Visa (NYSE:V) Partners With Extend To Empower Emerging Middle-Market Companies With Virtual Cards

Reviewed by Simply Wall St

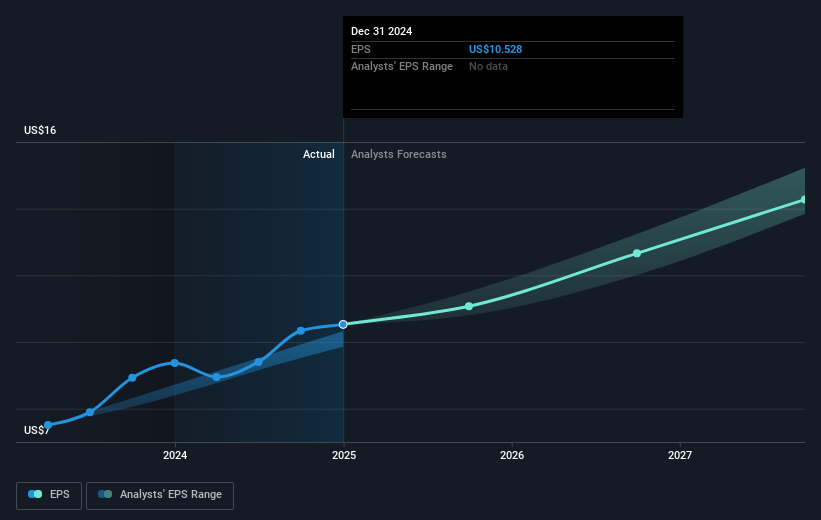

Visa (NYSE:V) experienced a 7% price increase in the last quarter. This movement follows several key developments, including a referral agreement with Extend to enhance Visa's service offerings through virtual cards. Additionally, Visa's robust Q1 earnings results, showcasing sales and net income growth, may have bolstered investor confidence. The company's effective share repurchase program also likely contributed to the positive sentiment. Meanwhile, external market factors, such as the recent fluctuations and concerns over potential tariffs, did not dampen Visa's performance, as the broader market showed a modest rise over the past week.

Buy, Hold or Sell Visa? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the last five years, Visa (NYSE: V) delivered a compelling total shareholder return of 121.63%, including share price appreciation and dividends. This robust performance is underscored by Visa's aggressive expansion in tap-to-pay technology and fruitful partnerships with prominent banks like ICICI and ICBC, which have significantly boosted transaction volumes. In addition, Visa’s acquisition of Featurespace has bolstered its fraud prevention capabilities, enhancing revenue and net margins through high-value solutions beyond traditional payment processing.

Furthermore, Visa's strategic fiscal maneuvers—such as effective share buyback programs—have bolstered shareholder value, with recent buybacks exceeding US$9.74 billion. The company also rolled out innovative products, including a Bitcoin rewards credit card in partnership with Fold, entering the burgeoning crypto rewards market. Visa exceeded the US market, which returned 10.5% over the past year. Despite the ongoing antitrust lawsuit and settlement challenges, Visa's comprehensive growth initiatives and resilience underscore its significant returns over the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives