- United States

- /

- Mortgage REITs

- /

- NYSE:TRTX

Reflecting on TPG RE Finance Trust's (NYSE:TRTX) Share Price Returns Over The Last Year

While it may not be enough for some shareholders, we think it is good to see the TPG RE Finance Trust, Inc. (NYSE:TRTX) share price up 20% in a single quarter. But that is minimal compensation for the share price under-performance over the last year. After all, the share price is down 47% in the last year, significantly under-performing the market.

Check out our latest analysis for TPG RE Finance Trust

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

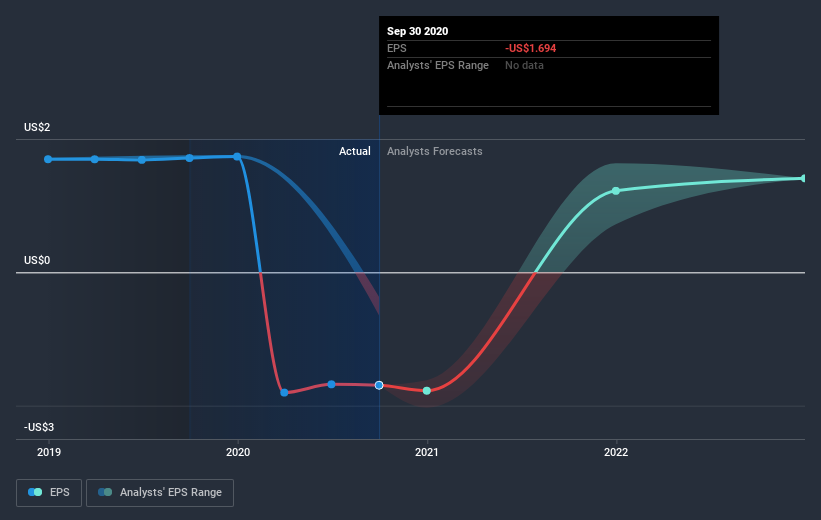

During the last year TPG RE Finance Trust saw its earnings per share drop below zero. While this may prove temporary, we'd consider it a negative, so it doesn't surprise us that the stock price is down. We hope for shareholders' sake that the company becomes profitable again soon.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on TPG RE Finance Trust's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of TPG RE Finance Trust, it has a TSR of -40% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

The last twelve months weren't great for TPG RE Finance Trust shares, which cost holders 40%, including dividends, while the market was up about 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 8% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand TPG RE Finance Trust better, we need to consider many other factors. Take risks, for example - TPG RE Finance Trust has 4 warning signs (and 1 which is a bit unpleasant) we think you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade TPG RE Finance Trust, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TPG RE Finance Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:TRTX

TPG RE Finance Trust

A commercial real estate finance company, originates, acquires, and manages commercial mortgage loans and other commercial real estate-related debt instruments in the United States.

Fair value with mediocre balance sheet.