- United States

- /

- Diversified Financial

- /

- OTCPK:FNMA

Fannie Mae (FNMA): Is the Stock Undervalued After Recent Volatility?

Reviewed by Simply Wall St

Federal National Mortgage Association (FNMA) stock has caught the attention of investors lately, with movements in recent trading sessions prompting renewed conversations about its valuation and long-term outlook.

See our latest analysis for Federal National Mortgage Association.

After a remarkable run-up earlier in the year, Federal National Mortgage Association's latest share price of $9.81 reflects some recent volatility, with a 6.63% gain over the last week but still down more than 10% over the past month. Despite this short-term dip, long-term shareholders have seen extraordinary rewards, highlighted by a one-year total shareholder return of 213% and an impressive 2,080% over three years. This suggests momentum may be taking a breather before its next move.

If you’re interested in what else is catching investors’ attention, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With strong historical returns and recent volatility, the real question becomes whether Federal National Mortgage Association’s shares are trading below their true value or if the recent run-up means future growth is already reflected in the current price.

Price-to-Sales Ratio of 2x: Is it justified?

Federal National Mortgage Association currently trades at a price-to-sales ratio of 2x, which looks appealing compared to both its peers and historical averages. At the last close of $9.81, the market appears to be assigning a relatively conservative multiple to a company that has demonstrated outsized shareholder returns over the past several years.

The price-to-sales ratio measures how much investors are willing to pay for every dollar of sales generated. Lower values typically signal undervaluation, especially when compared against competitors or the broader industry. For a business involved in mortgage finance and securitization, this multiple can also reflect expectations around future revenue stability and margin recovery.

FNMA’s price-to-sales ratio of 2x not only undercuts the peer average at 4x but also stands well below the estimated Fair Price-To-Sales Ratio of 6.7x. This suggests significant room for market sentiment to shift upward. In comparison to the US Diversified Financial industry average of 2.5x, FNMA’s multiple indicates a potentially overlooked value story in the sector.

Explore the SWS fair ratio for Federal National Mortgage Association

Result: Price-to-Sales of 2x (UNDERVALUED)

However, persistent net losses and only modest revenue growth remain key risks that could dampen enthusiasm for Federal National Mortgage Association’s undervaluation story.

Find out about the key risks to this Federal National Mortgage Association narrative.

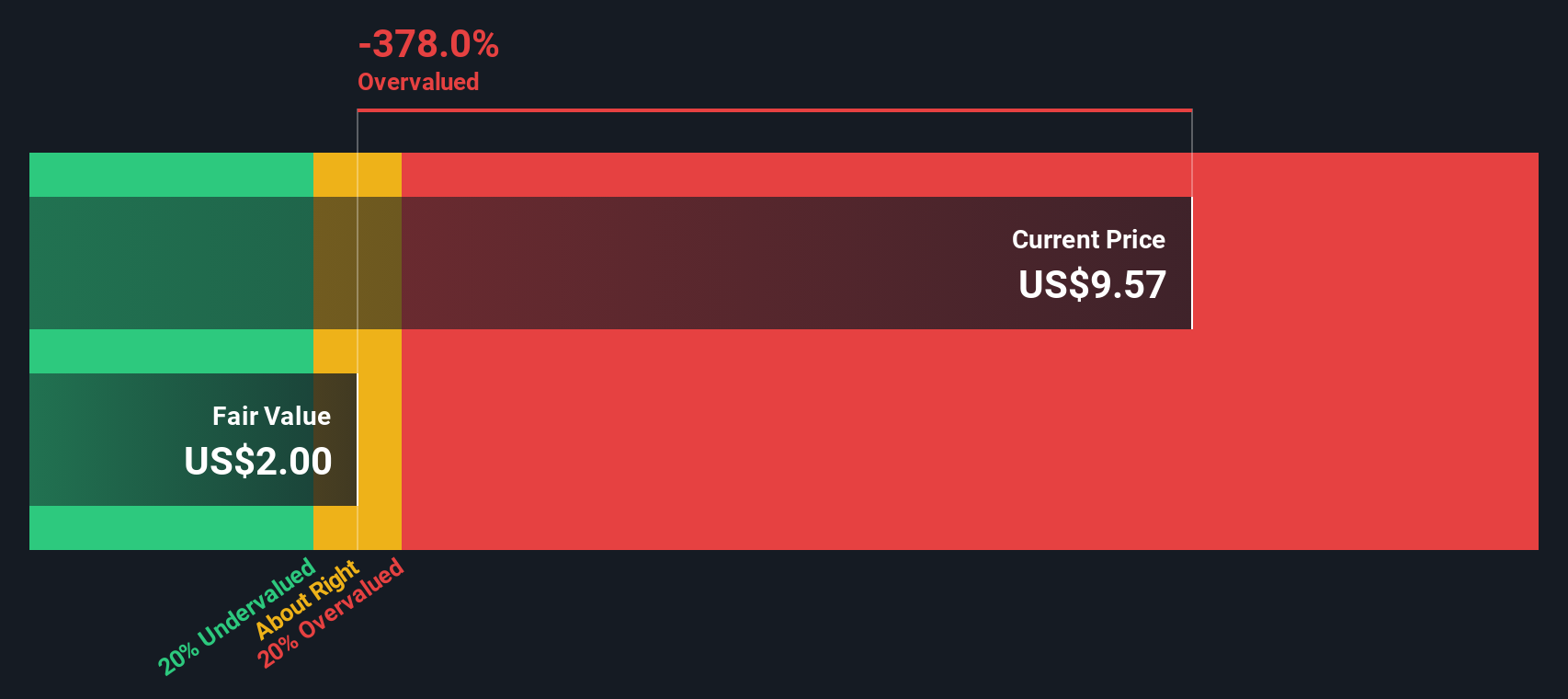

Another View: Discounted Cash Flow Sends a Different Signal

While Federal National Mortgage Association appears undervalued using the price-to-sales ratio, our DCF model provides a different perspective. According to this method, FNMA’s current share price is significantly above its estimated fair value of $2. This indicates potential downside risk and challenges the optimistic outlook suggested by sales multiples. Which perspective will influence market sentiment next?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal National Mortgage Association for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal National Mortgage Association Narrative

If you’d like to dig into the numbers yourself or think you see another angle, you can create your own narrative in under three minutes. Do it your way

A great starting point for your Federal National Mortgage Association research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Now is the perfect moment to seize new opportunities and find stocks that match your investing style. Simply Wall Street’s screener helps you uncover unique, high-potential picks others might overlook. Don’t let standout opportunities slip away. Act now to power up your portfolio.

- Boost your income stream as you uncover these 15 dividend stocks with yields > 3% with attractive yields and a track record of consistent payouts.

- Spot emerging trends by targeting these 25 AI penny stocks set to transform industries with advanced artificial intelligence innovation.

- Seize undervalued gems hiding in plain sight by researching these 923 undervalued stocks based on cash flows identified for strong cash flow potential and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FNMA

Federal National Mortgage Association

Provides financing solutions for residential mortgages in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.