- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Charles Schwab (SCHW): Taking a Fresh Look at Valuation Following Recent Share Fluctuations

Reviewed by Simply Wall St

Charles Schwab (SCHW) shares have been active lately, as investors weigh the company’s performance against recent market trends. With Schwab’s stock seeing some fluctuations over the past month, it is an interesting time to check on its progress.

See our latest analysis for Charles Schwab.

Over the past year, Charles Schwab’s share price has rebounded impressively with a 24.5% year-to-date gain, suggesting that sentiment is improving after last year’s volatility. The 1-year total shareholder return is 14.3%, and the long-term multi-year gains indicate that momentum is continuing, despite some recent pullbacks in the past week.

If Schwab’s recent moves have you rethinking your watchlist, now is a great time to discover fast growing stocks with high insider ownership.

With shares trading below analyst price targets but recent gains already factored in, the key question is whether Charles Schwab remains undervalued or if the market is already anticipating the company’s next stage of growth.

Most Popular Narrative: 17.9% Undervalued

Charles Schwab’s most closely followed narrative points to a fair value notably above the latest close, suggesting that the market may be too pessimistic on the company’s forward prospects. This setup highlights a gap between where the stock trades and the long-range assumptions driving current price targets.

Expanding client base and digital adoption are driving sustained asset growth, deeper client engagement, and increasingly diversified revenue streams. Operational efficiencies, innovative product launches, and industry scale are enhancing margins, competitive position, and long-term earnings resilience.

What’s behind this bullish outlook? The secret sauce is a set of aggressive growth projections, including surging client assets, expanding profit margins, and a valuation supported by metrics that defy conventional sector averages. Want to uncover how these optimistic assumptions drive Schwab’s potential upside? Click through and see what numbers anchor this fair value.

Result: Fair Value of $111.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition from digital brokers and unpredictable interest rate shifts could quickly undermine Schwab’s growth outlook and valuation case.

Find out about the key risks to this Charles Schwab narrative.

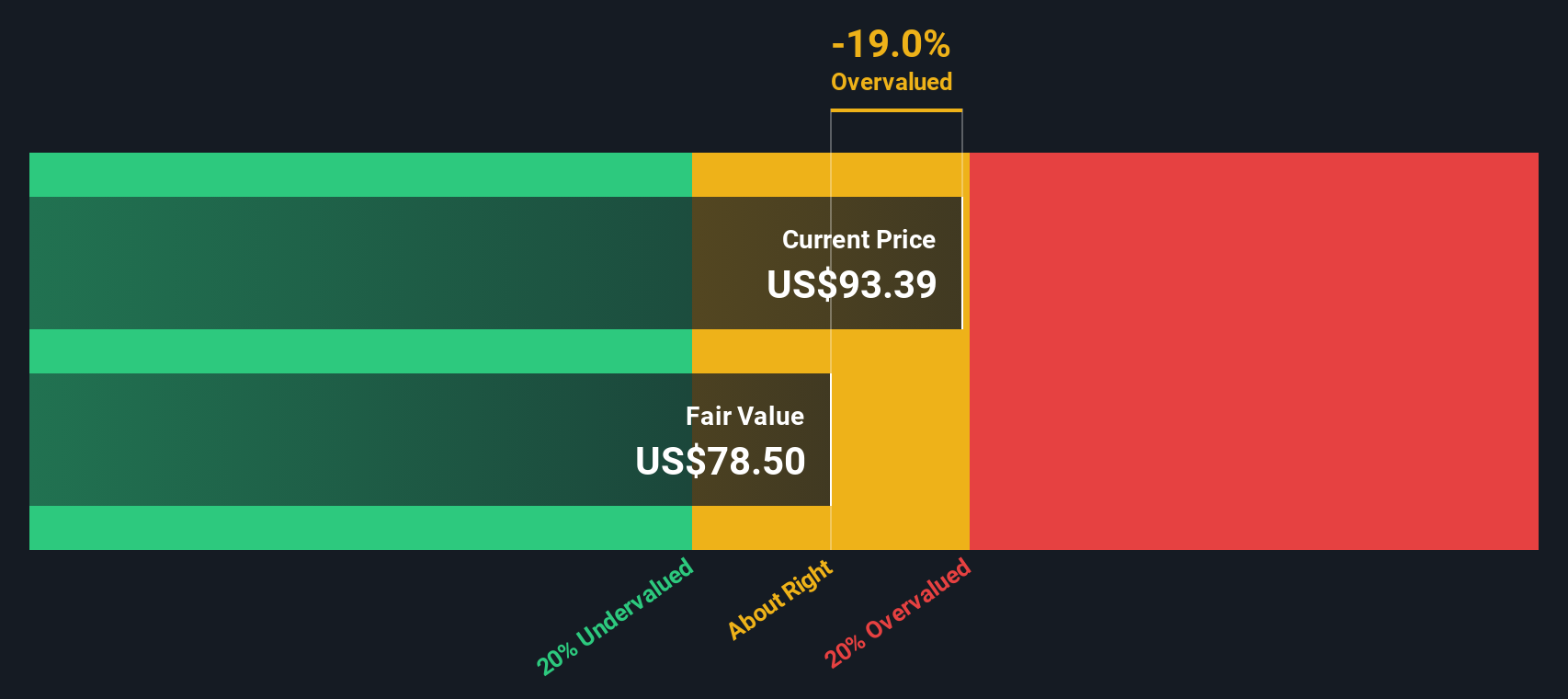

Another View: SWS DCF Model Offers a Reality Check

While many focus on the current price-to-earnings ratio versus industry benchmarks, our SWS DCF model values Charles Schwab at $89.77, slightly below its latest trading price. This suggests that, based on expected future cash flows, shares might be a touch overvalued from this angle. Which valuation better reflects real opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Charles Schwab Narrative

If you see things differently or want to dig into the numbers on your own terms, you can build your narrative in under three minutes. So why not Do it your way?

A great starting point for your Charles Schwab research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Seeking More Smart Opportunities?

Don’t let your next portfolio win slip away. Uncover unique stock ideas and fresh angles in overlooked corners of the market right now.

- Capture high yields and boost your income stream by checking out these 18 dividend stocks with yields > 3%, featuring yields above 3% that stand out in today's market.

- Tap into healthcare’s next big transformation and find potential growth leaders with these 31 healthcare AI stocks, which highlights companies advancing patient care with artificial intelligence.

- Ride the momentum of artificial intelligence breakthroughs and power up your portfolio by exploring these 27 AI penny stocks, showcasing companies driving innovation across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success