- United States

- /

- Capital Markets

- /

- NYSE:STT

Is It Too Late to Look at State Street After 19% Gain in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your State Street shares? Or maybe you’re eyeing the bank for the first time, wondering if you’ve already missed the boat after such a strong run. Either way, it’s a good time to take a closer look. State Street has been quietly but confidently asserting itself in the market, and if you’ve been watching the ticker, you’ll know it’s up 19.3% so far this year, part of a remarkable 112.9% gain over the last three years. Even over just the past month, the stock’s up 3.5%, hinting that investors are picking up on something beyond typical market moves.

Much of this momentum ties back to broad market optimism about big financial institutions that offer both stability and growth, and State Street has managed to capture a sweet spot in this trend. Recently, shifts in risk perception on Wall Street have worked in the company’s favor, and State Street’s diversified business model seems to be drawing renewed confidence from investors seeking exposure to global financial services without taking on excessive risk.

But is the stock still a bargain, or have the easy gains already been snapped up? To answer that, I’ve dug into several well-known valuation measures. Out of six checks for undervaluation, State Street passes four, giving it a solid value score of 4. But are these metrics enough to make a decision you can feel good about? Let’s look at each approach in turn, and at the end, I’ll share the most insightful way to evaluate any stock’s true worth.

Approach 1: State Street Excess Returns Analysis

The Excess Returns valuation model estimates a stock's worth by comparing how much profit the company generates from its equity investments over and above the minimum required return for shareholders. In essence, it focuses on return on invested capital, the cost of equity, and how efficiently the company is able to grow value for its shareholders while adjusting for risk.

For State Street, the latest data suggests a Book Value of $83.16 per share and a stable Earnings Per Share (EPS) projection of $11.56, based on weighted future Return on Equity (ROE) estimates from 9 analysts. The Cost of Equity is $9.02 per share, which means State Street generates an Excess Return of $2.55 per share. The company averages a healthy ROE of 12.60%, supporting these performance metrics. Looking forward, the stable Book Value is projected to grow to $91.77 per share, also sourced from analyst estimates.

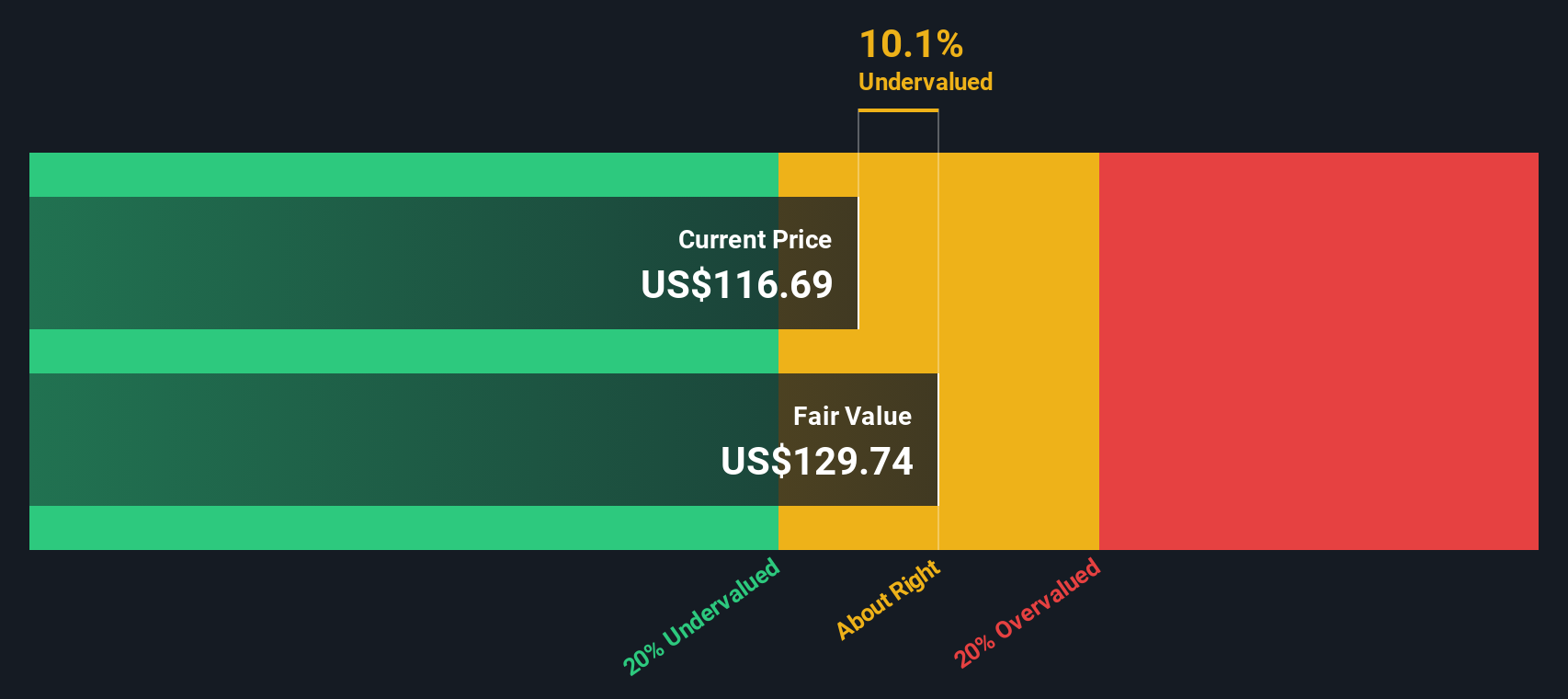

This approach results in an estimated intrinsic value that is 9.7% higher than the current share price, suggesting State Street is trading very close to its fair value based on excess returns. While not a significant bargain, the share price is not overvalued either.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out State Street's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: State Street Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies like State Street. It reflects how much investors are willing to pay for each dollar of earnings, providing a snapshot of market expectations around profitability. Generally, faster-growing and lower-risk companies can command higher PE multiples, while slower growers or those facing more uncertainty, see lower values.

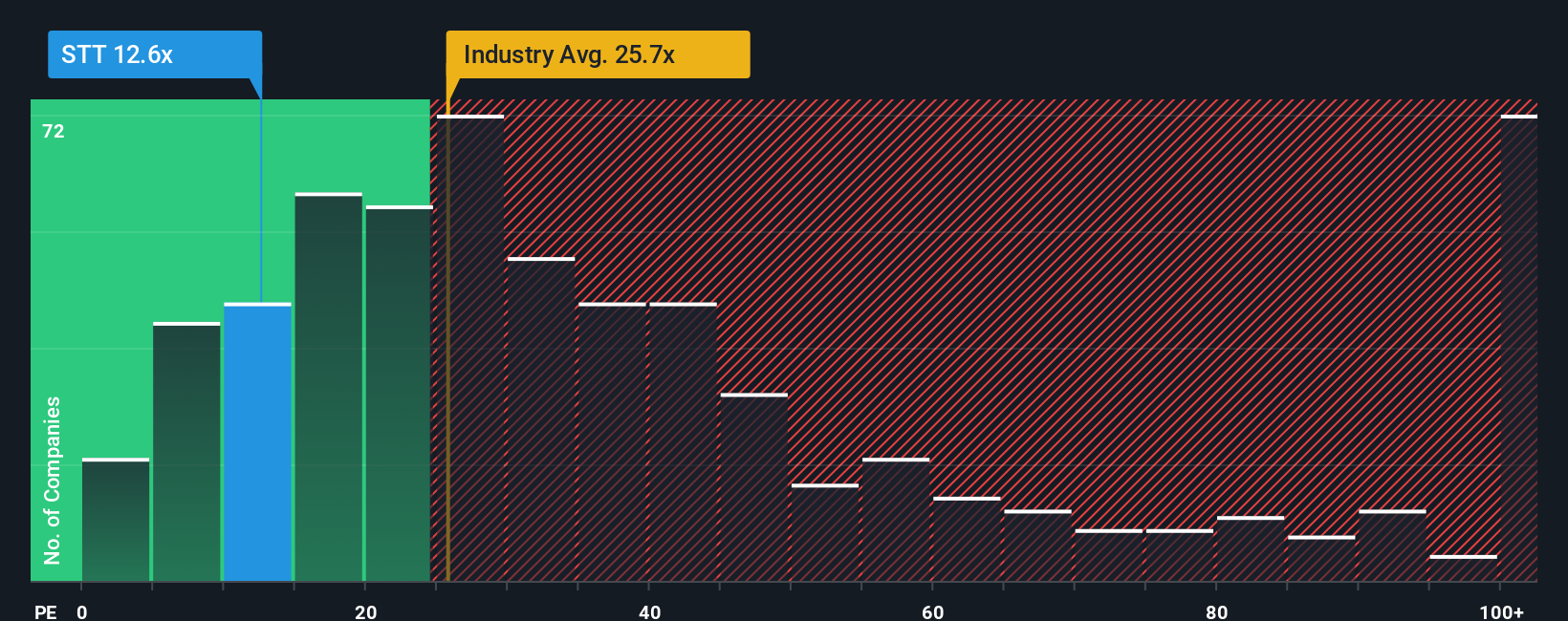

State Street currently trades at a PE ratio of 12.6x, which is noticeably below the Capital Markets industry average of 25.5x and also lower than its key peer group average of 14.8x. While this raw comparison might suggest State Street is undervalued, it is important to consider context. Companies with slower expected growth or slightly higher risk typically trade at a discount to the group.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio is a tailored PE multiple that adjusts for earnings growth, industry dynamics, profit margins, market capitalization, and unique company risks. This makes it a more nuanced benchmark than the broad strokes of industry or peer comparisons. For State Street, the Fair Ratio stands at 17.7x. Compared to its current multiple of 12.6x, the difference is notable, but not extreme.

Since the gap between the Fair Ratio and State Street’s actual multiple is less than 0.10 in absolute terms, it signals that the stock price is ABOUT RIGHT relative to its fundamentals and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your State Street Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a feature that lets you bring your own story for a company directly into the investing process. A Narrative is more than just numbers; it captures your unique perspective on State Street, including what you believe about its future, from its revenue growth and margins to its fair value, all supported by your chosen assumptions.

Narratives link the company's big picture, such as industry shifts or new technologies, to a financial forecast and then estimate a fair value. This approach makes your investment decision much more personal and actionable. They are straightforward to use and available on Simply Wall St’s Community page, where millions of investors update Narratives with new information from the latest news or earnings releases.

By comparing the Fair Value from your Narrative to the current share price, you can quickly see if it's time to buy, sell, or hold. For example, some investors currently forecast State Street's fair value as high as $131 and others as low as $95, reflecting their different views on risks and growth. This helps you see exactly where you stand, and why.

Do you think there's more to the story for State Street? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STT

State Street

Provides various financial products and services to institutional investors.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives