- United States

- /

- Consumer Finance

- /

- OTCPK:SUNL.Q

Investors in Sunlight Financial Holdings (NYSE:SUNL) from a year ago are still down 52%, even after 11% gain this past week

Over the last month the Sunlight Financial Holdings Inc. (NYSE:SUNL) has been much stronger than before, rebounding by 54%. But that isn't much consolation to those who have suffered through the declines of the last year. During that time the share price has sank like a stone, descending 52%. Some might say the recent bounce is to be expected after such a bad drop. Of course, it could be that the fall was overdone.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Sunlight Financial Holdings

Given that Sunlight Financial Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Sunlight Financial Holdings increased its revenue by 66%. That's a strong result which is better than most other loss making companies. In contrast the share price is down 52% over twelve months. Yes, the market can be a fickle mistress. Typically a growth stock like this will be volatile, with some shareholders concerned about the red ink on the bottom line (that is, the losses). Generally speaking investors would consider a stock like this less risky once it turns a profit. But when do you think that will happen?

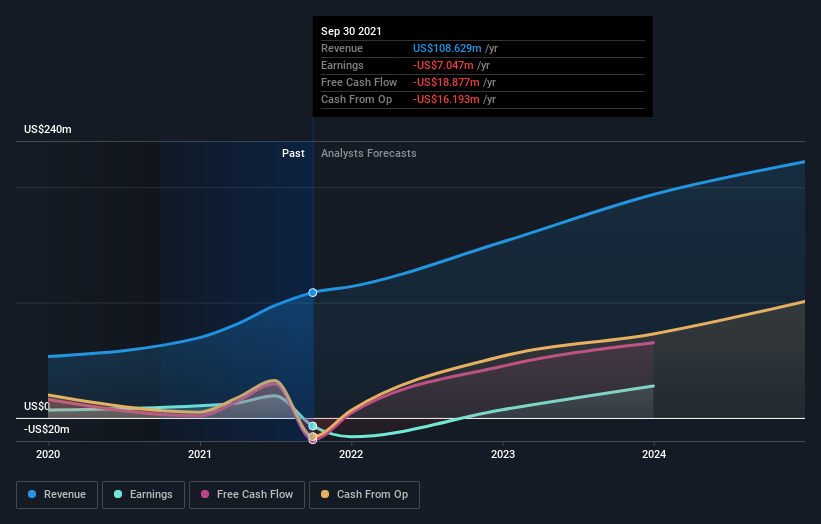

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Sunlight Financial Holdings stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Given that the market gained 1.4% in the last year, Sunlight Financial Holdings shareholders might be miffed that they lost 52%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 41% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Sunlight Financial Holdings is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:SUNL.Q

Sunlight Financial Holdings

Sunlight Financial Holdings Inc. operates a business-to-business-to-consumer technology-enabled point-of-sale financing platform in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives