- United States

- /

- Diversified Financial

- /

- NYSE:UWMC

UWM Holdings (NYSE:UWMC) Reports Q4 Revenue of US$560M Posts US$9M Net Income Declares US$0.10 Dividend

Reviewed by Simply Wall St

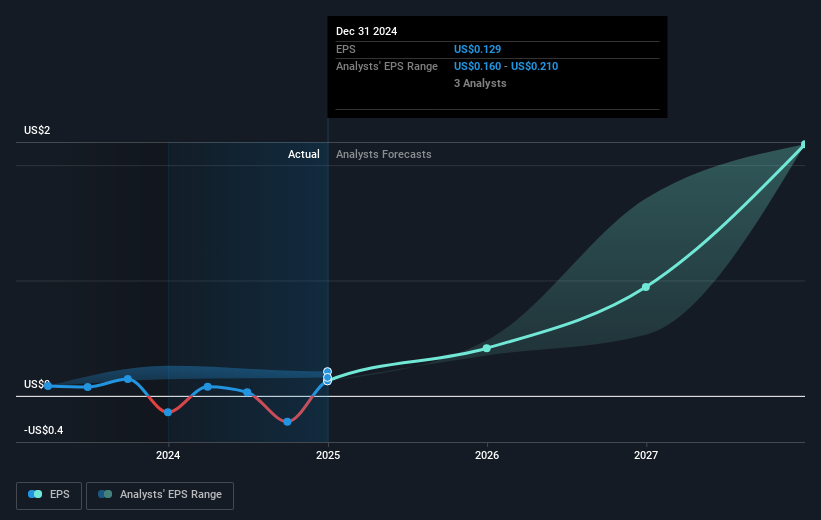

UWM Holdings (NYSE:UWMC) recently announced its transition to profitability in the fourth quarter, reporting a significant jump in revenue to $560 million compared to a loss the previous year. This financial turnaround, paired with the declaration of a $0.10 per share cash dividend and optimistic production guidance, bolstered investor confidence, contributing to a 6.99% rise in the company’s share price over the last month. This positive shift occurred despite general market declines, with major indices experiencing a 3.9% retreat in recent days. As the broader market struggled, driven by concerns over economic outlook and looming earnings reports, UWM Holdings' improved financial performance and shareholder-friendly decisions likely helped sustain its upward trajectory amidst a challenging market environment.

Dig deeper into the specifics of UWM Holdings here with our thorough analysis report.

Over the past three years, UWM Holdings has achieved a total shareholder return of 79.67%, incorporating both share price changes and dividends. This performance stands out particularly over the longer term, even though the company underperformed compared to the broader US market, which returned 17.8% over the past year. Key events contributing to this long-term performance include several quarters of fluctuating earnings. For example, recent Q4 2024 results reported a revenue jump to US$560.21 million from a previous loss, signaling a turnaround that aided investor sentiment.

Dividend announcements also played a vital role in shareholder returns, with regular US$0.10 per share dividends declared in 2024 and early 2025. Additionally, the issuance of US$800 million in senior notes at the end of 2024 strengthened the company's financial standing. Positive production guidance, with anticipated production as high as US$35 billion and promising gain margins, further bolstered investor confidence, contributing to UWM Holdings' overall shareholder returns.

- See how UWM Holdings measures up with our analysis of its intrinsic value versus market price.

- Assess the potential risks impacting UWM Holdings' growth trajectory—explore our risk evaluation report.

- Is UWM Holdings part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UWMC

UWM Holdings

Engages in the origination, sale, and servicing residential mortgage lending in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives