- United States

- /

- Oil and Gas

- /

- NasdaqGS:ARLP

Assessing Alliance Resource Partners (ARLP) Valuation After Recent Stock Volatility

Reviewed by Kshitija Bhandaru

Alliance Resource Partners (ARLP) stock has traded with some volatility over the past month, rising more than 11%. For investors watching coal and energy companies, these moves offer insight into current market sentiment and sector positioning.

See our latest analysis for Alliance Resource Partners.

Alliance Resource Partners’ recent pop follows a steady few months, suggesting that sentiment around coal stocks may be improving. While its 1-year total shareholder return stands at a healthy 12.5%, gains have cooled off compared to the past three and five years. Momentum is steady rather than surging.

If recent moves in energy stocks have you curious about broader opportunities, now is the perfect time to discover fast growing stocks with high insider ownership

The real question for investors now is whether Alliance Resource Partners is trading at a bargain based on its fundamentals, or if the market has already factored in all the potential for its future growth.

Most Popular Narrative: 16.1% Undervalued

According to the most widely followed narrative, Alliance Resource Partners' fair value is set at $30.50, about 16% higher than its last close of $25.58. This substantial gap is rooted in a combination of industry tailwinds and long-term growth assumptions, presenting a compelling setup for the company's valuation debate.

Recent legislative and administrative shifts in U.S. energy policy, such as regulatory reprieves for coal plants, the phasing out of renewable tax credits in favor of baseload power, and direct financial incentives to keep fossil fuel plants operational, have created the most favorable regulatory environment for coal in decades. These tailwinds should support stable or potentially higher future coal sales volumes and improve longer-term revenue visibility for Alliance Resource Partners.

Want to see what really fuels this price target? The core narrative factors in a powerful mix of regulatory shifts and bullish projections for cash flow and profit margins. Wondering which bold financial assumptions push the fair value so much higher than today's price? Uncover the surprising quantitative forecasts that might explain Analysts' latest consensus.

Result: Fair Value of $30.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, downside catalysts remain, including continued declines in coal pricing and potential shifts in U.S. energy policy that could quickly reduce demand.

Find out about the key risks to this Alliance Resource Partners narrative.

Another View: What Do Multiples Say?

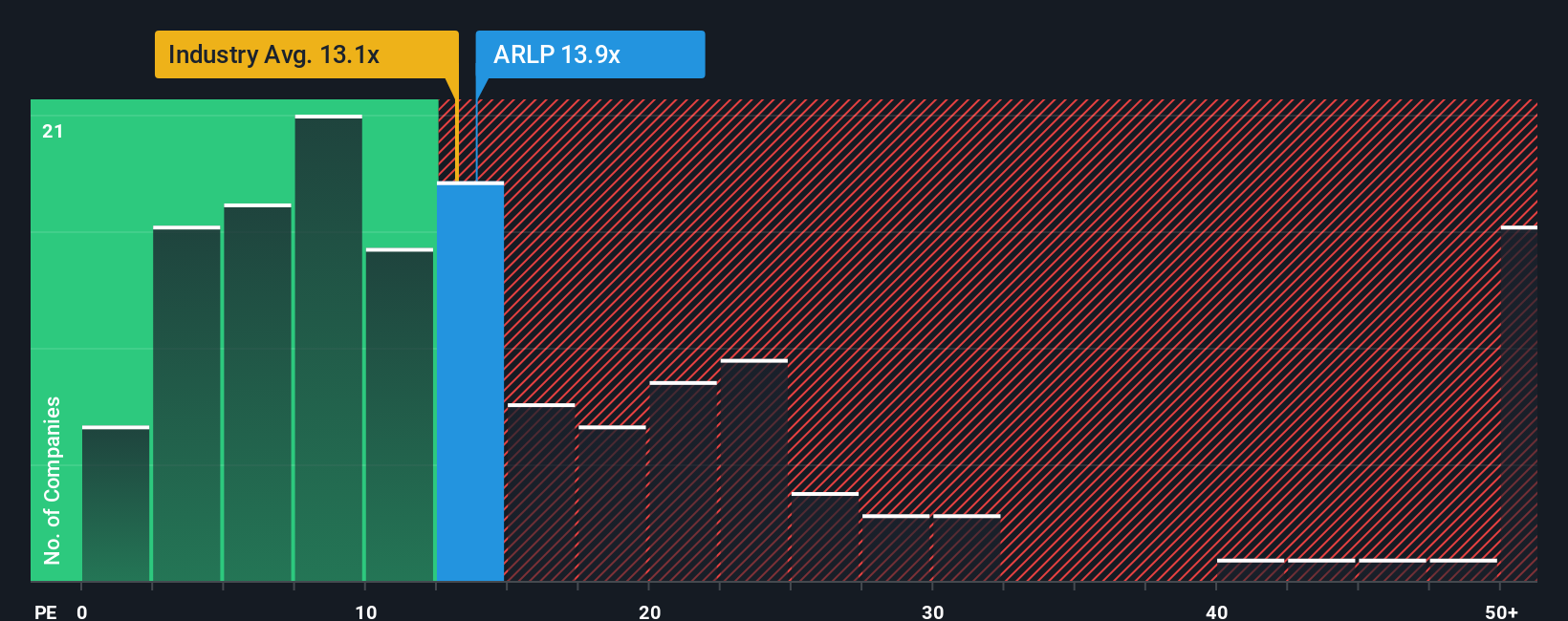

Looking at valuation through the lens of price-to-earnings, Alliance Resource Partners actually trades at 14.1x, slightly higher than the US Oil and Gas industry average of 13.5x, but well below its peer average of 26.4x. Interestingly, its current ratio is also cheaper than its fair ratio of 16.9x. This suggests some upside if the market adjusts, but also highlights potential risk if the industry moves away from this standard. So which signal should investors trust: the current market’s multiple or the long-term fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alliance Resource Partners Narrative

If you have a different view on Alliance Resource Partners or want to see how your own research stacks up, it's easy to create a custom narrative in just a few minutes. Simply Do it your way.

A great starting point for your Alliance Resource Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Move beyond the usual picks and get ahead of the curve by using the Simply Wall Street Screener. The right idea now could change your portfolio’s outlook for years to come. Don’t let smarter opportunities pass by.

- Snap up high-yield potential by reviewing these 19 dividend stocks with yields > 3% with robust returns above 3% and strong balance sheets for defensive income.

- Accelerate your growth game with these 24 AI penny stocks powering advancements in artificial intelligence, automation, and machine learning breakthroughs.

- Position for tomorrow’s trends by checking out these 26 quantum computing stocks driving innovation in quantum computing and next-generation data security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARLP

Alliance Resource Partners

A diversified natural resource company, engages in the production and marketing of coal to utilities and industrial users in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives