- United States

- /

- Diversified Financial

- /

- OTCPK:FNMA

Will Fannie Mae’s (FNMA) New Multifamily Cap Reshape Its Approach to Affordable Housing Risk?

Reviewed by Sasha Jovanovic

- Fannie Mae recently released its October 2025 Monthly Summary and announced the 2026 multifamily loan purchase cap of US$88 billion, providing detailed updates on its mortgage portfolio and support for the multifamily housing market.

- This dual update offers fresh insight into Fannie Mae’s ongoing initiatives to address liquidity, risk, and affordable housing across the United States.

- With a focus on the new multifamily loan purchase cap, we’ll explore how these developments impact Fannie Mae’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Federal National Mortgage Association's Investment Narrative?

To be a shareholder in Fannie Mae, you need to believe in the long-term need for liquidity, stability, and affordable housing within the U.S. real estate market, particularly in the multifamily sector. The most pressing short-term catalysts remain centered around federal housing policy, interest rate trends, and the company's ability to adapt under a new, largely untested management team. The recently announced US$88 billion multifamily loan purchase cap for 2026 and the October 2025 Monthly Summary reinforce the company's mandate to support affordable housing but do not appear to materially shift immediate catalysts or risks just yet, given the focus remains on execution amid leadership change and softer profitability. Analysts and the market have so far not recorded significant price movement on this news, so core risks including management experience and slower earnings remain in play, with added importance on watching how operational strategy evolves under new leadership.

However, the pace and direction of leadership transitions may weigh more than expected for some investors.

Exploring Other Perspectives

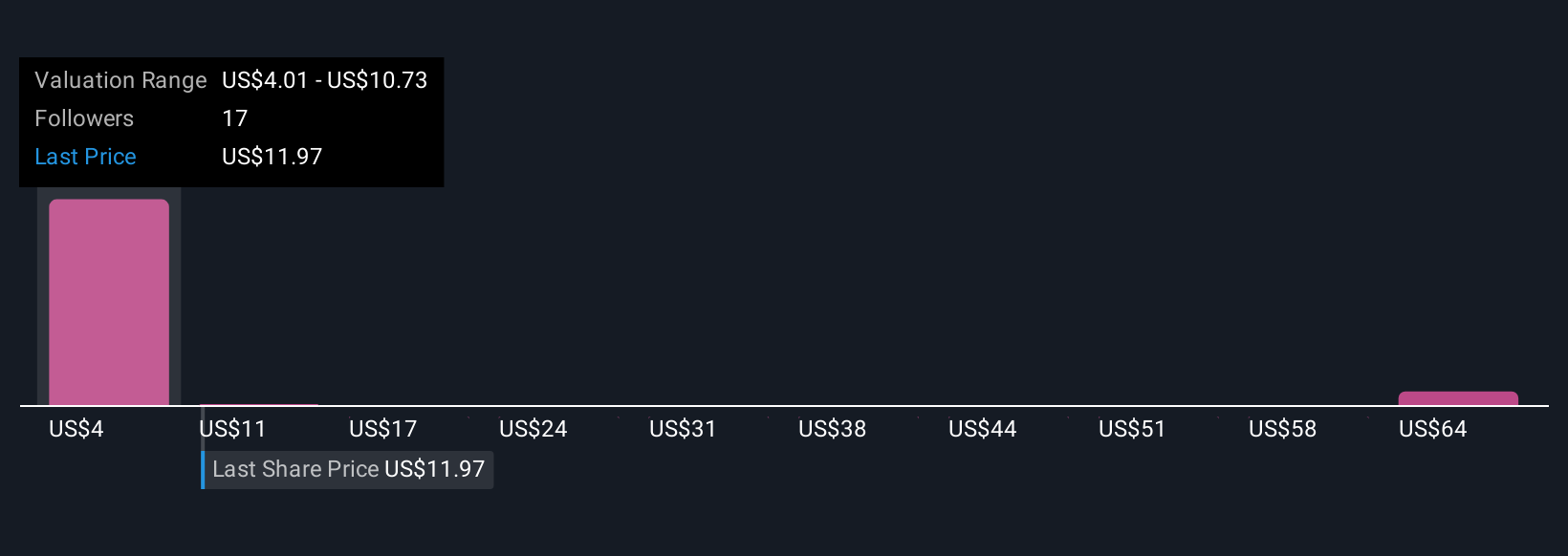

Explore 12 other fair value estimates on Federal National Mortgage Association - why the stock might be worth less than half the current price!

Build Your Own Federal National Mortgage Association Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal National Mortgage Association research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Federal National Mortgage Association research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal National Mortgage Association's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FNMA

Federal National Mortgage Association

Provides financing solutions for residential mortgages in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026