- United States

- /

- Diversified Financial

- /

- OTCPK:FNMA

Will Ackman’s Livestream Proposal Change Fannie Mae’s Regulatory Outlook or its Investment Narrative (FNMA)?

Reviewed by Sasha Jovanovic

- Earlier this week, billionaire hedge fund manager Bill Ackman announced plans to host a social media livestream to present a proposed transaction involving Fannie Mae and Freddie Mac, aiming to help achieve the Trump Administration's objectives for these entities.

- This development comes amid controversy surrounding Federal Housing Finance Agency chief Bill Pulte, who recently dismissed Fannie Mae's internal watchdogs investigating his conduct, raising new questions about agency oversight.

- We'll explore how Ackman's anticipated proposal may influence Fannie Mae's investment narrative at a time of heightened regulatory attention.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Federal National Mortgage Association's Investment Narrative?

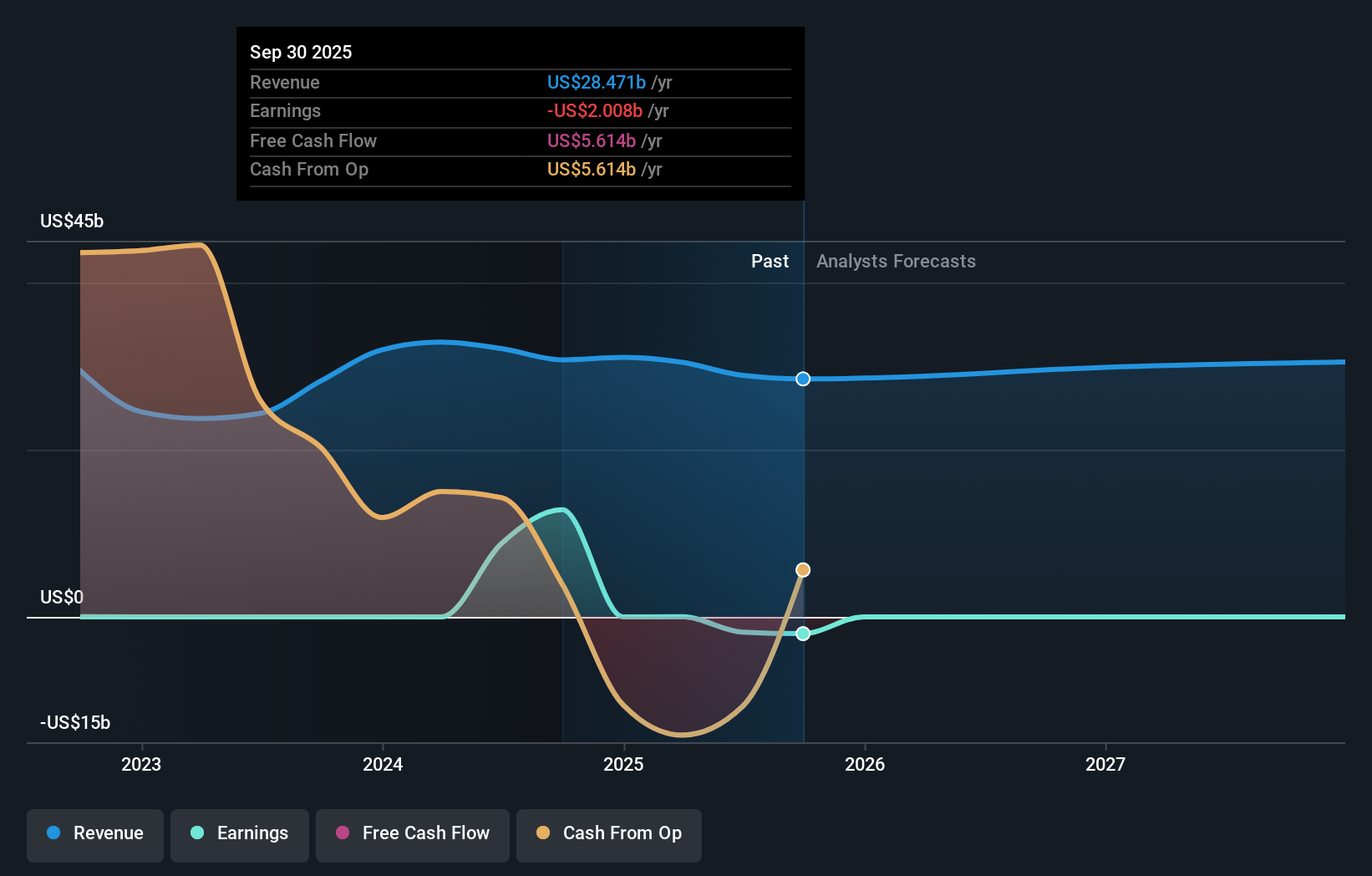

To be a shareholder of Federal National Mortgage Association, you need to believe in both its continued relevance in U.S. housing finance and the possibility of meaningful changes to its status as a government-sponsored enterprise. The short-term catalysts have often revolved around progress toward privatization, shifts in regulatory oversight, and the company’s efforts to restore profitability. This latest news, Bill Ackman’s proposed transaction and recent FHFA oversight controversies, could materially redirect the investment narrative. These developments heighten uncertainty around near-term governance and the potential for regulatory restructuring, which might speed up or stall decisions about public offerings or increased independence from government control. Fannie Mae’s recent management turbulence and Q3 earnings decline were already weighing on sentiment; now, any major policy or leadership change could quickly alter perceived risks and rewards. For now, price moves suggest this is an inflection point for both risk and opportunity.

But while investors often focus on profit growth, sudden leadership changes can bring surprises. Federal National Mortgage Association's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 11 other fair value estimates on Federal National Mortgage Association - why the stock might be worth less than half the current price!

Build Your Own Federal National Mortgage Association Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal National Mortgage Association research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Federal National Mortgage Association research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal National Mortgage Association's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FNMA

Federal National Mortgage Association

Provides financing solutions for residential mortgages in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives