- United States

- /

- Diversified Financial

- /

- NYSE:SQ

Three US Growth Companies With High Insider Ownership And Up To 63% Earnings Growth

Reviewed by Simply Wall St

Amid a buoyant U.S. market, where major indices like the Nasdaq and S&P 500 have recently hit record highs following encouraging job data, investors continue to seek opportunities that combine growth potential with strong insider commitment. High insider ownership in growth companies often signals confidence from those who know the business best, aligning well with current market optimism and making these stocks particularly interesting in such economic conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.3% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's uncover some gems from our specialized screener.

Globus Medical (NYSE:GMED)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Globus Medical, Inc. is a medical device company that specializes in creating healthcare solutions for musculoskeletal disorders, operating both in the United States and internationally, with a market capitalization of approximately $9.29 billion.

Operations: The company generates its revenue primarily from the medical products segment, which brought in approximately $1.90 billion.

Insider Ownership: 16.7%

Earnings Growth Forecast: 40.7% p.a.

Globus Medical, despite its recent exclusion from multiple Russell indexes as of July 1, 2024, shows promising financial growth with a significant increase in annual revenue guidance to between US$2.46 billion and US$2.485 billion. However, the company reported a net loss of US$7.12 million for Q1 2024, contrasting sharply with the net income from the previous year. Insider activity has been mixed with no substantial buying and some selling over the past three months, raising questions about insider confidence even as earnings are expected to grow robustly at 40.74% per year.

- Navigate through the intricacies of Globus Medical with our comprehensive analyst estimates report here.

- The analysis detailed in our Globus Medical valuation report hints at an inflated share price compared to its estimated value.

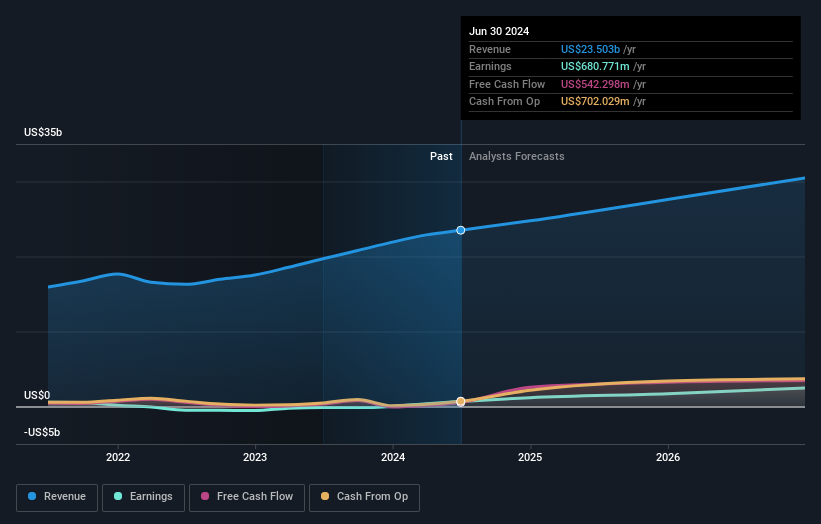

Block (NYSE:SQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Block, Inc. operates globally, developing integrated commerce and financial ecosystems, with a market capitalization of approximately $40.65 billion.

Operations: The company generates revenue primarily through two segments: Square, which brought in $7.21 billion, and Cash App, contributing $15.47 billion.

Insider Ownership: 10.2%

Earnings Growth Forecast: 36.3% p.a.

Block, Inc. has recently increased its debt financing to US$2 billion at 6.50%, signaling robust capital management for future growth initiatives like acquisitions and strategic investments. Despite no substantial insider purchases in the past quarter, the company's revenue surged to US$5.96 billion in Q1 2024 from US$4.99 billion a year prior, with net income also rising significantly to US$472.01 million. Analysts forecast Block's earnings will grow by 36.28% annually, outpacing broader market expectations significantly, though its Return on Equity is projected low at 11.8%.

- Click here and access our complete growth analysis report to understand the dynamics of Block.

- Insights from our recent valuation report point to the potential overvaluation of Block shares in the market.

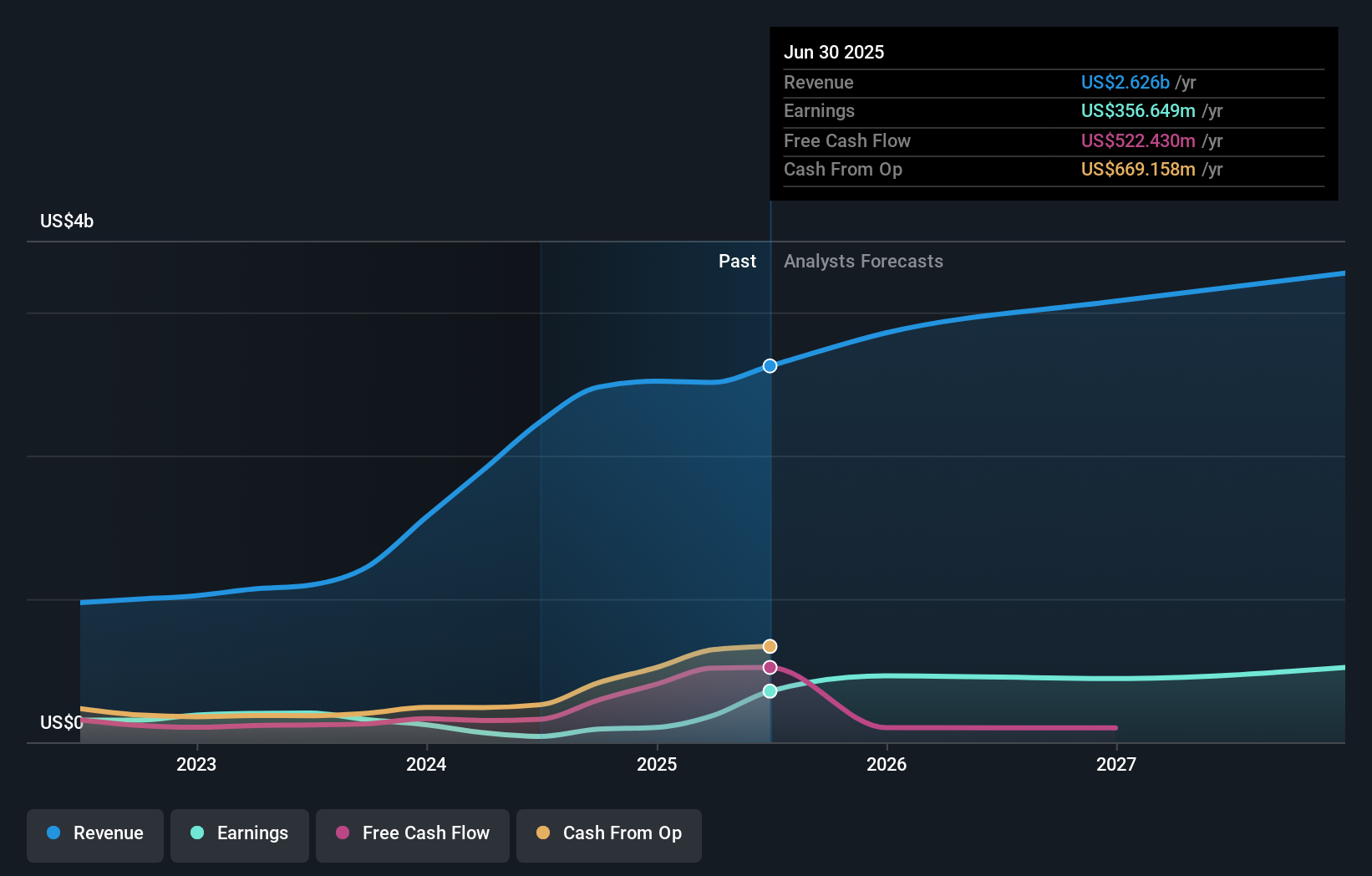

Toast (NYSE:TOST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Toast, Inc. provides a cloud-based technology platform tailored for the restaurant industry across the United States, Ireland, and India, with a market capitalization of approximately $14.25 billion.

Operations: The company generates $4.12 billion in revenue from its data processing services.

Insider Ownership: 21.7%

Earnings Growth Forecast: 63.2% p.a.

Toast, Inc. is poised for notable growth with its revenue expected to increase by 16.9% annually, outpacing the US market average of 8.7%. Despite recent shareholder dilution, earnings are projected to surge by 63.23% per year. The company's Return on Equity could reach a high of 22.1% in three years, indicating strong potential profitability and financial health. Recent strategic moves include amendments limiting officer liability and active pursuit of mergers and acquisitions to bolster long-term growth.

- Click here to discover the nuances of Toast with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Toast is trading beyond its estimated value.

Key Takeaways

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 179 more companies for you to explore.Click here to unveil our expertly curated list of 182 Fast Growing US Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Excellent balance sheet with reasonable growth potential.