- United States

- /

- Capital Markets

- /

- NYSE:VIRT

Virtu Financial (VIRT) Valuation in Focus After Earning ‘Strong Buy’ and Value Recognition from Analysts

Reviewed by Simply Wall St

Virtu Financial (VIRT) is catching the eye of investors this week after receiving a 'Strong Buy' rating and an 'A' grade in the Value category from Zacks. At a time when many are hunting for value plays in the market, Virtu is standing out for its attractive valuation metrics and favorable earnings outlook. The recent spotlight on its price-to-earnings, price-to-sales, and related ratios has increased interest among those looking for growth at a reasonable price.

The stock's performance has been far from static. Over the year, Virtu Financial notched a 17% gain, easily outpacing broader markets. Its three-year and five-year returns have been even stronger. Despite these returns, shares have slipped over the past month, which could be signaling a shift in momentum or simply a breather after prior gains. With analyst attention intensifying and the stock’s price action cooling lately, the conversation is quickly turning toward whether the market is underappreciating Virtu's underlying fundamentals.

Is this recent pause just an opportunity to buy Virtu Financial on sale, or is the market already pricing in all of its future growth and value prospects?

Most Popular Narrative: 22% Undervalued

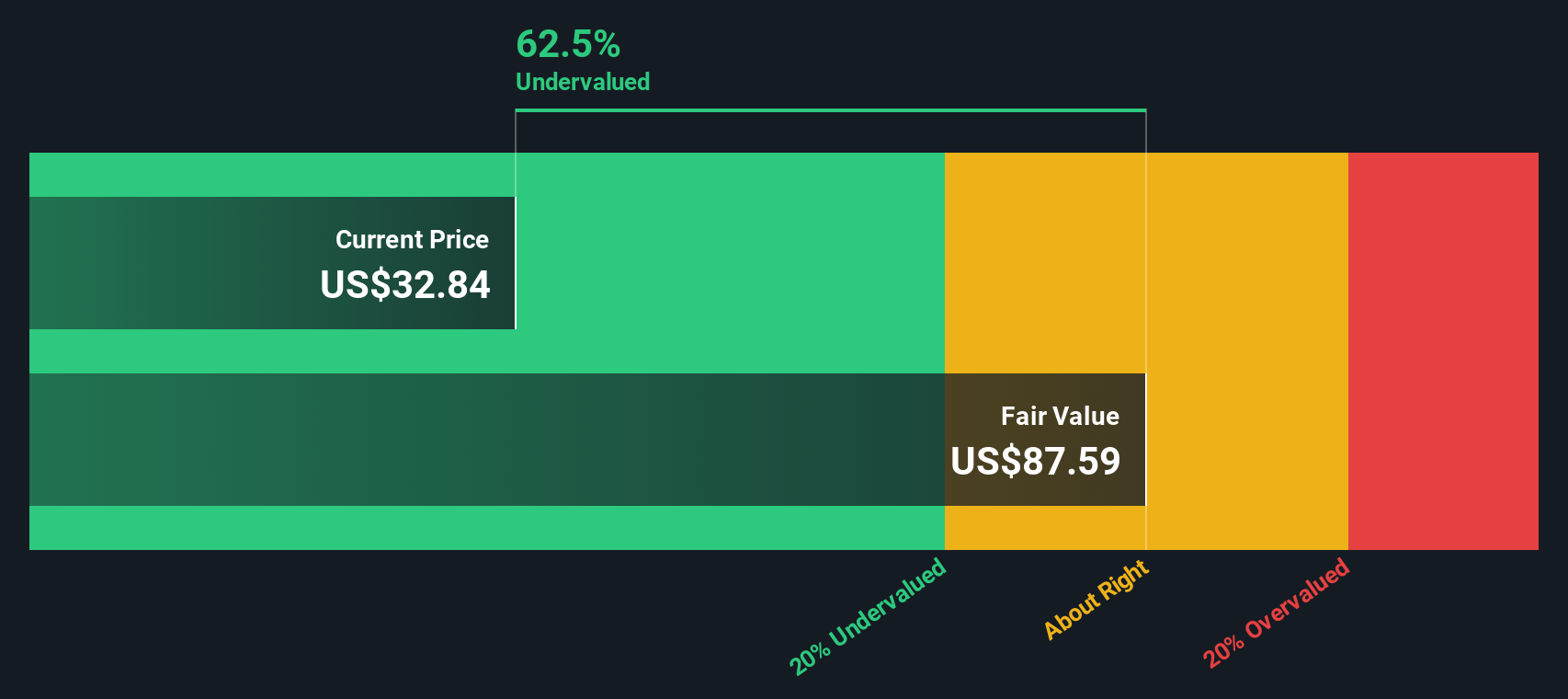

According to the most widely followed narrative, Virtu Financial's fair value sits well above its current share price. This suggests the stock is trading at a significant discount.

"Virtu's investments in trading technology, cross-asset platform integration, and digital asset capabilities (including crypto, stablecoins, and tokenized assets) position it to capture new wallet share. This provides earnings growth and improved revenue diversification."

Curious about the financial engine driving this bold valuation? The story hints at transformative expansion into new markets and improving profitability assumptions that could reshape Virtu's future. Want to see which key numbers and forecasts power this aggressive fair value? Dive in to uncover the surprising projections behind this attention-grabbing price target.

Result: Fair Value of $47.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising competition from tech-driven trading rivals and rapidly evolving digital regulations could threaten Virtu’s growth momentum and challenge long-term revenue projections.

Find out about the key risks to this Virtu Financial narrative.Another View: The SWS DCF Model’s Perspective

While earlier assumptions have centered on where analysts see Virtu headed, our DCF model presents a different lens. This method also sees the stock as undervalued, but it raises its own questions about whether market pessimism has gone too far or if deeper headwinds are ahead for Virtu.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Virtu Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Virtu Financial Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own take on Virtu in just a few minutes. Do it your way.

A great starting point for your Virtu Financial research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunity does not wait. If you want to stay ahead of the crowd, consider these hand-picked strategies that have attracted serious attention this year.

- Uncover overlooked gems with solid financials and growth potential by checking out our list of penny stocks with strong financials.

- Tap into the AI revolution by reviewing cutting-edge businesses that are shaking up markets in our curated collection of AI penny stocks.

- Fast-track your value strategy and discover which stocks appear truly undervalued today through the tailored insights in undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIRT

Virtu Financial

Operates as a financial services company in the United States, Ireland, and internationally.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026