- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Schwab (SCHW) Profit Margin Jumps to 31.4%, Reinforcing Bullish Valuation-Focused Narratives

Reviewed by Simply Wall St

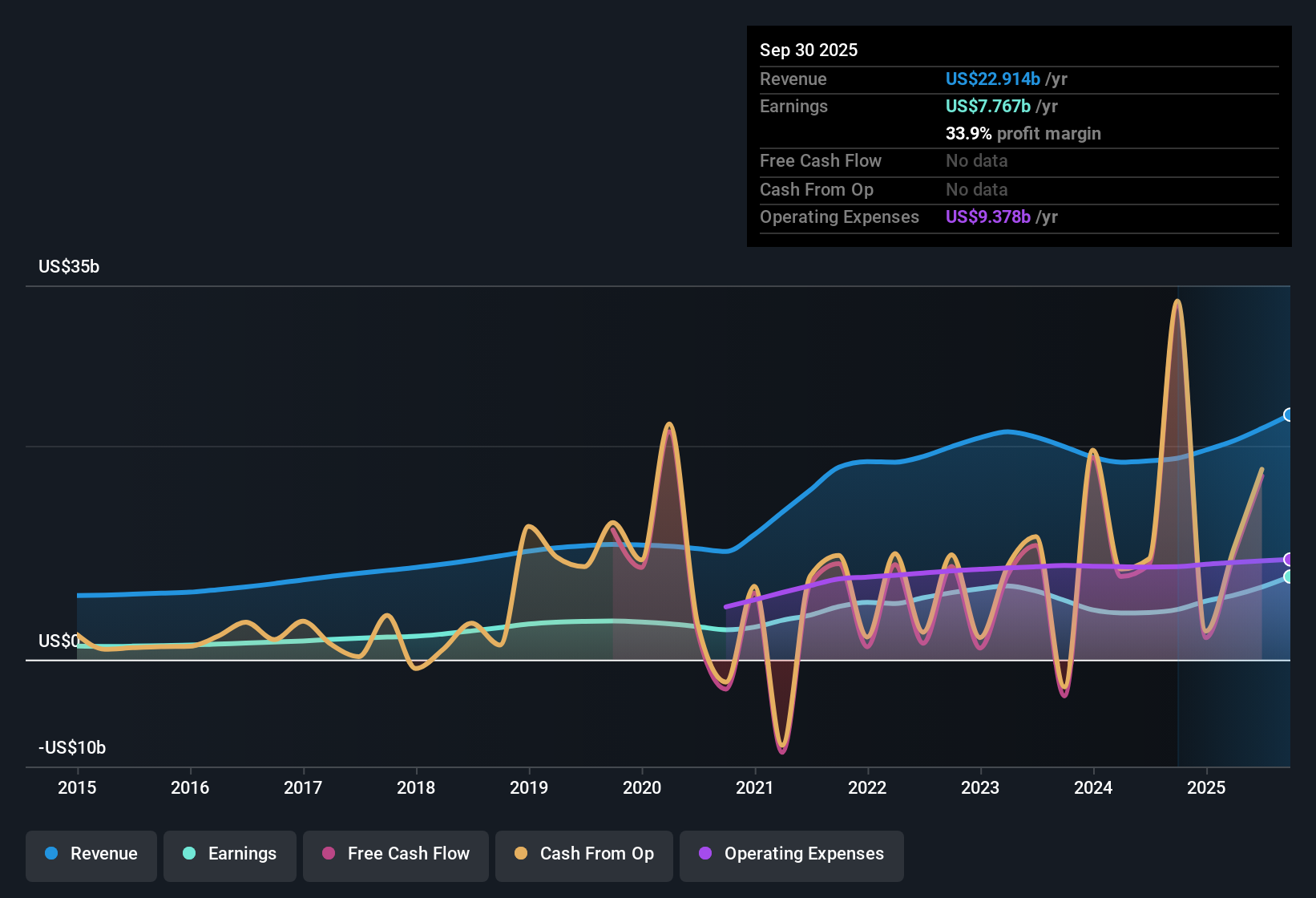

Charles Schwab (SCHW) delivered strong earnings growth, reporting a 54.1% increase in profit over the past year, far outpacing its 5-year average of 8.2% per year. Net profit margin jumped to 31.4% versus last year’s 23.7%. While forecasts call for continued annual earnings growth of 11.15%, this is slower than the projected US market average of 15.6%. Even with shares currently trading at $93.41, above the estimated fair value of $78.32, the company’s sustained margin improvements and attractive valuation compared to peers point to a robust business foundation for investors.

See our full analysis for Charles Schwab.The next step is to see how Schwab’s headline earnings compare to the narratives that are shaping market sentiment, highlighting where the consensus holds firm and where it might be challenged.

See what the community is saying about Charles Schwab

Margin Expansion Lifts Profitability Higher

- Net profit margin increased to 31.4% this year, well above last year's 23.7%. This confirms sustained margin improvement that extends beyond revenue growth.

- Analysts' consensus view highlights several drivers for this margin strength:

- Operational efficiencies and new product innovations are lowering costs and boosting long-term margin resilience. This supports a stronger competitive position even as sector pressures mount.

- Sustained digital adoption is deepening client engagement, helping drive more recurring revenue and supporting further margin durability across business cycles.

- Want to understand how these operating gains stack up across the market? Analysts’ consensus sees margin expansion as the key lever for durable growth. 📊 Read the full Charles Schwab Consensus Narrative.

Price-to-Earnings Stays Below Sector Average

- Schwab’s Price-to-Earnings ratio stands at 25x, providing a valuation edge against the sector average of 26.7x and peer group benchmarks, even with shares at $93.41.

- Analysts' consensus view points out a double-edged story:

- While the valuation keeps Schwab attractive to value-focused investors, it also assumes the projected earnings growth will materialize at an 11.15% annual pace. This rate trails the broader US market’s 15.6% expected rate.

- This creates tension between current relative value and the risk that slower growth could cap upside, especially if analysts’ estimates prove optimistic.

Client Growth and Digital Adoption Fuel Upside

- Over 60% of Schwab’s new-to-firm clients are under age 40, and June’s net new asset growth surged 46% year over year. This reveals powerful momentum from younger investors and digital engagement.

- Analysts' consensus view links these trends to the investment case:

- Expanding the client base through strong digital uptake and cross-selling is generating more fee-based revenue and deepening client relationships. This drives persistent AUM and supports long-term earnings durability.

- However, rising competition from digital-first brokerages and potential regulatory shifts could moderate future organic growth and profit margins. This puts Schwab's resilience to the test as the industry evolves.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Charles Schwab on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the data that deserves a fresh take? Share your point of view and craft a narrative in just a few minutes. Do it your way

A great starting point for your Charles Schwab research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

With Schwab’s projected earnings growth lagging behind the broader market and some risk that slower performance could cap returns, investors may want to consider alternatives.

For those seeking stronger upside potential, check out high growth potential stocks screener (52 results) which highlights established stocks forecast to deliver faster earnings growth over the next few years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives