- United States

- /

- Diversified Financial

- /

- NYSE:UWMC

UWM Holdings (UWMC): Valuation in Focus After Strong Q2 Results and Upsized Debt Offering

Reviewed by Kshitija Bhandaru

UWM Holdings (UWMC) just delivered better-than-expected second-quarter results, catching investors’ attention with both strong earnings and revenue. The company also boosted its senior notes offering, which underscores positive market sentiment toward its financial health.

See our latest analysis for UWM Holdings.

After a mostly steady first half, UWM Holdings’ strong second-quarter earnings and the upsized senior notes offering have kickstarted momentum, with investors beginning to warm to its upside. Despite some turbulence over the past year, its recent moves may hint at improving sentiment. Although the one-year total shareholder return remains slightly negative, the three-year figure is back in positive territory.

If this financial comeback has you thinking about what else is gaining traction with insiders, now is the perfect time to discover fast growing stocks with high insider ownership

With shares hovering just below recent analyst targets and momentum turning positive, the question for investors is whether UWM Holdings still has room to run or if current prices already reflect future growth.

Most Popular Narrative: Fairly Valued

The latest fair value call sits right on top of UWM Holdings’ current price, indicating narrow daylight between analyst consensus and the market. The next move hinges on whether the story behind the price holds up to scrutiny.

Continued investment and successful deployment of advanced AI tools (like BOLT, ChatUWM, LEO, and Mia) are materially increasing broker productivity, efficiency, and borrower retention. This provides UWM with lower unit costs and the ability to handle significantly higher loan volumes without a proportional increase in costs, which should drive long-term revenue growth and operating margin expansion.

Want to peek under the hood of this valuation? There’s a bold assumption in play: UWM’s operating margins could drastically shift as digital automation takes over the mortgage process. What’s the surprising metric driving this entire growth thesis? Click through to see the underlying numbers.

Result: Fair Value of $6.03 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including persistent high rates or broker channel erosion. Either of these factors could weaken UWM’s operating leverage and growth momentum.

Find out about the key risks to this UWM Holdings narrative.

Another View: What Do the Numbers Say?

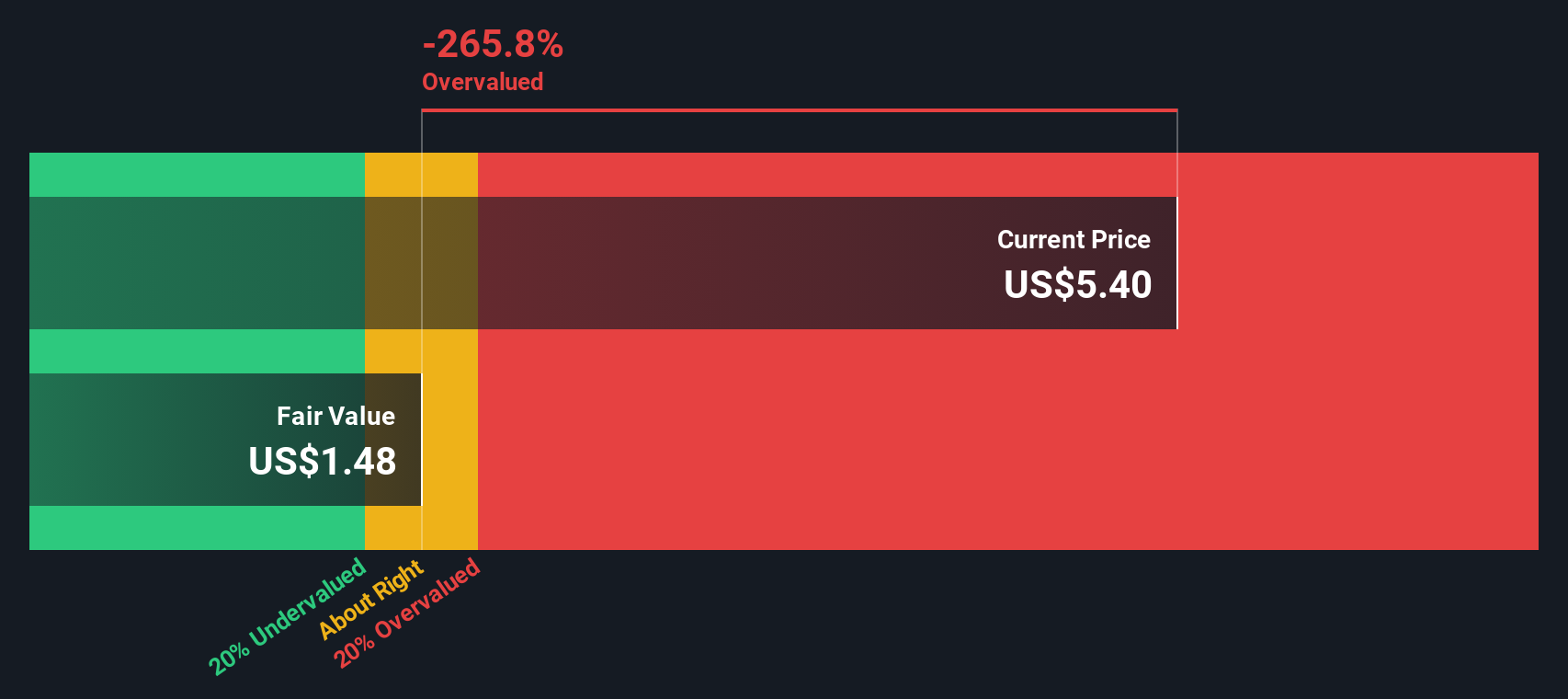

While analyst consensus suggests UWM Holdings is trading close to fair value, our SWS DCF model paints a different picture. According to this method, shares might actually be overvalued, with the current price sitting above our intrinsic value estimate. Does this mean the analyst optimism has outpaced underlying fundamentals, or is the model missing something that only the market can see?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own UWM Holdings Narrative

If you see the story differently or want to dig deeper into the numbers yourself, building your own view is just minutes away. Do it your way

A great starting point for your UWM Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want to skip the noise and zero in on high-potential stocks, these curated themes are your shortcut to the market’s most exciting stories.

- Boost your income potential by checking out these 19 dividend stocks with yields > 3% that offer attractive yields exceeding 3% along with steady performance even in uncertain markets.

- Capitalize on medical innovation and spot future leaders through these 31 healthcare AI stocks as they push boundaries in artificial intelligence and healthcare breakthroughs.

- Catch the early momentum in tech shifts with these 24 AI penny stocks which are at the forefront of artificial intelligence advancements and industry disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UWMC

UWM Holdings

Engages in the origination, sale, and servicing residential mortgage lending in the United States.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives