- United States

- /

- Diversified Financial

- /

- NYSE:UWMC

Could Recent Insider Sales at UWM Holdings (UWMC) Reveal Shifts in Management Confidence or Strategy?

Reviewed by Sasha Jovanovic

- In late September and early October 2025, UWM Holdings' founder Mat Ishbia and SFS Holding sold a combined 1,192,712 shares of Class A Common Stock for roughly US$7.3 million under a pre-arranged 10b5-1 trading plan, shortly after UWM reported second-quarter earnings that exceeded expectations with earnings per share of US$0.16 and revenue of US$758.7 million.

- The company successfully upsized and priced a US$1 billion senior notes offering at a 6.25% interest rate, up from US$600 million, reflecting strong demand from investors for UWM Holdings' debt securities.

- Next, we’ll explore how UWM Holdings’ robust debt offering shapes the outlook for its mortgage and technology-driven business model.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

UWM Holdings Investment Narrative Recap

Shareholders in UWM Holdings need to believe in the company's ability to translate its large-scale, tech-forward wholesale mortgage platform into sustained volume and margin expansion. The recent insider share sales occurred amid robust second-quarter results and the upsized US$1,000,000,000 senior notes issue, but do not appear to materially affect the most important short term catalyst, ongoing deployment of advanced AI tools to boost broker productivity. However, the largest current risk remains that fixed costs from technology investments may pressure margins if origination volumes do not keep pace.

Of the latest announcements, the successful upsizing and pricing of US$1,000,000,000 in senior notes at a 6.25% rate is most relevant. This strong market demand for UWM’s debt signals confidence in the company’s funding capacity, which supports the ongoing technology build-out that underpins its key growth catalyst: enabling higher broker efficiency and larger origination volumes without proportional cost increases.

Conversely, investors should be aware that while funding and technology are critical, if origination volumes plateau or decline...

Read the full narrative on UWM Holdings (it's free!)

UWM Holdings is projected to reach $3.6 billion in revenue and $119.3 million in earnings by 2028. This outlook assumes annual revenue growth of 10.8% and a $107.4 million increase in earnings from the current $11.9 million.

Uncover how UWM Holdings' forecasts yield a $6.03 fair value, in line with its current price.

Exploring Other Perspectives

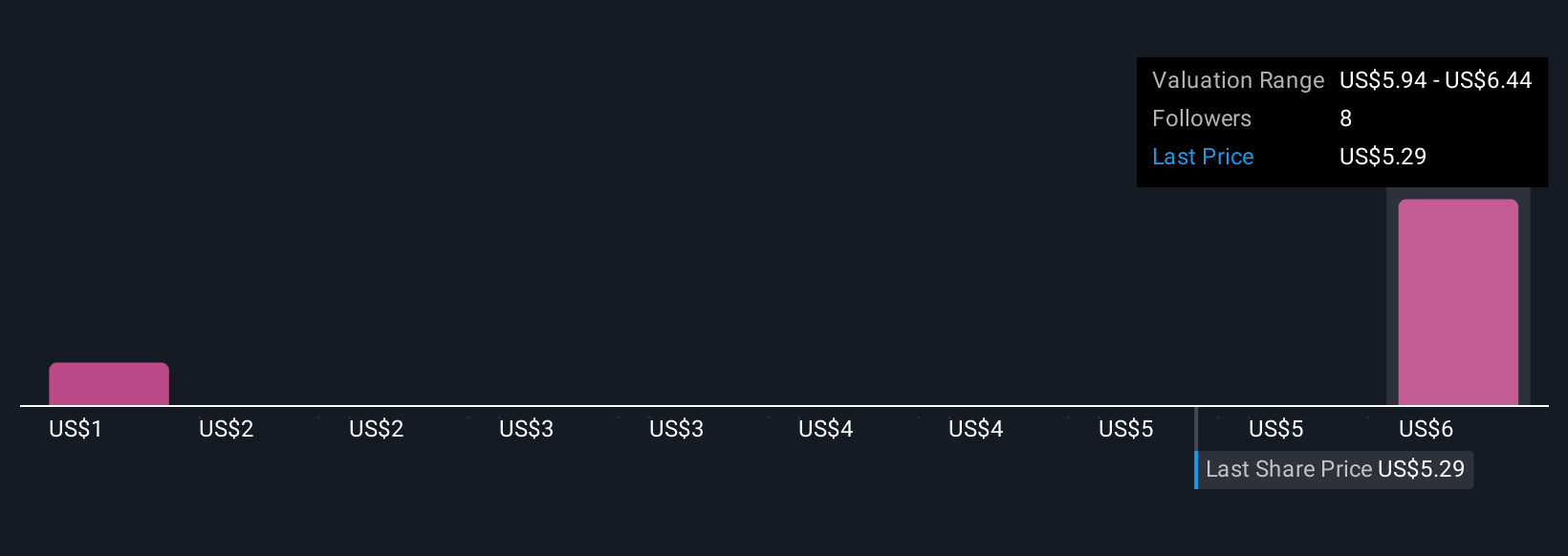

Simply Wall St Community members supplied three different fair value estimates for UWM Holdings, ranging from US$1.52 to US$6.44 per share. With this diversity of opinions, consider how continued investment in technology could either support UWM’s margins or intensify operating leverage risks under challenging conditions. Review several viewpoints to inform your own outlook.

Explore 3 other fair value estimates on UWM Holdings - why the stock might be worth as much as 8% more than the current price!

Build Your Own UWM Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UWM Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free UWM Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UWM Holdings' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UWMC

UWM Holdings

Engages in the origination, sale, and servicing residential mortgage lending in the United States.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives