- United States

- /

- Consumer Finance

- /

- NYSE:SYF

Is Synchrony Still Attractive After Its Five Year 183% Surge and Recent Volatility?

Reviewed by Bailey Pemberton

If you are weighing up what to do with Synchrony Financial stock, you are definitely not alone. Maybe you have been watching as shares have soared over the past few years, or maybe the recent volatility has caught your attention and you are wondering if now is a smart entry point. Either way, the numbers are hard to ignore. Synchrony closed at $70.25, which is up an incredible 183.0% over the past five years and 139.2% over three years. However, the last month has seen a modest pullback of 5.7% and a dip of 1.0% just within the last week. Still, even year-to-date, the stock is higher by 7.7%, showing resilience amid shifting market sentiment around consumer lenders.

So what is really going on? Part of the recent price swings can be traced to broader market jitters about economic growth and financial sector conditions. There is a growing sense from many investors that companies like Synchrony might have an edge as interest rates evolve and consumers adjust their spending. But is the current price still a good deal?

To cut through the noise, it helps to look at valuation. Synchrony actually passes 5 out of 6 key undervaluation checks, earning a robust value score of 5. That is not something many financial stocks can claim right now. In the next section, we will break down what goes into that valuation assessment, using some familiar methods that every investor should know. And, if you are curious about taking your analysis a step further, stick around for a fresh perspective on valuation that might change how you look at Synchrony and the whole sector.

Approach 1: Synchrony Financial Excess Returns Analysis

The Excess Returns valuation approach focuses on how much return a company generates above its cost of equity, using core measures like book value and stable earnings per share. Instead of only projecting cash flows, this model highlights whether the company is consistently earning more on its investments than they cost. This provides a clearer understanding of its true ability to drive shareholder value.

For Synchrony Financial, here are the key figures:

- Book Value: $44.00 per share

- Stable EPS: $10.10 per share

(Source: Weighted future Return on Equity estimates from 12 analysts.) - Cost of Equity: $4.72 per share

- Excess Return: $5.38 per share

- Average Return on Equity: 19.60%

- Stable Book Value: $51.55 per share

(Source: Weighted future Book Value estimates from 10 analysts.)

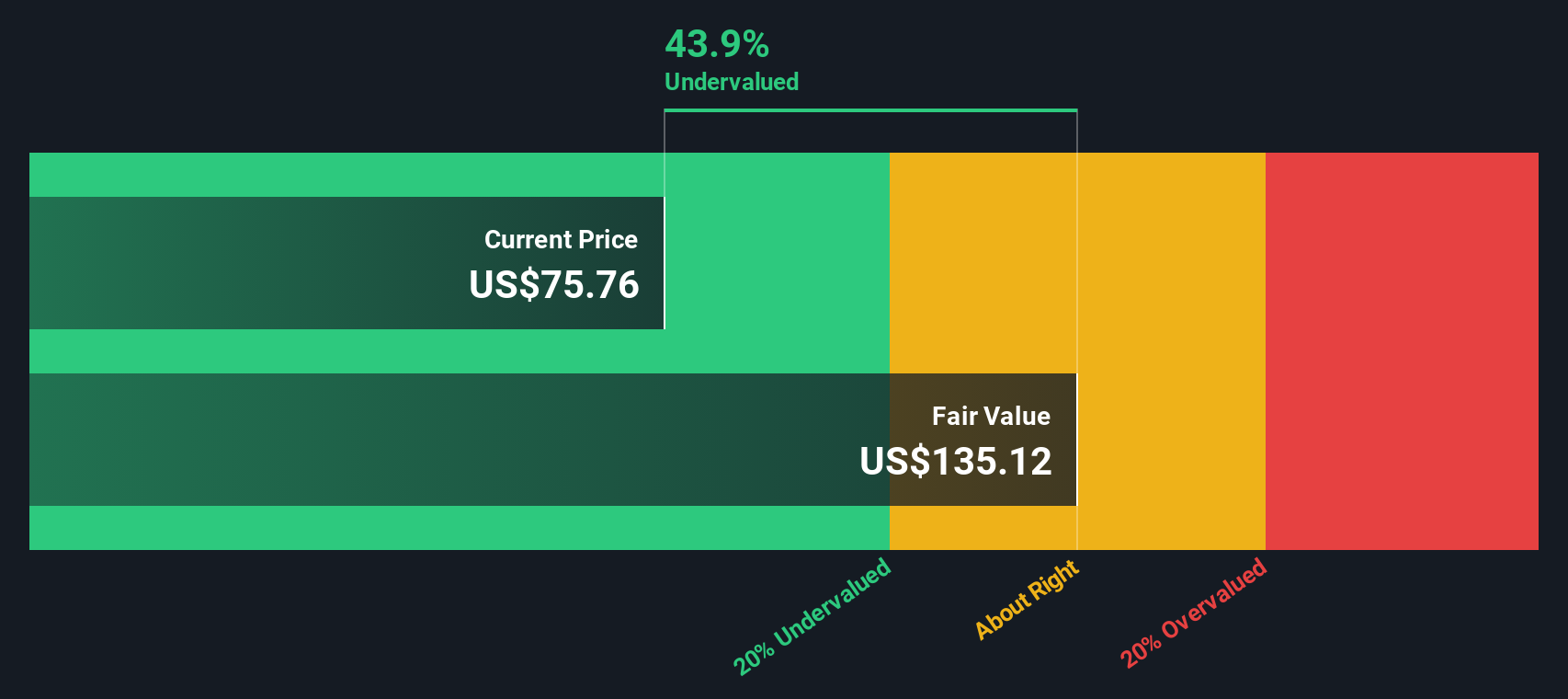

Based on this model, Synchrony’s estimated intrinsic value is $140.01 per share, significantly higher than its current share price of $70.25. This suggests the stock is trading at a 49.8% discount to its intrinsic value and may be undervalued at the moment.

Result: UNDERVALUED

Our Excess Returns analysis suggests Synchrony Financial is undervalued by 49.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Synchrony Financial Price vs Earnings

The price-to-earnings (PE) ratio is often seen as the go-to valuation metric for established and consistently profitable companies like Synchrony Financial. Because it compares share price to earnings, it helps investors gauge how much they are paying for each dollar of current profit. Importantly, a company's PE reflects not just its current profits but also market expectations for growth, profitability, and risk. Higher projected growth and lower risk often justify a higher "fair" PE, while more risk or slower growth points to a lower fair multiple.

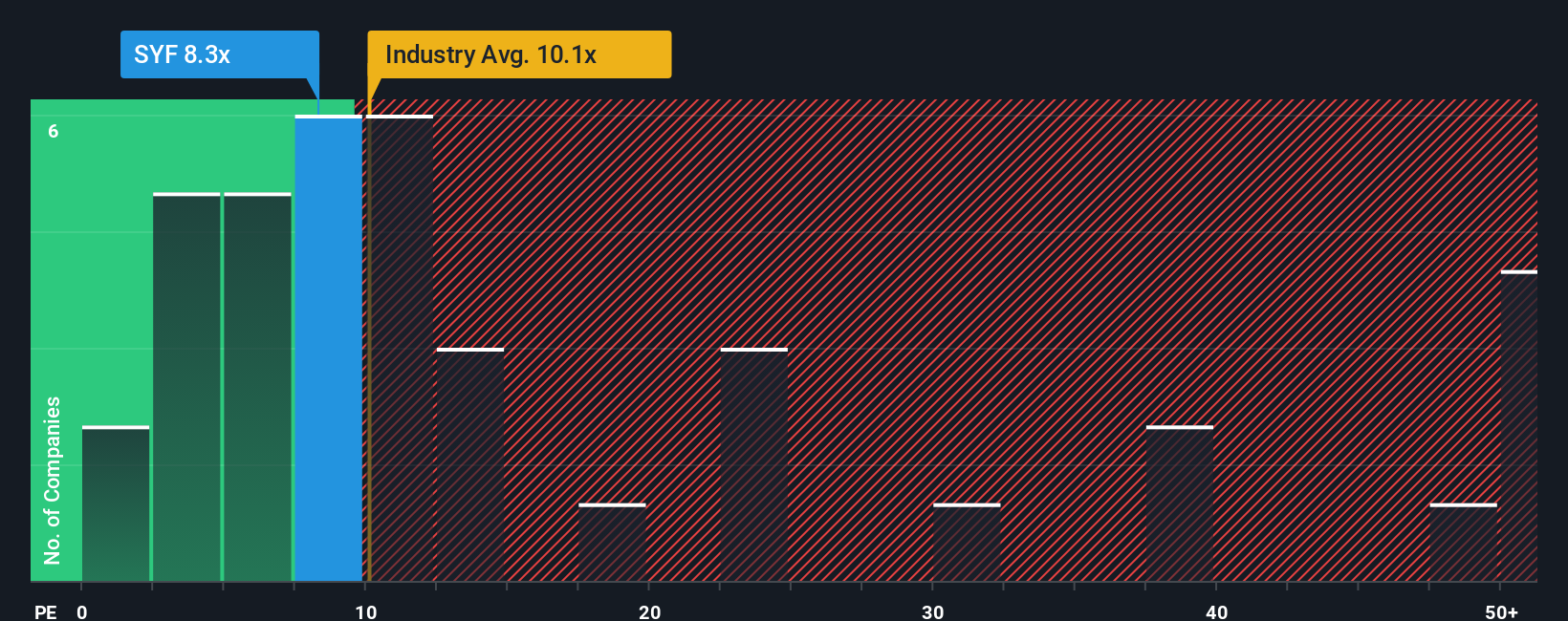

Currently, Synchrony Financial trades at a PE ratio of 7.24x. This is well below the Consumer Finance industry average of 9.99x and also under the peer group average of 63.71x. At first glance, this steep discount might suggest the market is overlooking Synchrony's potential. To get a more nuanced view, it helps to consider Simply Wall St’s “Fair Ratio.”

The Fair Ratio for Synchrony Financial stands at 15.45x. Unlike basic peer or industry comparisons, this proprietary measure factors in the company’s specific earnings outlook, risk profile, profit margins, market cap, and sector dynamics. This means it is tailored to Synchrony’s unique situation rather than relying on less precise averages.

With Synchrony currently trading at about half its Fair Ratio, the stock appears meaningfully undervalued through this lens, suggesting an opportunity for investors seeking value.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Synchrony Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your personal investment story for a company, the unique way you connect what is happening at Synchrony Financial with what you believe its future will hold. Narratives allow you to spell out your assumptions for future revenue, earnings, and margins, and link them directly to a fair value. This makes it crystal clear how your expectations compare to the current price.

Unlike static models, Narratives bring financial forecasts to life. They are updated dynamically as new news or earnings come in, keeping your thinking relevant and up to date. The best part is that Narratives are easy to create and explore right on Simply Wall St's Community page, where millions of investors swap perspectives and test their own ideas.

This tool makes it simple to track when to buy or sell by comparing your fair value with the market price. For example, for Synchrony Financial, some investors' Narratives are bullish, with price targets as high as $100, while others are more cautious, placing fair value closer to $60. The takeaway: Narratives put you in control, helping you make decisions based on your own view of the company's story, not just someone else's numbers.

Do you think there's more to the story for Synchrony Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYF

Synchrony Financial

Operates as a consumer financial services company in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives