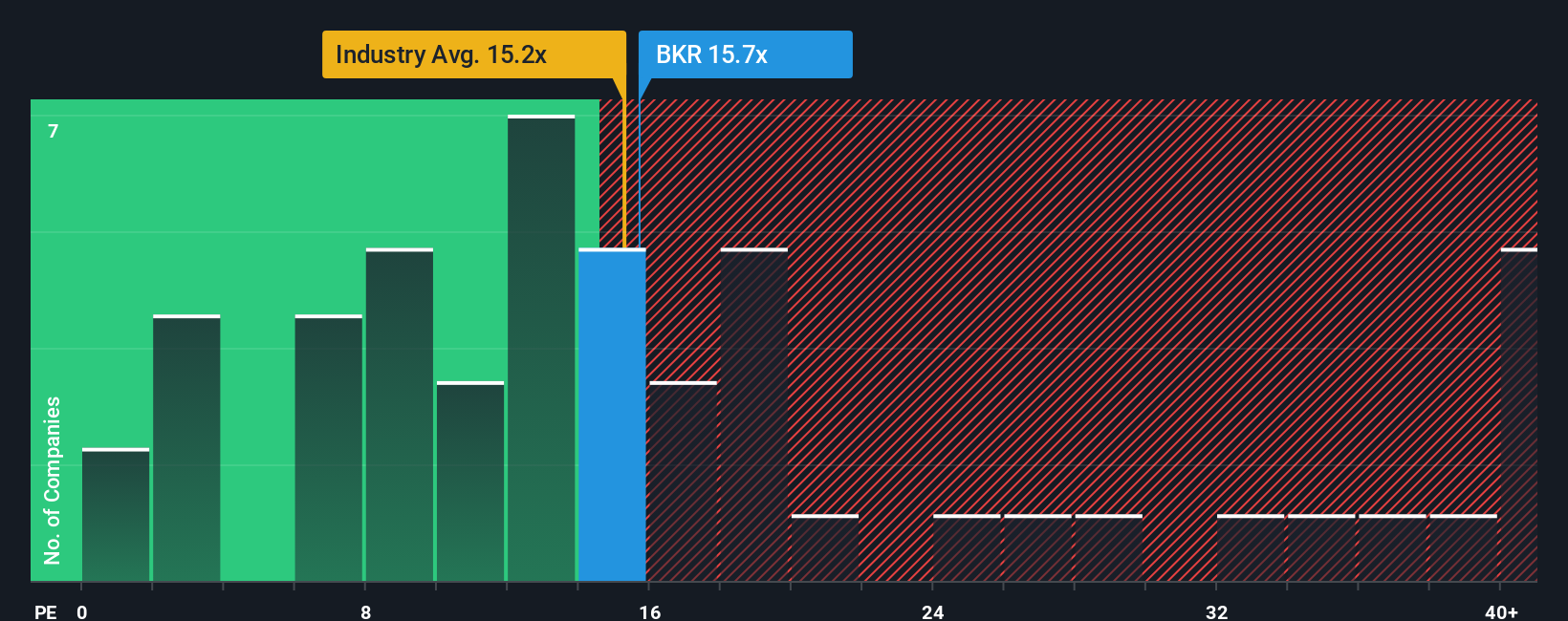

The “right” PE ratio for a stock depends on growth potential and risk. Companies with strong earnings growth usually warrant higher PE multiples, while more cyclical or higher-risk businesses tend to trade at lower PEs. Baker Hughes currently trades at a PE ratio of 15x. For context, its direct peers in the Energy Services space average 12.7x, while the industry as a whole carries an average PE of about 15.1x.

To go a step beyond these basic comparisons, Simply Wall St calculates a tailored Fair PE Ratio. This proprietary measure accounts for factors like Baker Hughes’ earnings growth, profit margins, risk, industry conditions, and market cap, offering a more holistic benchmark than simple peer or industry averages. For Baker Hughes, the Fair Ratio is 15.77x, which is very close to the company’s present PE ratio. This suggests that, after accounting for business-specific factors, the current price reflects a fair and balanced view of Baker Hughes’ earnings potential.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Baker Hughes Narrative

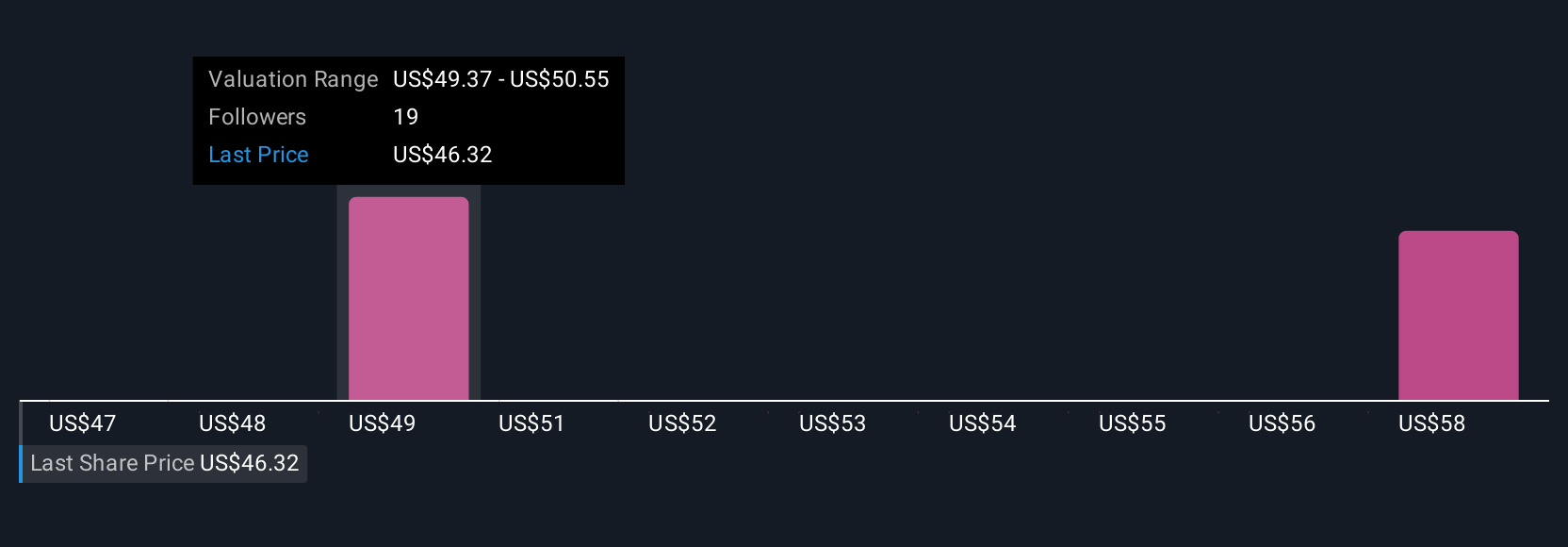

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a fresh approach that gives you the power to create your own story about a company, linking your perspective on its future to specific forecasts for revenue, earnings, and margins, and ultimately arriving at what you believe to be a fair value. This method goes beyond the numbers, letting you justify your assumptions with real business drivers, whether you believe Baker Hughes will win from energy transition or face headwinds from policy and competition.

On Simply Wall St’s Community page, millions of investors actively use Narratives as an accessible tool to visualize and refine their investment case. Narratives help you decide whether to buy, hold, or sell by comparing your fair value to the current market price. Your Narrative dynamically refreshes with the latest news and earnings, helping you stay up to date. For instance, with Baker Hughes, one investor might look at contract wins and margin expansion and set a high valuation, while another might focus on cyclical oil demand risks and set a lower fair value. Both perspectives are captured instantly as new data arrives, empowering you to invest with conviction and context.

Do you think there's more to the story for Baker Hughes? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKR

Baker Hughes

Provides a portfolio of technologies and services to energy and industrial value chain worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026