- United States

- /

- Diversified Financial

- /

- NYSE:SQ

3 US Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market continues to rally post-election, with major indices like the Dow Jones and S&P 500 reaching record highs, investors are increasingly optimistic about potential opportunities. In such a buoyant market environment, identifying stocks that may be trading below their estimated value can offer unique investment prospects for those looking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Business First Bancshares (NasdaqGS:BFST) | $29.13 | $55.82 | 47.8% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.56 | $63.96 | 49.1% |

| Datadog (NasdaqGS:DDOG) | $124.45 | $246.86 | 49.6% |

| West Bancorporation (NasdaqGS:WTBA) | $23.93 | $46.88 | 49% |

| Proficient Auto Logistics (NasdaqGS:PAL) | $10.00 | $19.92 | 49.8% |

| Alaska Air Group (NYSE:ALK) | $51.00 | $98.15 | 48% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $277.43 | $546.47 | 49.2% |

| Coeur Mining (NYSE:CDE) | $6.59 | $12.56 | 47.5% |

| Carter Bankshares (NasdaqGS:CARE) | $19.53 | $38.28 | 49% |

| Mobileye Global (NasdaqGS:MBLY) | $16.45 | $31.69 | 48.1% |

We'll examine a selection from our screener results.

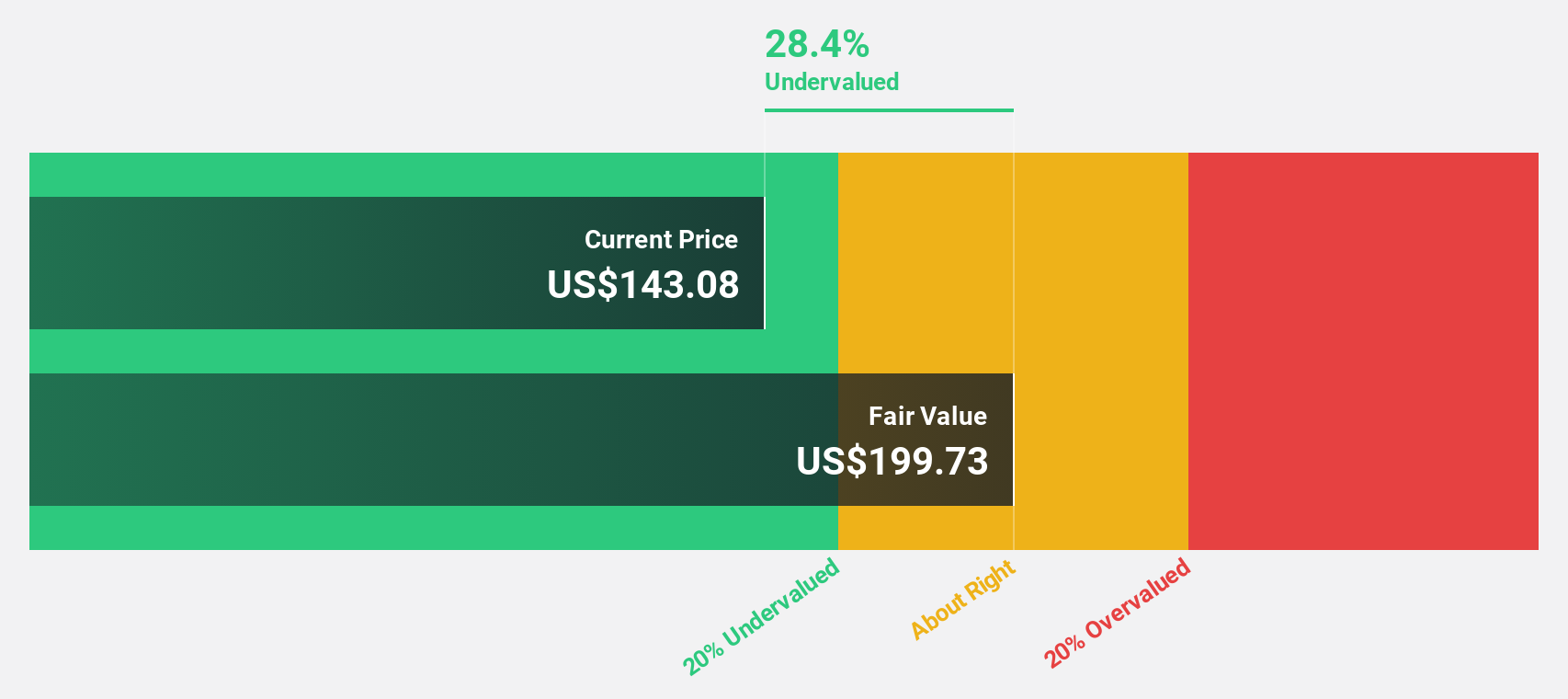

Mr. Cooper Group (NasdaqCM:COOP)

Overview: Mr. Cooper Group Inc., with a market cap of approximately $6.46 billion, operates as a non-bank servicer of residential mortgage loans in the United States through its subsidiaries.

Operations: The company's revenue is primarily derived from its Servicing segment, which generated $1.48 billion, and its Originations segment, contributing $416 million.

Estimated Discount To Fair Value: 40.2%

Mr. Cooper Group is trading at US$100.96, 40.2% below its estimated fair value of US$168.7, suggesting it is undervalued based on cash flows. Despite recent declines in quarterly revenue and net income, the company maintains a strong financial position with significant forecasted earnings growth of 25% annually over the next three years, outpacing the broader U.S. market's expected growth rate of 15.5%.

- Upon reviewing our latest growth report, Mr. Cooper Group's projected financial performance appears quite optimistic.

- Dive into the specifics of Mr. Cooper Group here with our thorough financial health report.

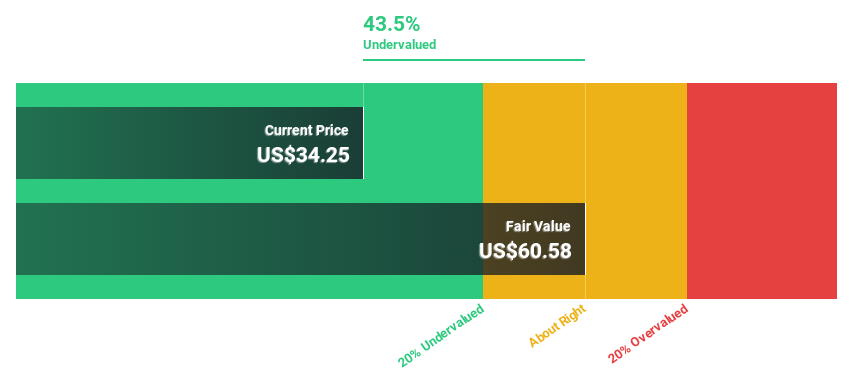

Range Resources (NYSE:RRC)

Overview: Range Resources Corporation is an independent company engaged in the production of natural gas, natural gas liquids, crude oil, and condensate in the United States with a market cap of approximately $7.97 billion.

Operations: The company's revenue is primarily generated from its Oil & Gas - Exploration & Production segment, which totaled $2.33 billion.

Estimated Discount To Fair Value: 45.4%

Range Resources is trading at US$33.03, significantly below its estimated fair value of US$60.45, indicating it is undervalued based on cash flows. Despite a decrease in profit margins from 43.6% to 20.4% over the past year, earnings are projected to grow at an impressive rate of 20.8% annually, surpassing the broader U.S. market's growth expectations of 15.5%. Recent guidance anticipates a modest increase in production for 2024.

- Our comprehensive growth report raises the possibility that Range Resources is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Range Resources.

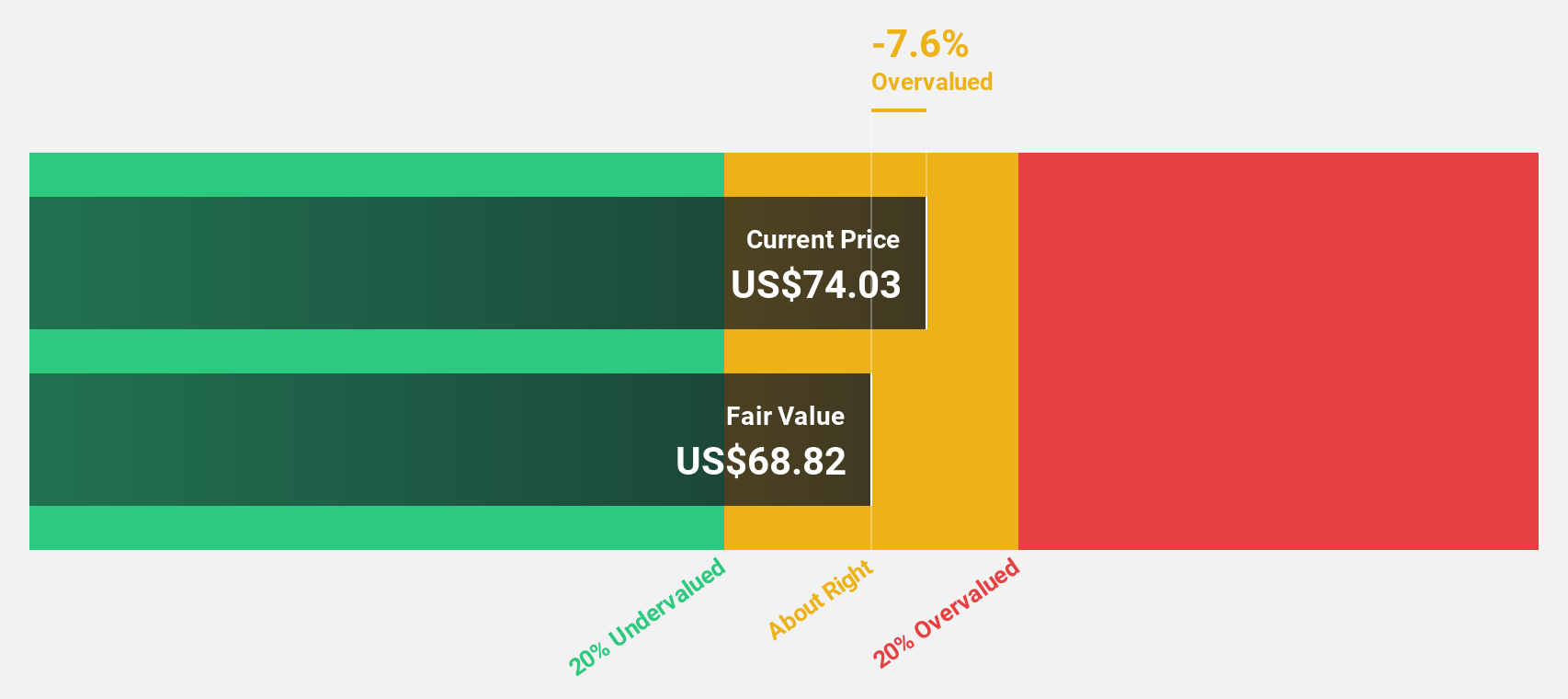

Block (NYSE:SQ)

Overview: Block, Inc. operates globally by developing ecosystems centered on commerce and financial products and services, with a market cap of $46.21 billion.

Operations: Block's revenue is primarily derived from its Square segment, generating $3.67 billion, and the Cash App segment, contributing $7.62 billion.

Estimated Discount To Fair Value: 10.1%

Block, Inc. is trading at US$74.56, below its estimated fair value of US$82.92, reflecting potential undervaluation based on cash flows. The company reported a significant turnaround with a net income of US$283.75 million for Q3 2024 compared to a loss last year and has actively engaged in share buybacks totaling US$1.14 billion since November 2023. Earnings are forecast to grow 27.7% annually, outpacing the U.S market's growth expectations.

- According our earnings growth report, there's an indication that Block might be ready to expand.

- Get an in-depth perspective on Block's balance sheet by reading our health report here.

Summing It All Up

- Click here to access our complete index of 189 Undervalued US Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Excellent balance sheet with reasonable growth potential.