- United States

- /

- Capital Markets

- /

- NYSE:SCHW

Charles Schwab (SCHW): Assessing Valuation Following Strong Earnings Beat and New Dividend Announcement

Reviewed by Simply Wall St

Charles Schwab just posted earnings that topped expectations, thanks to a jump in net interest income and a dip in taxes. The board also increased shareholder rewards by confirming its regular cash dividend.

See our latest analysis for Charles Schwab.

Momentum is picking up for Charles Schwab, with the stock up 28% year-to-date and a total shareholder return of nearly 35% over the past year as positive earnings, new initiatives, and ongoing dividends keep the spotlight on the company’s fundamentals and growth potential.

If Schwab’s steady climb has you inspired to expand your research, now is your chance to discover fast growing stocks with high insider ownership

Yet with shares trading near 52-week highs and strong returns already in the rear view, investors now face the key question: is Schwab offering an attractive entry point, or is the market already factoring in future growth?

Most Popular Narrative: 15% Undervalued

With Charles Schwab's fair value pegged at $111.50 and a last close of $94.52, the prevailing narrative sees the stock trading below what its strong fundamentals suggest. These expectations are being driven by ongoing momentum in client growth and rising operational efficiency.

Operational efficiencies, innovative product launches, and industry scale are enhancing margins, competitive position, and long-term earnings resilience.

Want to discover the powerful numbers fueling this optimism? The secret is a bold combination of profit acceleration and ambitious growth projections, all built on future margin expansion. Wondering just how aggressive these analyst assumptions get, and if they're sustainable? Dive in to unlock every key assumption behind this high-conviction fair value call.

Result: Fair Value of $111.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from digital platforms and the risk of unfavorable interest rate shifts could quickly undermine Schwab’s growth momentum and profit expansion.

Find out about the key risks to this Charles Schwab narrative.

Another View: Unpacking the SWS DCF Model

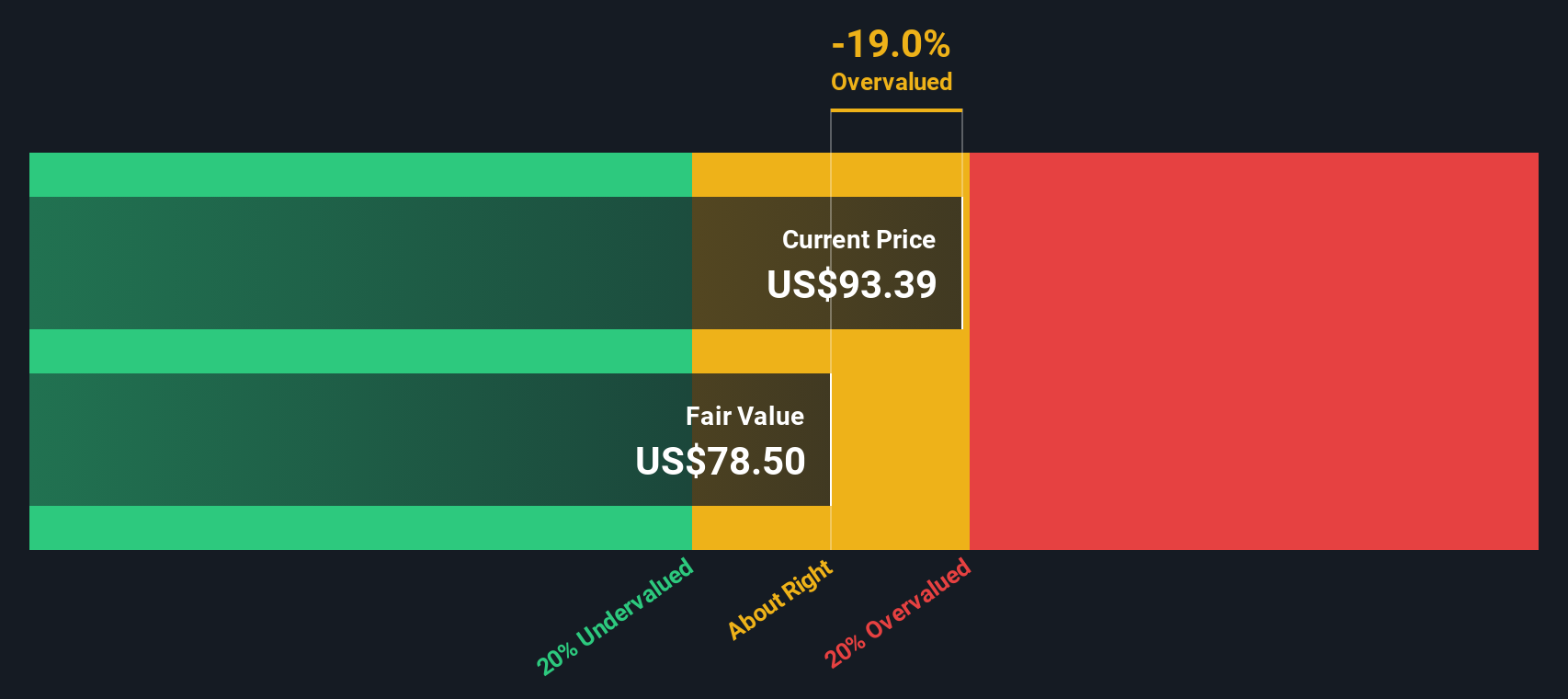

While analysts point to Charles Schwab's upside based on traditional earnings and multiples, our SWS DCF model takes a different angle, suggesting the stock is trading above its fair value of $87.69. This method factors in future cash flows and discount rates, challenging the bullish narrative on valuation. Could it mean the market’s optimism is running ahead of underlying fundamentals, or does it miss longer-term growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Charles Schwab for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Charles Schwab Narrative

If you see things differently or want to dig into the data yourself, crafting your own narrative takes just a couple of minutes. Do it your way

A great starting point for your Charles Schwab research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Winning Move?

Don’t let opportunities pass you by. Make your next smart investment by tapping into hand-picked lists featuring today’s top growth and value stocks across emerging megatrends.

- Seize the chance to grow your portfolio with these 840 undervalued stocks based on cash flows that could be trading beneath their real worth for savvy investors like you.

- Tap into market-defining innovation by getting to know these 28 quantum computing stocks, where the next breakthroughs in computing power are taking shape.

- Maximize your steady returns when you review these 22 dividend stocks with yields > 3% offering yields above 3 percent and proven track records for cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCHW

Charles Schwab

Operates as a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives