Visa (NYSE:V) Expands Reach with Global Money Transfer Partnership

Reviewed by Simply Wall St

Visa (NYSE:V) experienced a price move of 6% over the last month, amid significant market momentum, where the broader market posted a 5% increase. Key developments during this period included Visa's collaboration with Euronet to enhance digital payout services through Visa Direct, potentially adding value to its market position. The partnership with Webull for faster fund transfers and Rain's stablecoin settlement initiative may have further bolstered investor confidence in Visa's innovative strides. These collaborations, along with a positive market climate, likely contributed to the overall positive sentiment driving Visa's share price performance.

Buy, Hold or Sell Visa? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

Visa's recent collaborative strides, particularly with Euronet and Webull, are poised to align with the company's strategy to enhance global payment systems through tokenization and stablecoin settlements. These initiatives not only address security and efficiency but also bolster user engagement globally, potentially boosting revenue streams and reinforcing Visa's market position. Over the past five years, Visa's total shareholder return, including dividends, soared by 90.53%, illustrating robust performance in a competitive landscape.

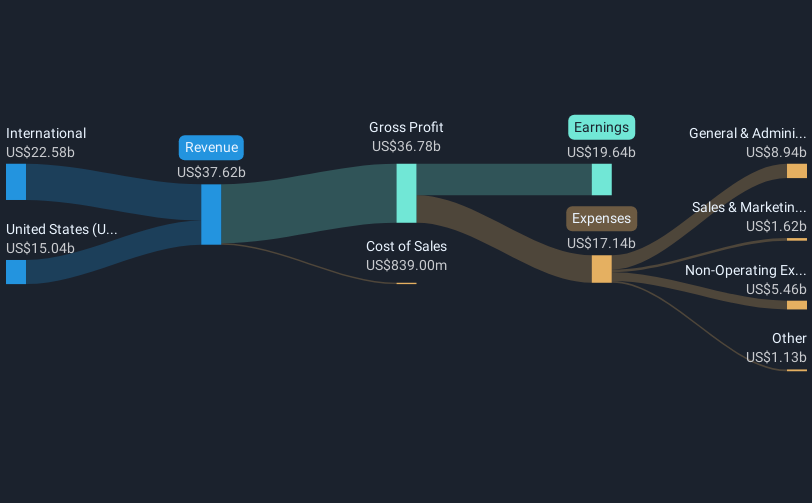

In the last year, Visa's earnings growth outpaced the US Diversified Financial industry, exhibiting an 8.5% increase against the industry's 7.9%. While the market saw a 10.6% rise, Visa also delivered relatively superior returns over the same period. Recent developments are likely to positively influence analysts' revenue and earnings forecasts. Analysts currently anticipate Visa's earnings to grow 11.01% annually, largely supported by increasing cross-border transactions and stablecoin innovations.

At present, Visa's share price reflects an optimistic market sentiment, trading closely near consensus price targets. The share is at about US$347.70, with a price target of US$374.25, implying a modest potential upside of 7.1%. The relatively small gap between Visa's current share price and the price target suggests a consensus that the stock is fairly valued based on projected earnings and market positioning. Investors should consider this balance of optimistic innovation-driven growth against prevailing market risks and operational challenges.

Unlock comprehensive insights into our analysis of Visa stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives