- United States

- /

- Capital Markets

- /

- NYSE:VIRT

How Should Investors View Virtu After Its Recent 19% Drop in 2025?

Reviewed by Bailey Pemberton

If you’re considering what to do with Virtu Financial right now, you’re not alone. The stock has certainly made waves, and even if recent weeks have been rocky, the long-term story is grabbing attention. Shares closed at $33.64, and while the last week saw a dip of 4.5% and the past month is down 18.9%, these shorter-term moves come after years of hard-earned gains. Take a step back, and you’ll see Virtu has delivered a solid 8.6% return over the past year, an impressive 74.4% over three years, and a noteworthy 83.2% over five. That kind of performance is hard to ignore, especially during times when market sentiment and risk perception are shifting across the financial sector.

What’s really intriguing is that Virtu Financial currently scores a 6 out of 6 on key valuation checks, suggesting it is undervalued by every measure used in our analysis. That’s a perfect score, and not one you come across all that often. In just a moment, we’ll break down exactly which valuation approaches are pointing to opportunity, but stick around until the end for a perspective on valuation that goes beyond the usual checks and could help you make the most informed decision yet.

Why Virtu Financial is lagging behind its peers

Approach 1: Virtu Financial Excess Returns Analysis

The Excess Returns valuation model focuses on how effectively a company generates profits above its cost of equity using its invested capital. In Virtu Financial’s case, this approach highlights both strong profitability and robust growth prospects relative to shareholder investments.

Virtu Financial has a Book Value of $16.59 per share and a Stable EPS of $8.61 per share. The latter is sourced from weighted future Return on Equity estimates from five analysts. The company’s average Return on Equity stands at an impressive 41.43%, indicating that management is delivering well above the sector norm. With a Cost of Equity estimated at $2.48 per share and an Excess Return of $6.13 per share, the company’s profits after covering the cost of capital are substantial. Its Stable Book Value also projects upward to $20.79 per share, backed by analyst projections.

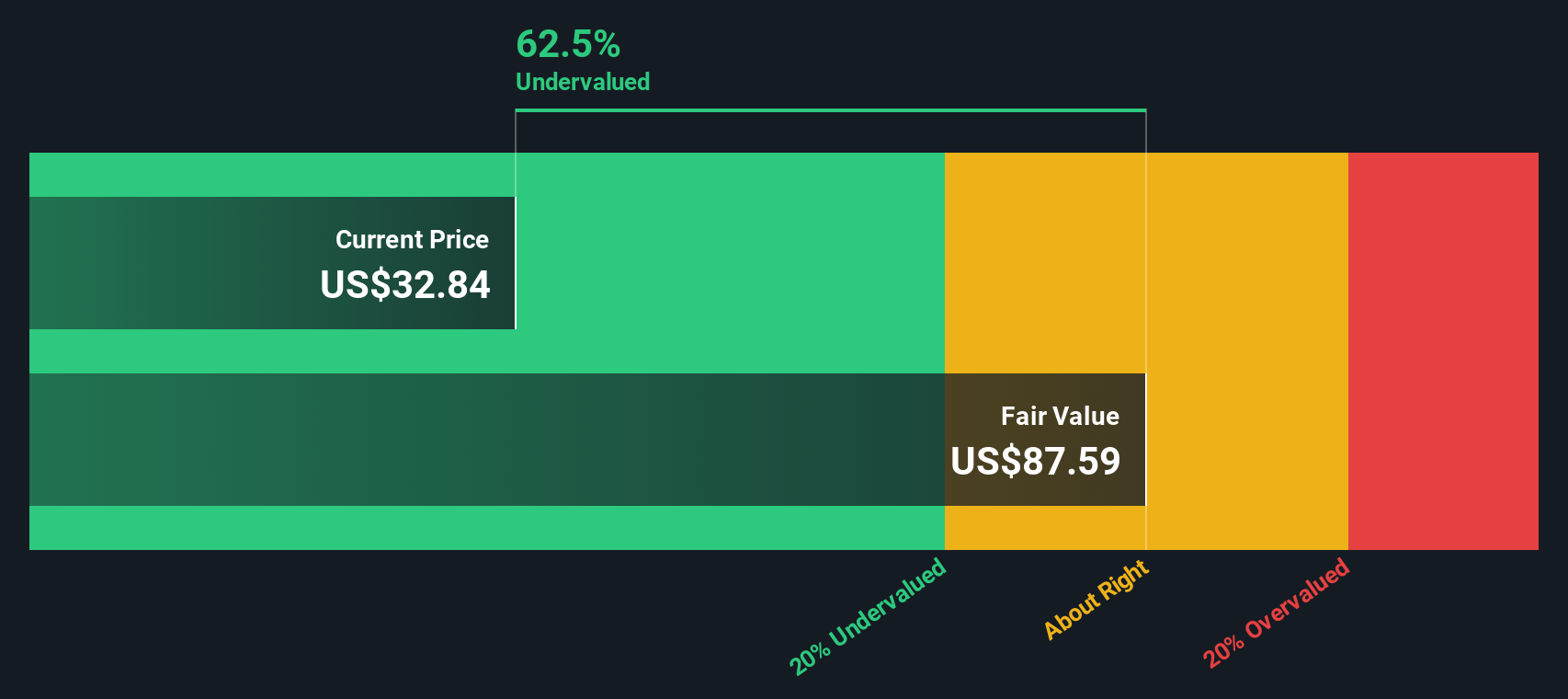

Based on this analysis, Virtu Financial’s estimated intrinsic value is $89.89 per share. Compared to the current share price of $33.64, the stock appears to be significantly undervalued by around 62.6%.

Result: UNDERVALUED

Our Excess Returns analysis suggests Virtu Financial is undervalued by 62.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Virtu Financial Price vs Earnings

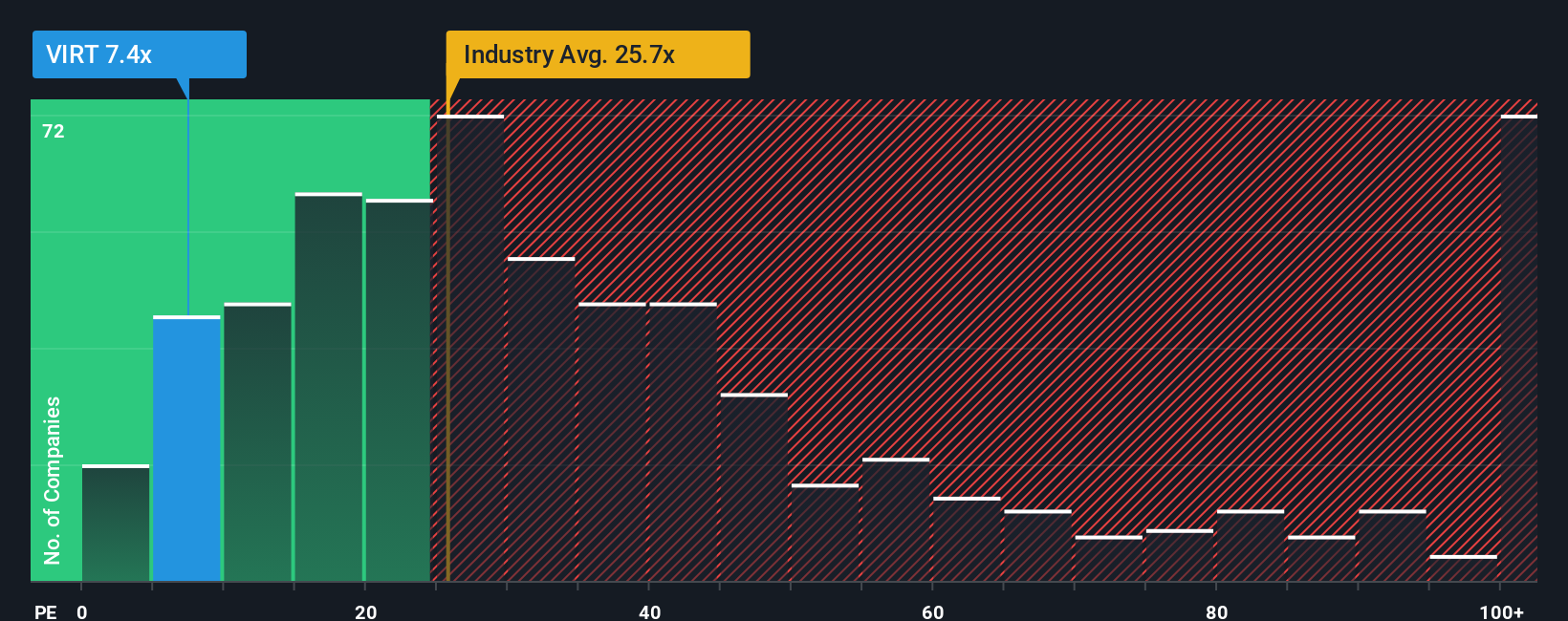

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for profitable companies like Virtu Financial. Because PE relates the share price to the company's earnings, it provides a direct view of how much investors are willing to pay for every dollar of profit. This makes it especially relevant for firms with strong and consistent earnings, as is the case here.

However, what constitutes a "normal" or "fair" PE ratio is not universal. Growth expectations and risk profile play a crucial role. Companies with higher expected future earnings growth or lower risk typically command a higher PE, whereas lower-growth or riskier companies tend to trade at a discount.

Virtu Financial currently trades on a PE of 7.5x, which is markedly lower than the Capital Markets industry average of 27.1x and the peer average of 13.7x. While those benchmarks are helpful, Simply Wall St's proprietary "Fair Ratio" offers additional insight. For Virtu, this Fair Ratio is calculated to be 14.1x, taking into account not just growth and industry group, but also factors like profit margins, market capitalization, and the specific risks the company faces.

The Fair Ratio is a more precise and holistic benchmark because it incorporates the company’s unique characteristics rather than simply averaging across potentially incomparable peers. By comparing Virtu’s current PE of 7.5x to the Fair Ratio of 14.1x, the stock appears significantly undervalued on this measure as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Virtu Financial Narrative

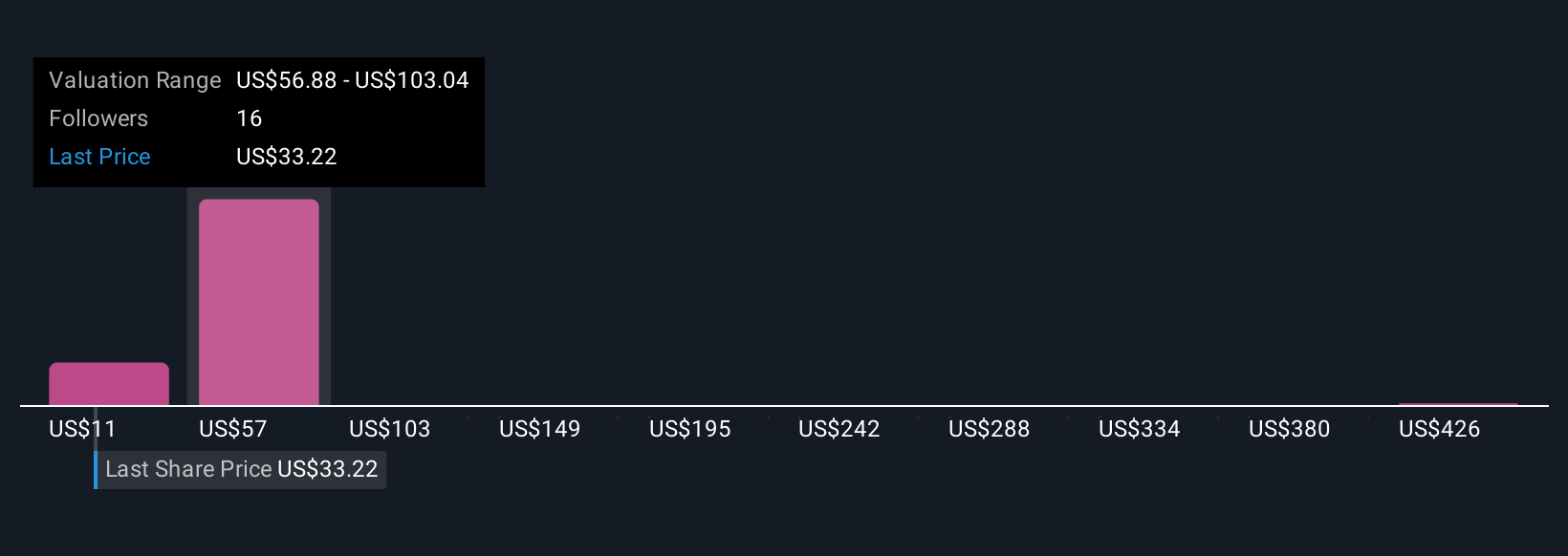

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a straightforward but powerful concept, letting you attach your own story and perspective to the numbers behind a company, such as your view on Virtu Financial’s fair value, future revenue, earnings, and margins.

Instead of simply looking at recent results or analyst forecasts, Narratives let you link what you believe about a company’s business and future to your own financial projections and see how those translate to a fair value.

Accessible to everyone on Simply Wall St’s Community page, used by millions of investors, this tool helps you decide when to buy or sell by comparing your calculated Fair Value to the current share Price. Narratives update dynamically as fresh information or earnings reports are released, keeping your investment thesis current and actionable.

For example, investors who see digital asset adoption driving long-term growth might build a Narrative with a higher fair value for Virtu Financial, while those more concerned about tech-driven competition or regulatory risks could arrive at a lower target. By using Narratives, you can ground your investment decisions in your own informed view, not just consensus numbers.

Do you think there's more to the story for Virtu Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIRT

Virtu Financial

Operates as a financial services company in the United States, Ireland, and internationally.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion