- United States

- /

- Semiconductors

- /

- NasdaqCM:NVEC

Undiscovered Gems In The US Market For June 2025

Reviewed by Simply Wall St

As the United States market continues its rally, with the S&P 500 and Nasdaq reaching fresh record highs, investors are closely watching developments in trade talks and fiscal policy that could impact future growth. Amid this backdrop of optimism and geopolitical calm, identifying promising small-cap stocks becomes essential for those looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

NVE (NVEC)

Simply Wall St Value Rating: ★★★★★★

Overview: NVE Corporation is a company that specializes in developing and selling spintronics-based devices for information acquisition, storage, and transmission, with a market cap of approximately $358.10 million.

Operations: NVE's revenue is derived entirely from its electronic components and parts segment, totaling $25.87 million.

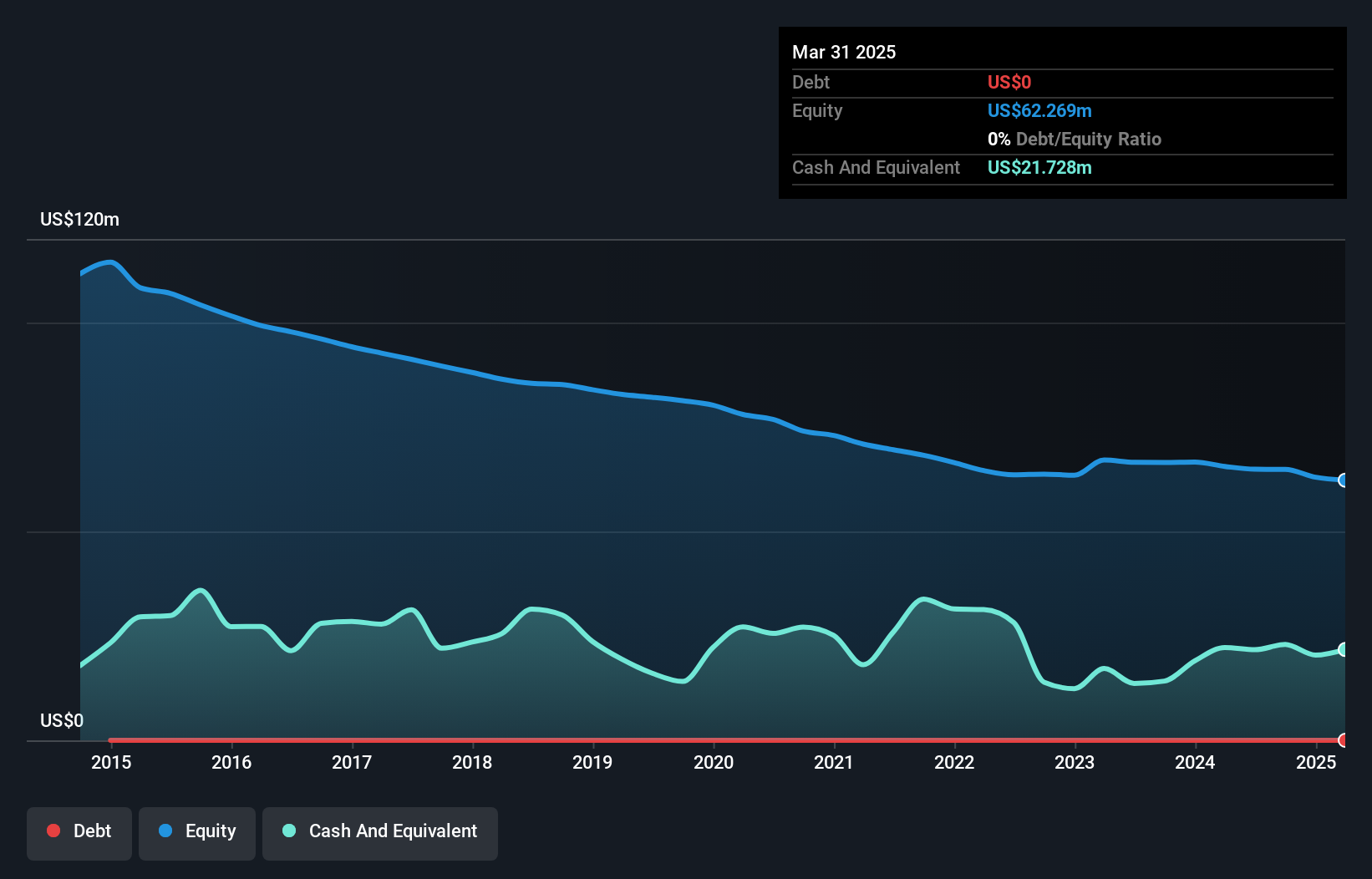

NVE, a nimble player in the semiconductor space, showcases a debt-free balance sheet over five years, enhancing its financial flexibility. Despite facing negative earnings growth of 12% last year compared to the industry average of 0.7%, it maintains high-quality earnings and a favorable price-to-earnings ratio at 23.8x against the industry's 28.5x. Recent financials reveal fourth-quarter revenue at US$7.27 million and net income at US$3.89 million, slightly up from last year’s figures. The full-year revenue stood at US$25.87 million with net income slipping to US$15.06 million from US$17.12 million previously, reflecting some challenges amidst steady dividend payouts of $1 per share.

- Delve into the full analysis health report here for a deeper understanding of NVE.

Assess NVE's past performance with our detailed historical performance reports.

Fidelity D & D Bancorp (FDBC)

Simply Wall St Value Rating: ★★★★★★

Overview: Fidelity D & D Bancorp, Inc. serves as the bank holding company for The Fidelity Deposit and Discount Bank, offering a variety of banking, trust, and financial services to individual and business clients with a market capitalization of $265.36 million.

Operations: The company generates its revenue primarily from banking, trust, and financial services, amounting to $81.32 million. Its market capitalization stands at $265.36 million.

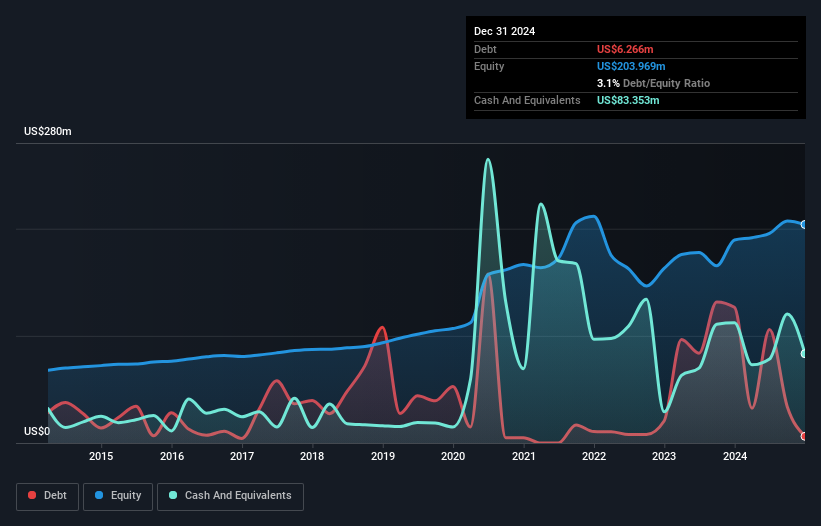

Fidelity D & D Bancorp, with assets totaling US$2.7 billion and equity of US$211.7 million, stands out for its robust financial health in the banking sector. The bank's reliance on customer deposits as 98% of its funding reduces risk significantly compared to external borrowing. Total deposits are at US$2.5 billion, while loans amount to US$1.8 billion, maintaining a net interest margin of 2.7%. A sufficient allowance for bad loans at 0.3% underscores prudent management practices, and earnings growth of 33.9% over the past year surpasses industry averages by a wide margin, highlighting strong performance dynamics.

- Click here to discover the nuances of Fidelity D & D Bancorp with our detailed analytical health report.

Evaluate Fidelity D & D Bancorp's historical performance by accessing our past performance report.

Central Securities (CET)

Simply Wall St Value Rating: ★★★★★★

Overview: Central Securities Corp. is a publicly owned investment manager with a market cap of approximately $1.38 billion.

Operations: Revenue for Central Securities primarily comes from its financial services segment, specifically closed-end funds, amounting to approximately $23.70 million.

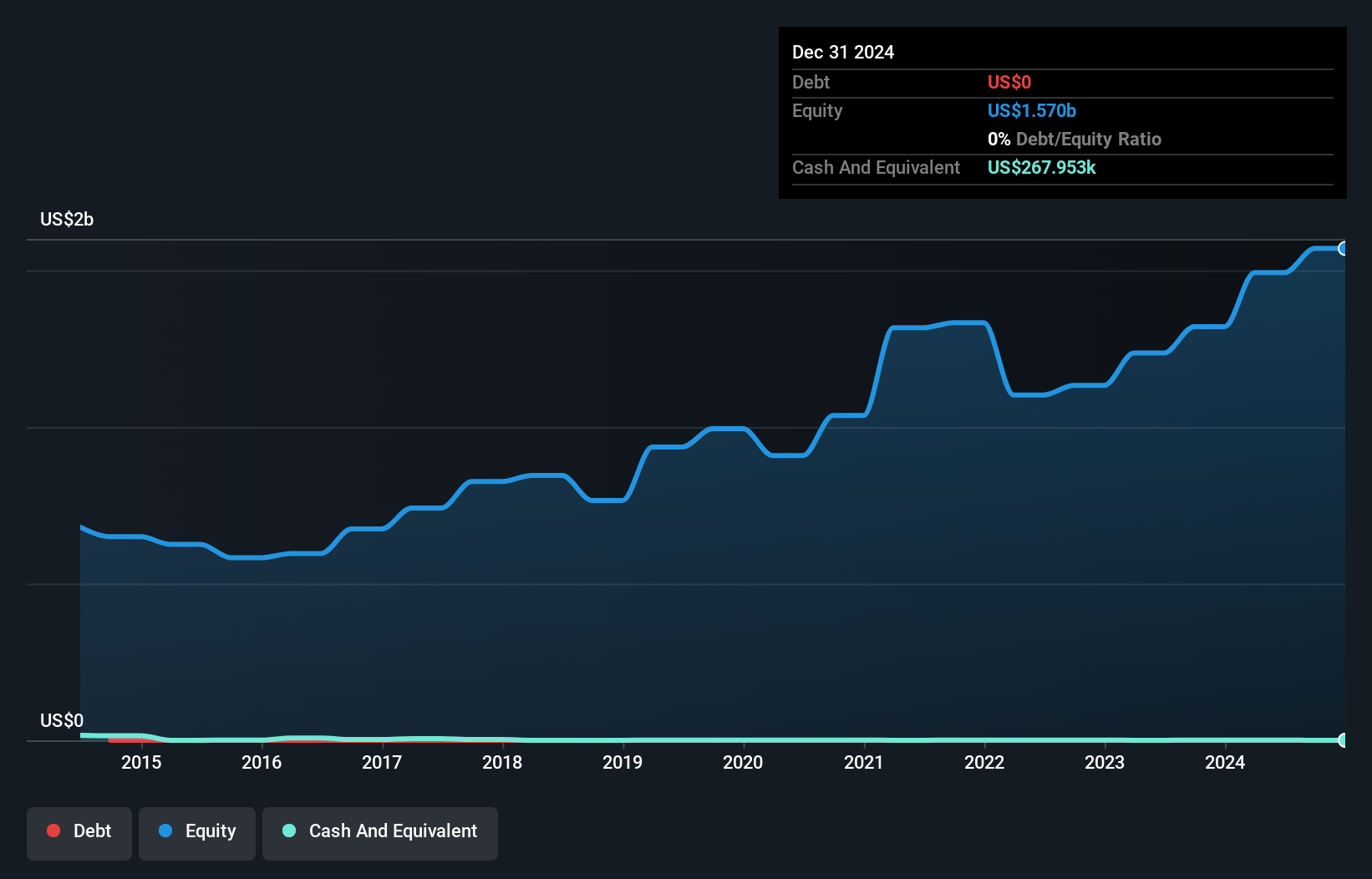

Central Securities, a nimble player in the market, has demonstrated robust performance with a 28.8% earnings growth over the past year, outpacing the Capital Markets industry's 13.7%. The company is debt-free and trades at an attractive 49% below its estimated fair value. A notable $272.5M one-off gain significantly impacted its financial results for the last year ending December 2024, suggesting potential volatility in earnings quality. On June 27, 2025, shareholders received a $0.25 per share dividend, highlighting shareholder returns despite some portion being taxable as ordinary income and long-term capital gains.

Seize The Opportunity

- Unlock our comprehensive list of 281 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NVEC

NVE

Develops and sells devices that use spintronics, a nanotechnology relying on electron spin to acquire, store, and transmit information, both in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives